This Is Not Going To End Well

Is this the bottom? I don't know and 2 days of trading does not make a trend. But what I can tell you is that from the article I wrote on Monday titled, "I am probably early but I am getting really bullish," my conviction stands.

So why won't this end well?

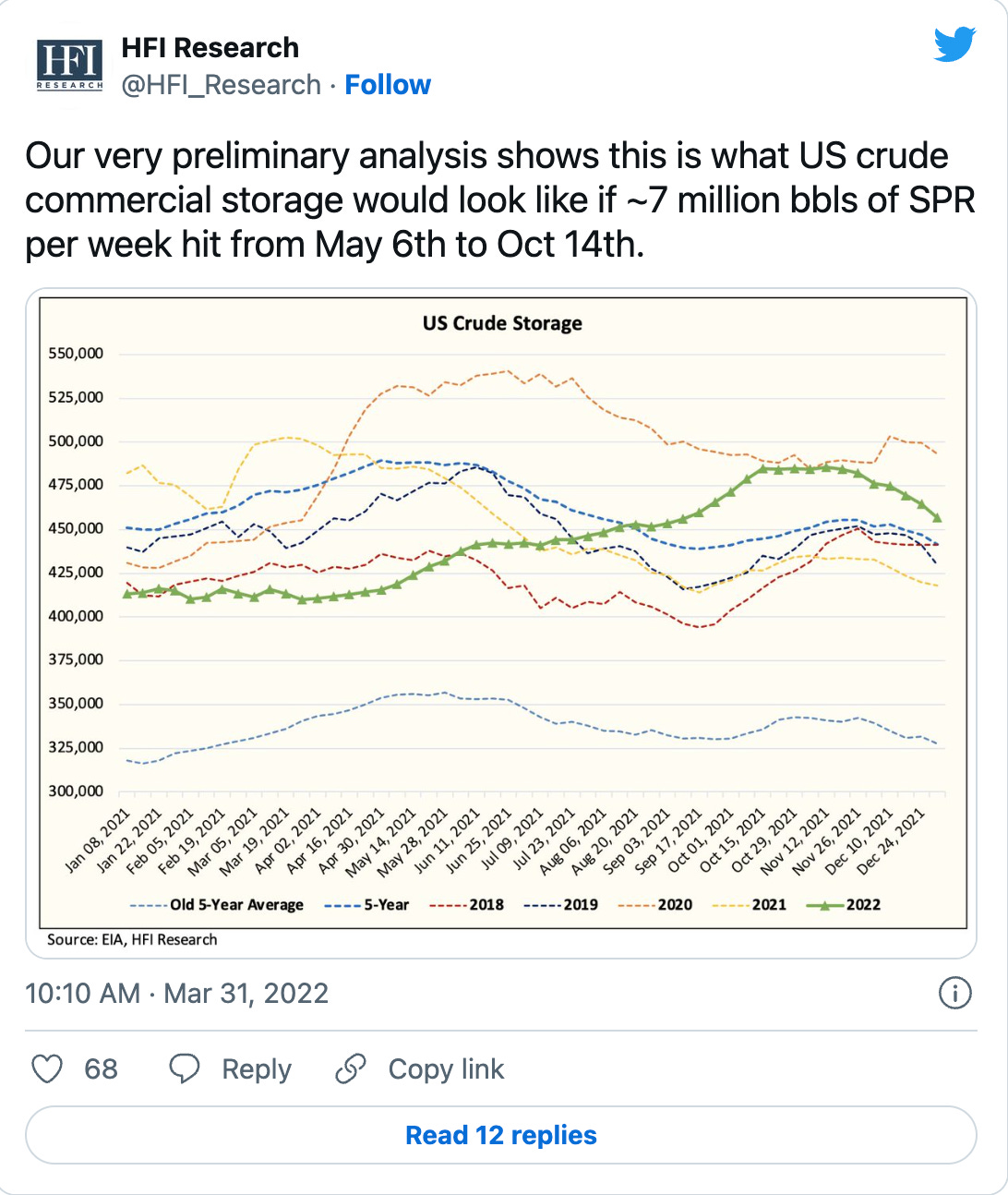

We have to first rewind it back to April. IEA just came out with the report predicting Russia will lose ~3 million b/d of production and a global coordinated SPR release effort was underway. At the time, the US was set to release ~1 million b/d or ~7 million bbls per week. Some of the oil bulls doubted that the Department of Energy was even capable of doing that citing pipeline constraints. We took a different view. SPR release was real and US commercial crude storage will build as a result.

Now fast forwarding to today, the impact of the SPR release has resulted in a small increase in US commercial crude storage, but nowhere near the extent we had projected. This is in large part thanks to higher US crude exports, which is ironic because the rest of the world is benefiting from the US SPR releases.

But the reason why I am saying this won't end well is that 1) global onshore crude storage continues to decline despite the SPR release and 2) Russia hasn't even lost any oil production yet.

Here's a glimpse of global onshore crude inventories from Kpler, and as you can see, even with elevated US crude exports, global crude storage continues to decline.

What does this mean?

This is bad. In theory, we should have seen large builds in global onshore crude oil inventories. Why? Because if the global coordinated SPR release was set at ~1.5 million b/d with the assumption that Russia loses ~3 million b/d, then it would've only dampened some of the production loss. But with Russia not losing any production during this time period, and still yet, we saw inventories draw, then what happens when Russia actually loses ~1 million b/d?

Could the US continue to release SPR well into 2023? Most definitely. But let me just show you this chart:

Last week saw SPR fall below that of US commercial crude storage for the first time since 1983. Now if we assume that the Biden administration continues to use SPR to "cap" oil prices, this is what SPR would be if we continue to release ~5 million bbls a week or ~0.7 million b/d to the end of 2023.

This is an extremely unlikely scenario because it would severely damage our national security if SPR fell below ~100 million bbls.

So judging by this simple, yet straightforward analysis, you should reach the clear and obvious conclusion that the SPR release is unsustainable. Just put aside the notion that they will refill SPR for a second here. The current trend is unsustainable.

This is why it's not going to end well. And I really don't know how much more I can emphasize this. The only remaining key variable left in all this is just figuring out how much demand will recover next year. We've already done an extensive write-up on this about how China is artificially lowering global oil demand by ~2 million b/d. So when China ends its irrational dynamic zero-COVID policy, demand will rebound.

And despite the SPR release, lack of Russian crude production loss, and China's zero COVID policy, global onshore crude storage is still trending down. This really won't end well.