This Is No Time For Celebration, The Oil Rally Is Just Getting Started

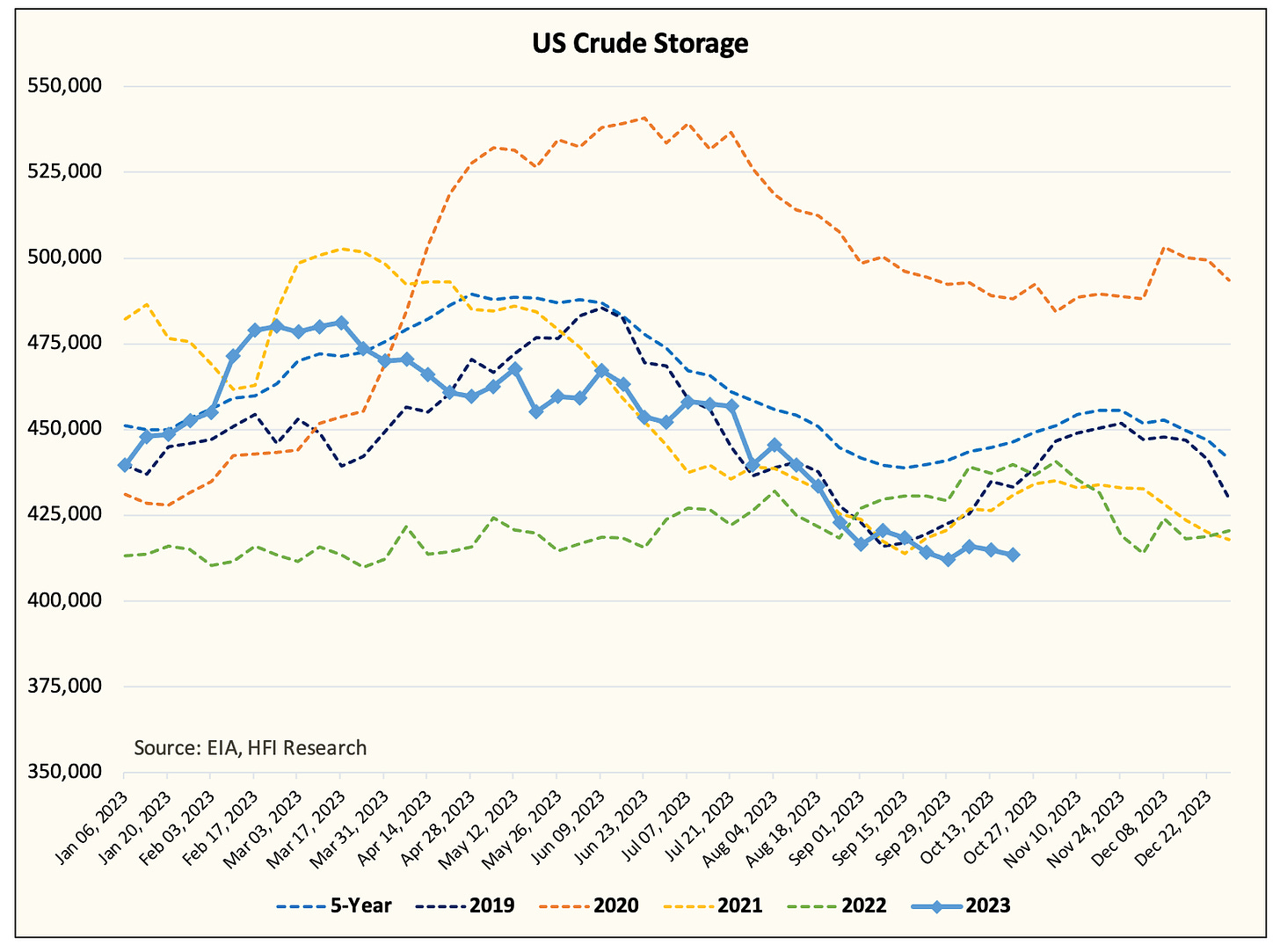

In our WCTW this Monday, we wrote that the market is not prepared for what's coming. The US has, in essence, bailed out the rest of the world from an oil supply shortage, and that is about to come to an end. With US crude storage failing to build and likely trend lower by mid-October, US crude exports will fall. The combination of falling US crude exports coupled with Saudi and Russia's voluntary cuts will send the physical oil market into a frenzy.

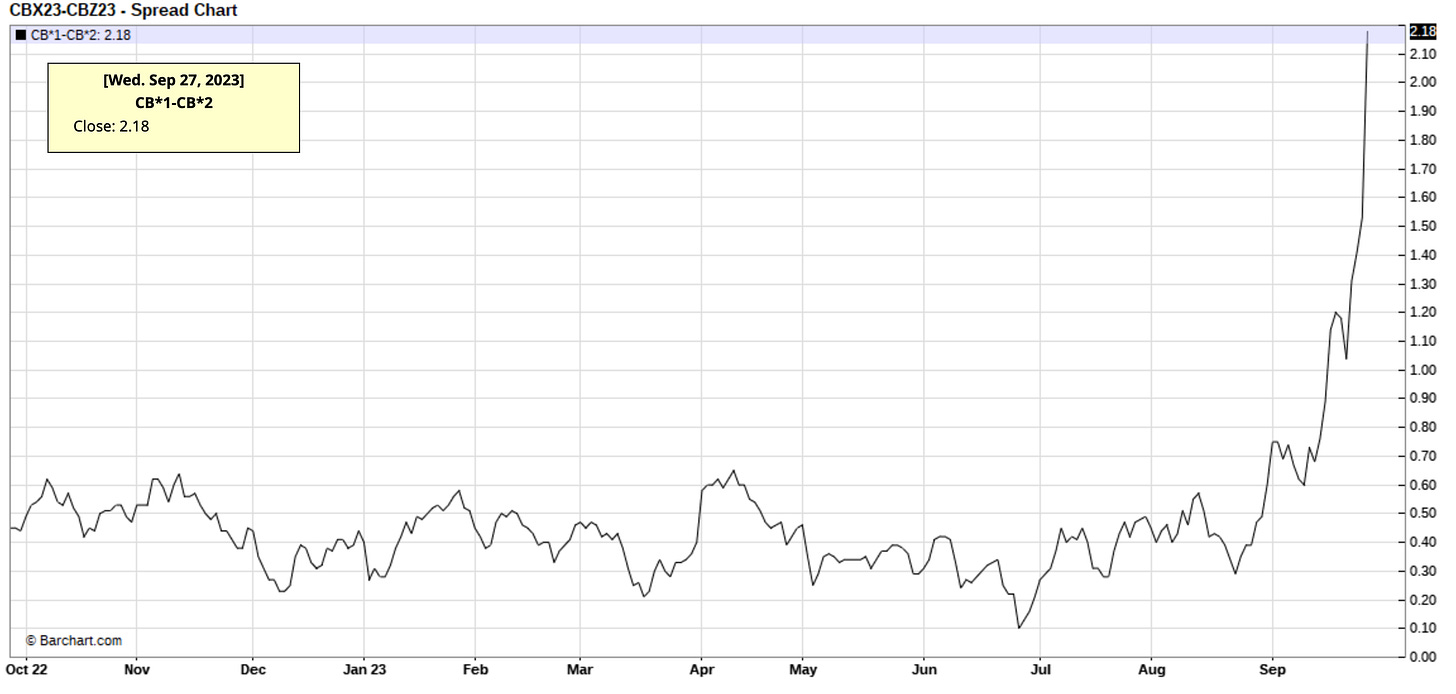

We are already seeing eye-popping backwardation, and there's more to come.

If you thought March/April 2022 was bad, you haven't seen the real thing yet. We are talking about real supply cuts this time, not some fantasy potential supply drop.

What makes this time even more beautiful is that the IEA will be well behind the eight ball. As we wrote in our report two weeks ago, IEA really messed up by assuming massive builds in H1 2024. What they should've done instead is caution everyone that the market is about to get very tight. But nope, as a political outfit now more than an energy agency, it chose a completely different path, one that will inevitably lead the world into a crisis.

And similar to the path the IEA took when Russia invaded Ukraine telling the world that Russian oil production would fall by ~3 million b/d, this time around, it is preaching the exact opposite: ample supply.

But as the title of this OMF suggests, this is no time for celebration, this is no time for pats on the back, because this is only just getting started.

Our latest US crude storage forecast shows non-existent crude builds during refinery maintenance season. We have one last rush of US crude exports and that's it. US crude storage will likely stay flat to higher into year-end because US crude exports will fall. This is what we expect and the end result is a much tighter global oil market environment.

So for readers trying to stay ahead of the curve, please do not expect US commercial crude storage to fall well below ~400 million bbls. We are already tight and so the market will force relief one way or another.

Dominos are falling...

One of the bear factors was demand, but demand is holding up well. Unlike some of the bulls argue, we don't see demand as being robust, but it's not terrible like the bears are claiming. Refining margins will continue to remain under pressure as crude tightness gets even tighter. Bears will point to falling refining margins as a sign of demand weakness, when in reality, it's just crude tightness.

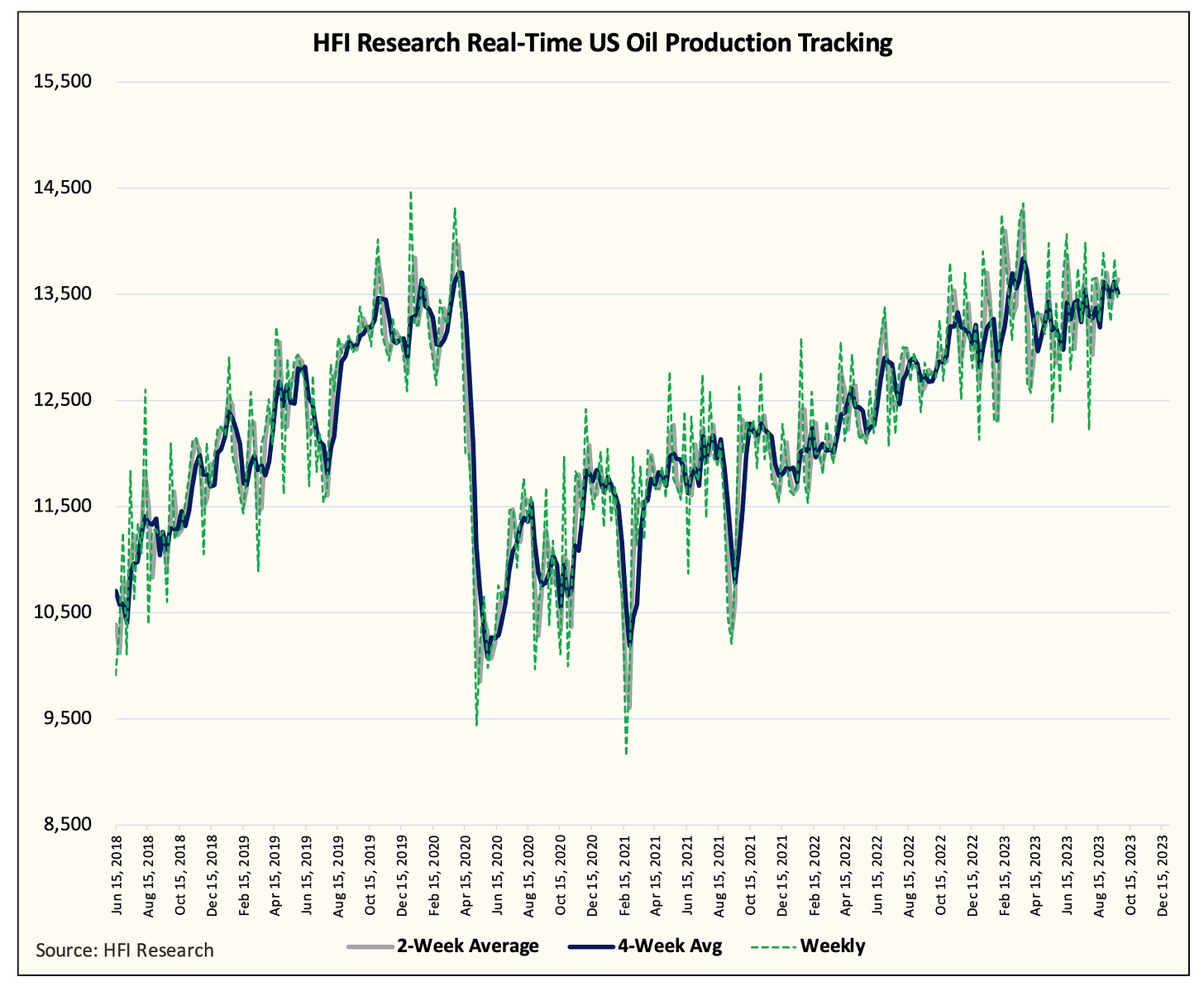

Oil, in the meantime, will continue to climb the wall of worries. Recession, high interest rates, lower refining margins, OPEC+ spare capacity, all of these things will prevent people from seeing the bigger picture, and that's that the marginal supply has all but peaked.

And the US, being the largest growth in supply over the last decade, is all but on its last leg. The oil market is firmly in the hands of the Saudis and they can do however they please going forward.

So this is no time for celebration because it's only just getting started. Buckle up, extreme tightness in the physical market is coming.

and here i thought Monday's article was bullish... :)