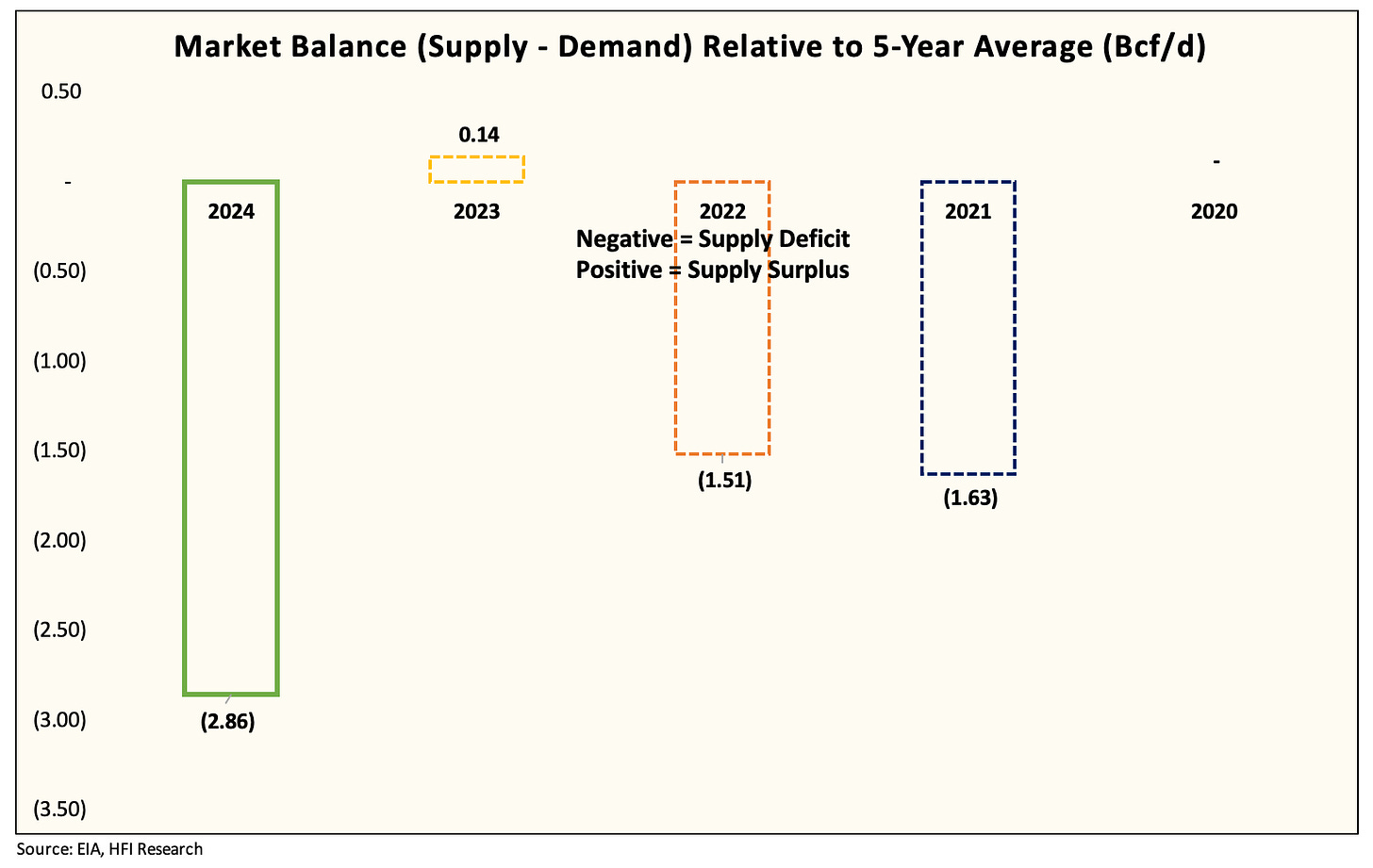

Low prices cure low prices, that's certainly what we are seeing in natural gas fundamentals. The recent price decline that prompted natural gas producers to cutback production is now manifesting into one of the tighter markets we've seen in years going into shoulder season.

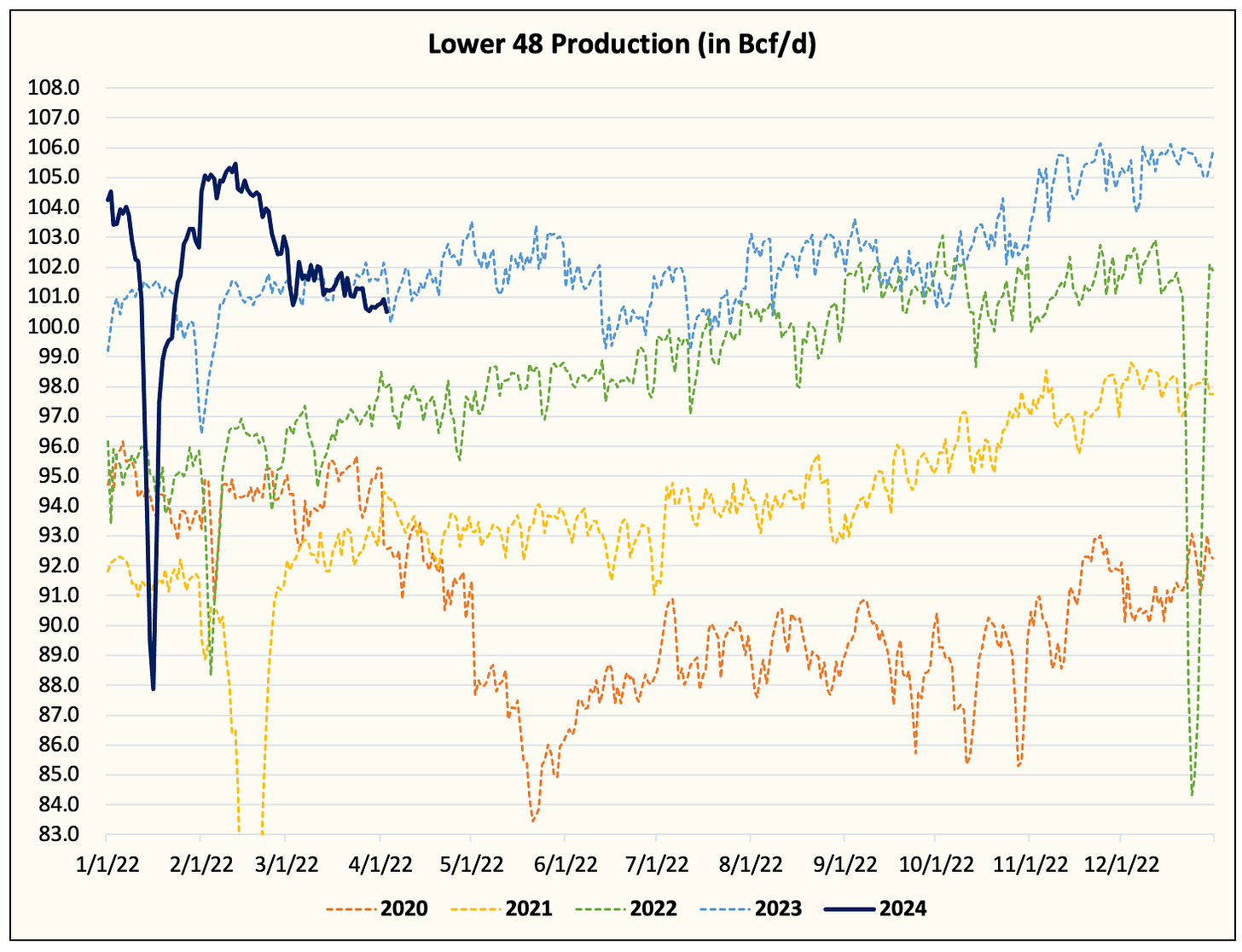

March saw Lower 48 gas production average just above ~101 Bcf/d with April early readings right around ~100.7 Bcf/d. As we said many times, the key to balancing the natural gas market this year is lower production, so long as production stays below ~102.5 Bcf/d, we have a tighter market.

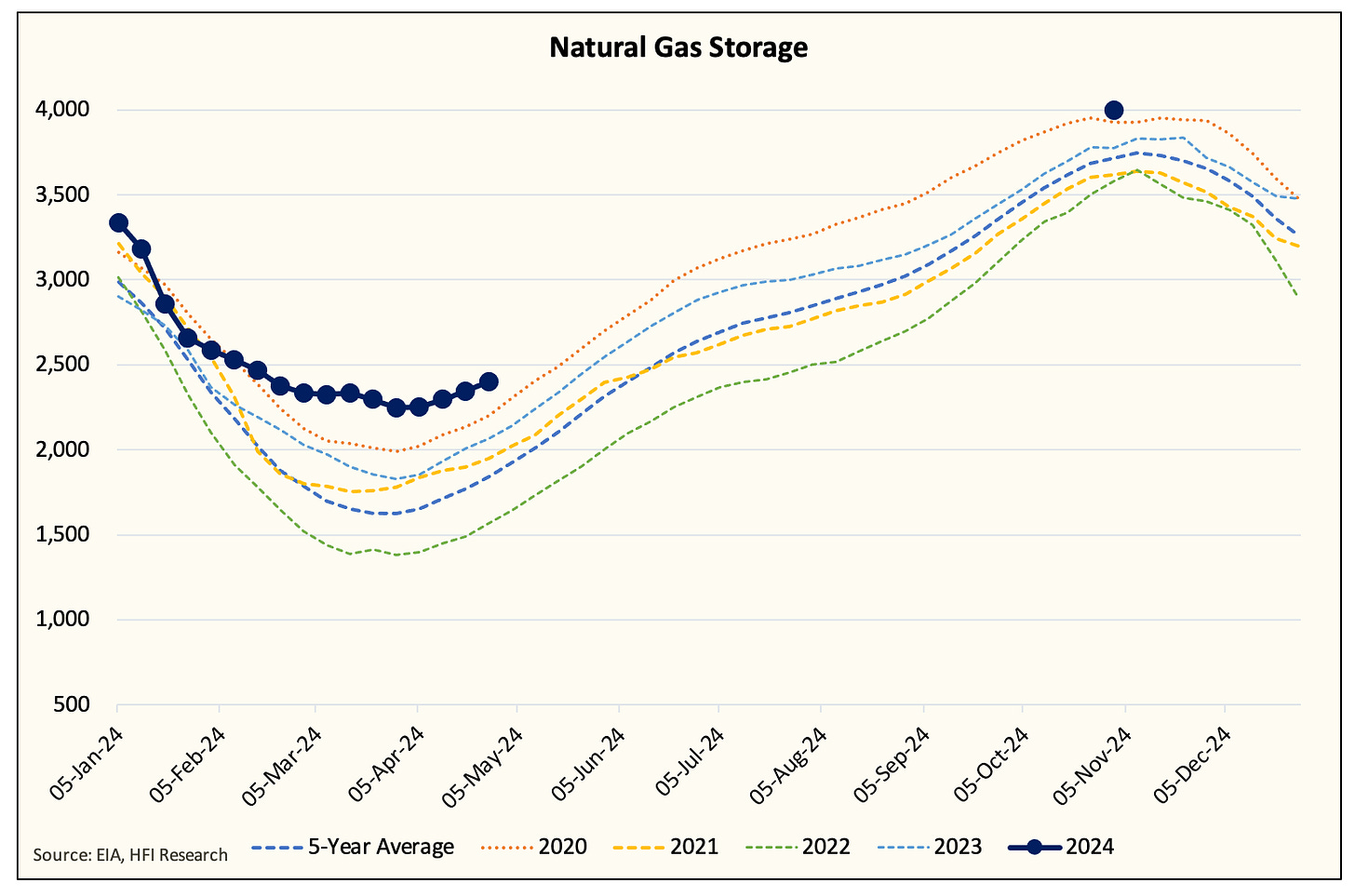

Looking at our implied balance going forward, we have the US gas market at a deficit of 2.86 Bcf/d. Assuming this production level holds into year-end (likely impossible outcome), natural gas storage would revert back to the 5-year average.

But as all readers should know, Lower 48 gas production is being throttled back and producers have TILs (turn in line wells) ready to bring online the moment prices jump. As a result, we can't assume ~101 Bcf/d will persist through the summer.