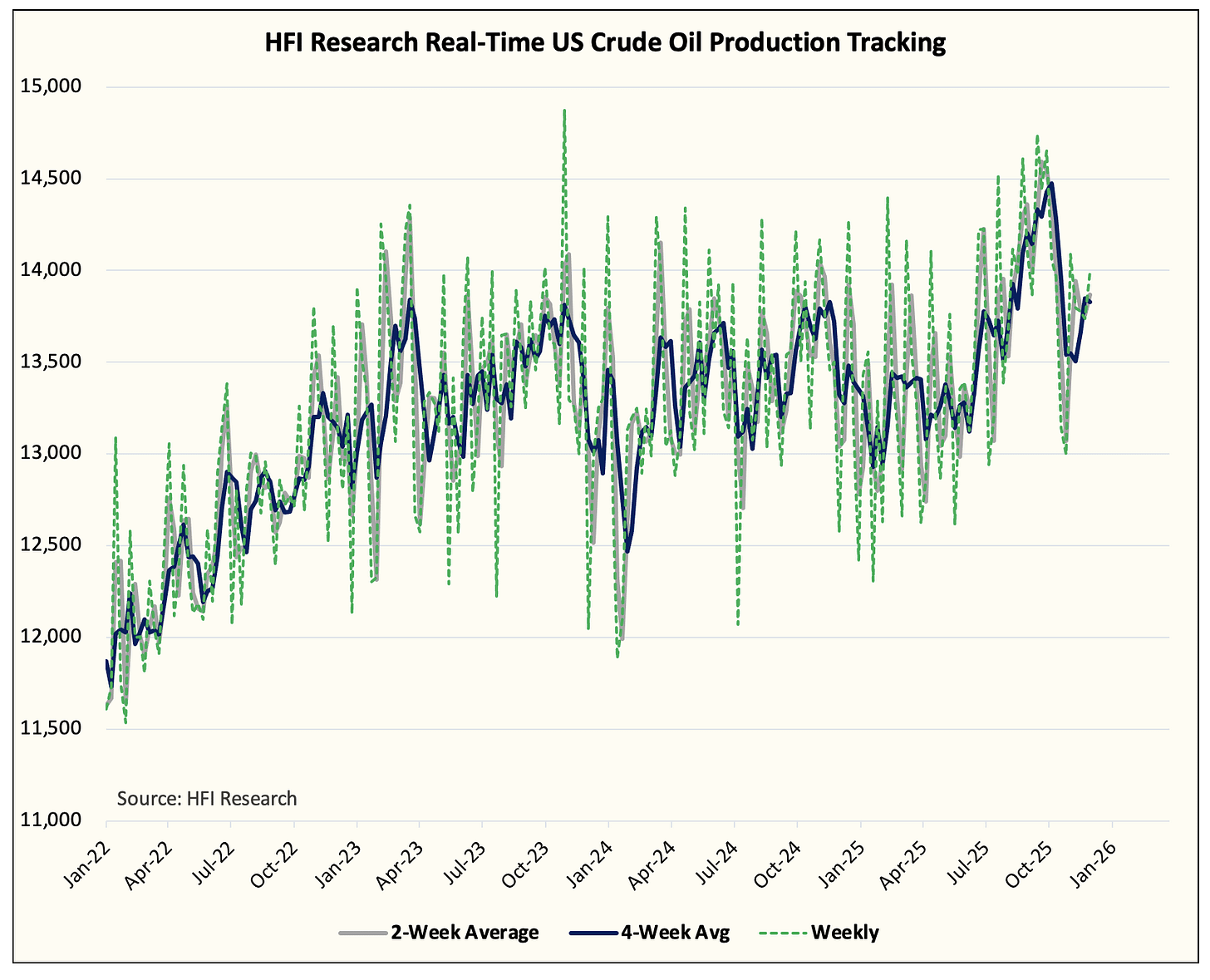

US crude oil production continues to defy gravity. Despite WTI averaging near ~$60/bbl since late September, US crude oil production continues to average above ~13.8 million b/d today.

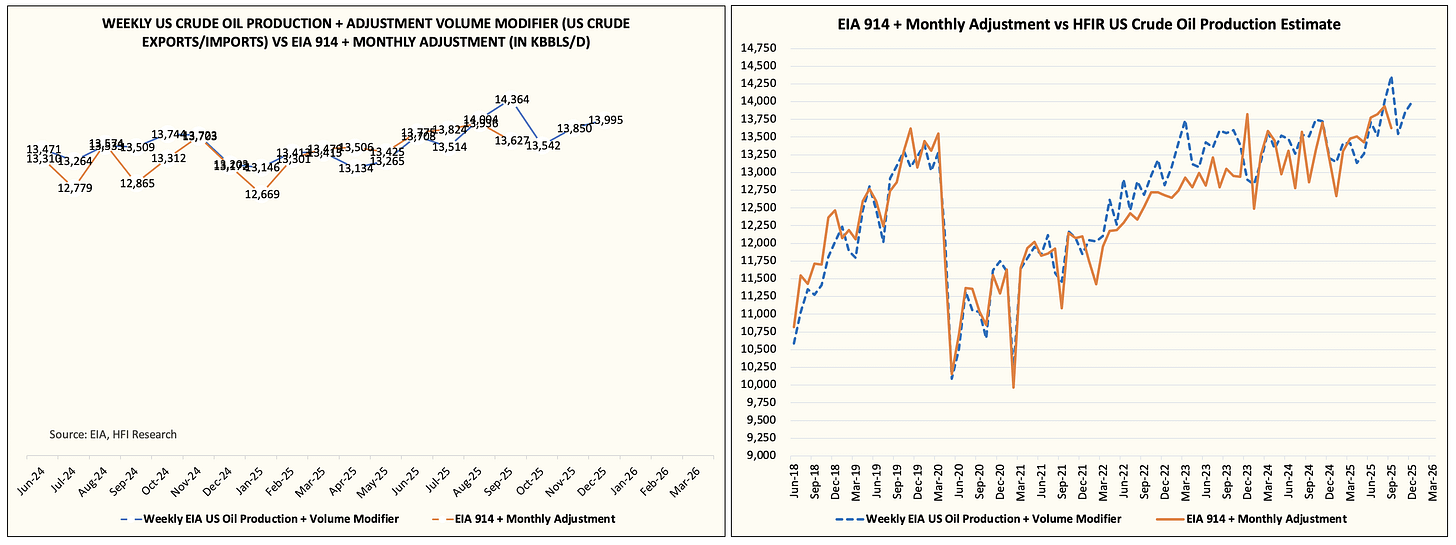

Our real-time data for November US crude oil production concluded last week, and it averaged ~13.85 million b/d or in line with EIA’s weekly estimate.

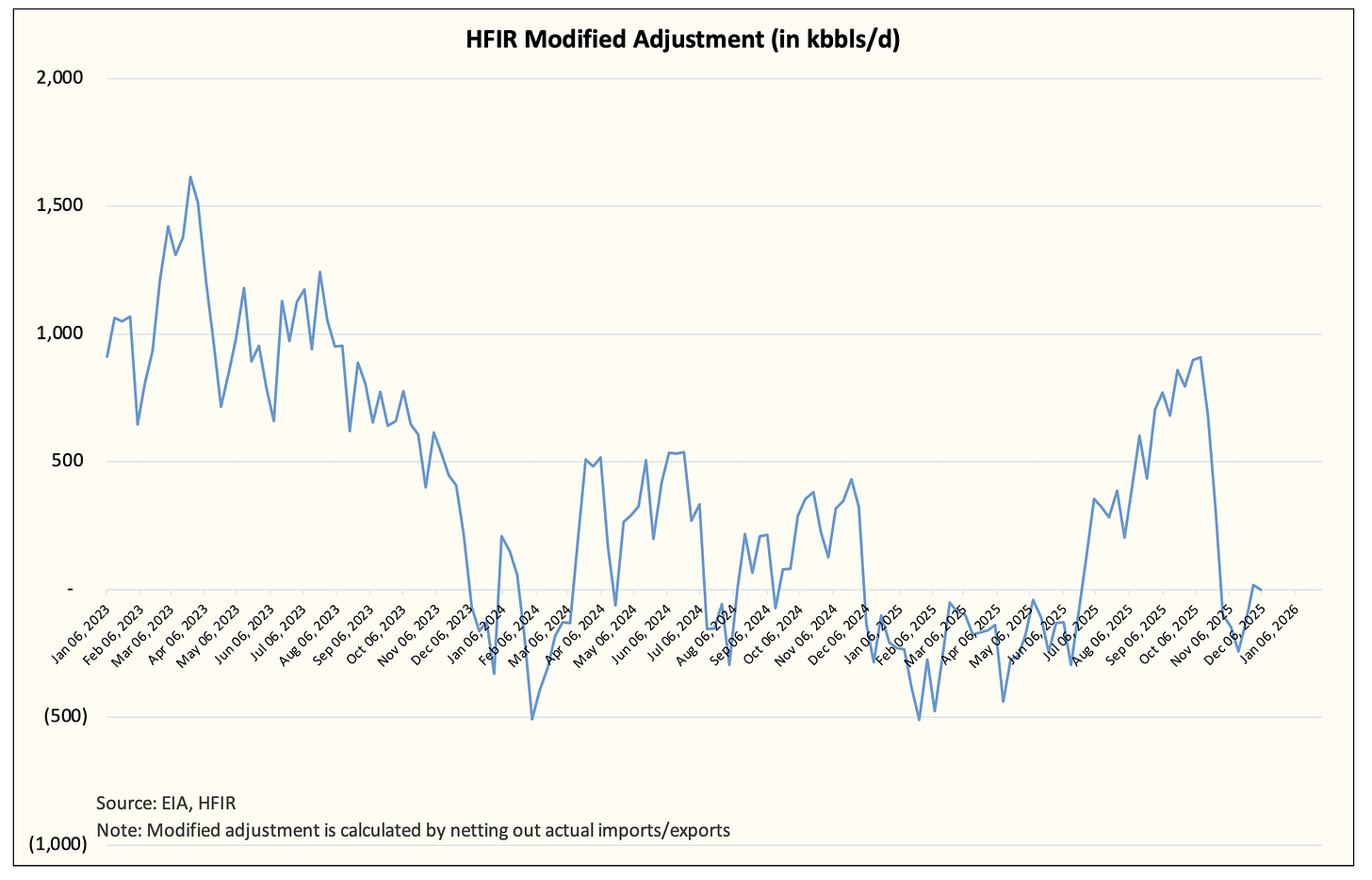

In the first week of November, EIA materially revised higher its weekly US crude oil production figure to ~13.8 million b/d. After it did that, the modified adjustment calculation averaged close to zero.

In other words, our real-time data matches the EIA data. As a result, we are very confident that US crude oil production today is close to ~13.85 million b/d.

But the puzzling thing here is that despite such weak oil prices, why isn’t US crude oil production declining?

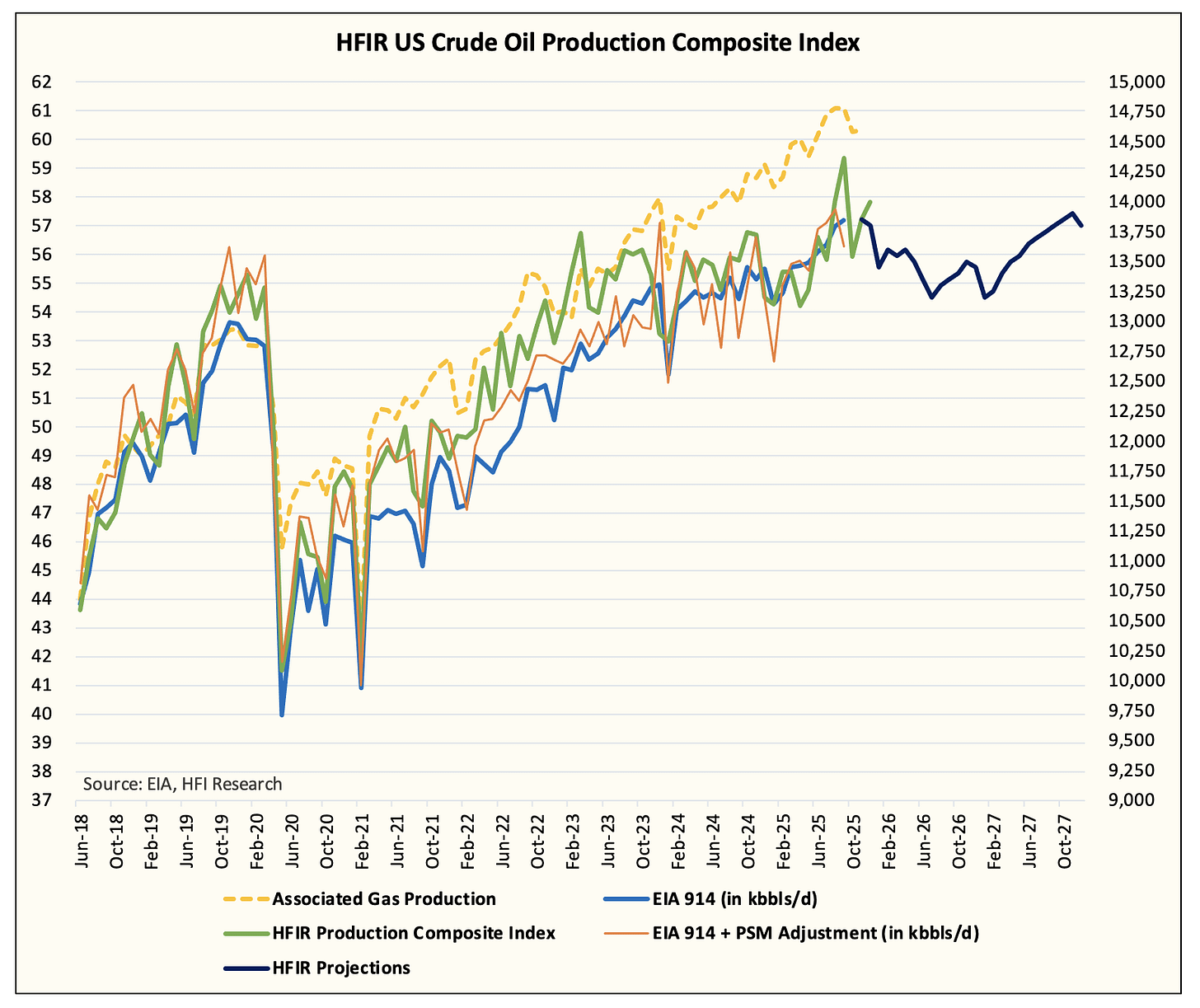

As you can see in our production composite index, December US crude oil production should have started to decline, but the latest figure points to a production reading near ~14 million b/d. We still have more weeks to finalize this month’s data, but the fact that we aren’t seeing material weakness yet implies that production could be stronger than expected going into 2026.

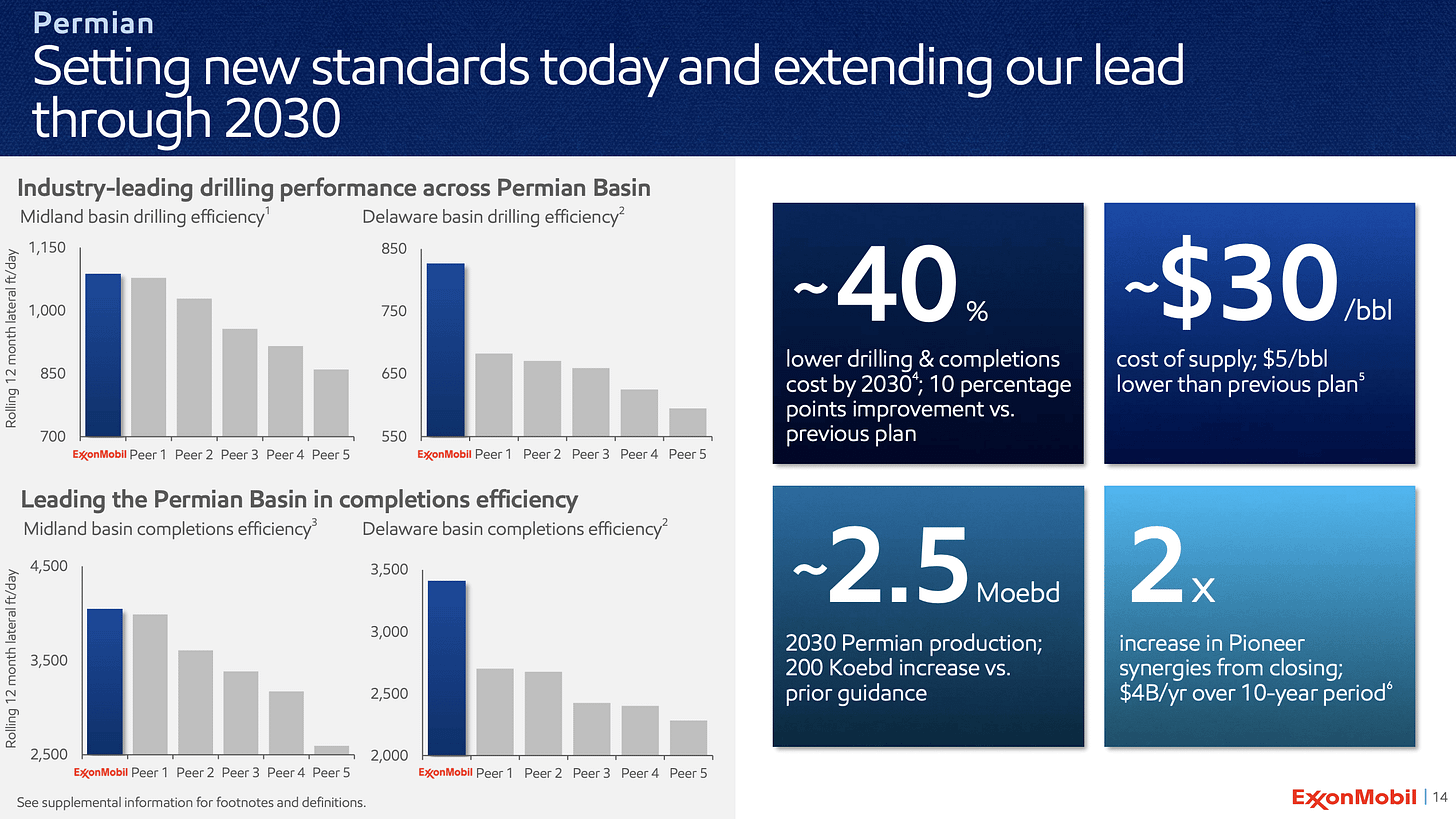

Part of the reason for the outperformance stems from Exxon. In Q3 2025, Exxon reported that Permian production averaged ~1.7 million boe/d. In its latest 2030 company guidance update, it noted that the Permian is expected to grow to ~2.5 million boe/d (+200k boe/d vs previous guidance).

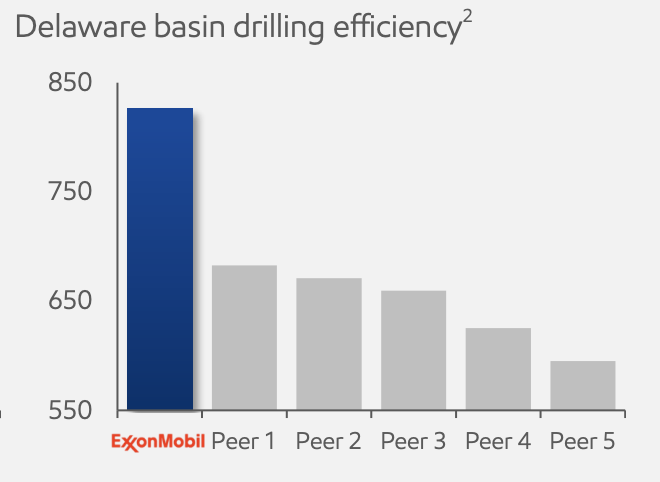

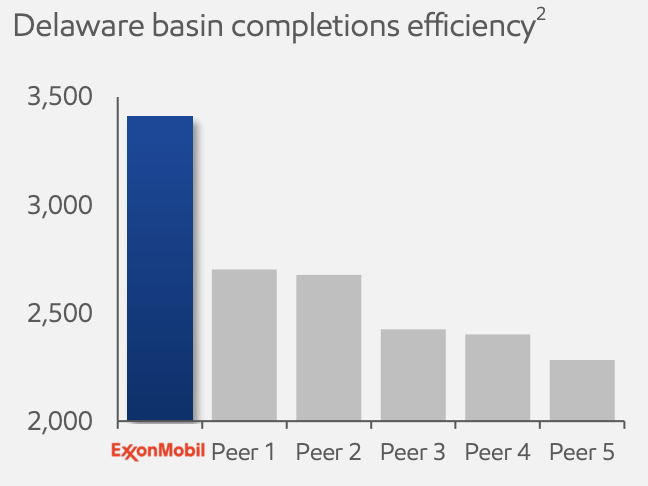

Source: Exxon Presentation

In particular, you will note the material drilling and completion efficiencies Exxon is seeing in the Delaware Basin.

Drilling

Completion

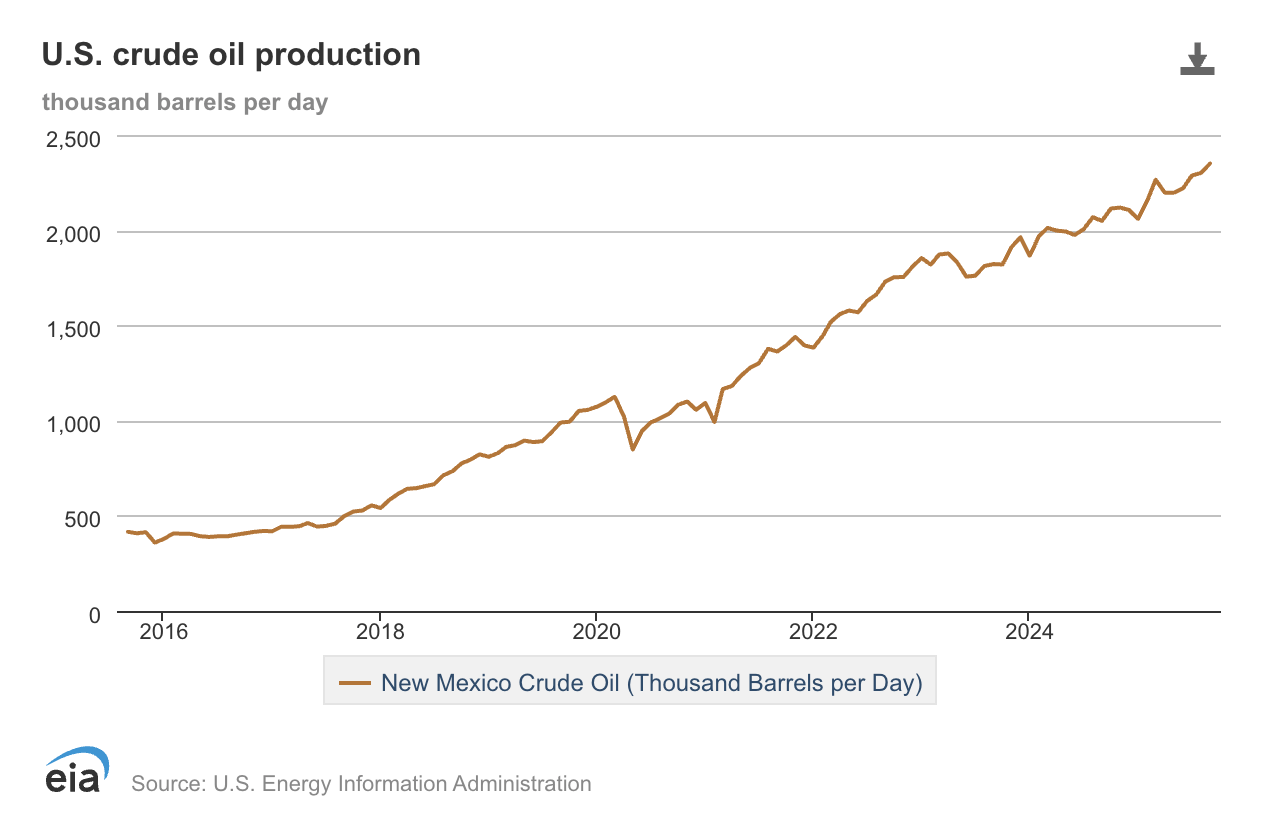

Now if you go to the EIA 914 report where it breaks down all of the crude production by state, you will see that New Mexico has been responsible for the material growth we are seeing out of the US.

Exxon, along with multi-year Gulf of America projects, is the reason why US crude oil production is coming in higher than expected.