This Is Where I Think The Market Is Headed

On June 21, we published a WCTW report titled, "We are in for a massive bear market rally." In the article, we wrote:

- Bond yields are moving lower.

- Inflation expectations are topping out.

- And copper vs gold broke down suggesting a global economic slowdown ahead.

All three indicators tell me that the market believes the Fed rate hikes will work. As a result, global growth is headed lower, bond yields are going to move lower, the yield curve will further flatten, and the Fed won't need to keep jacking up interest rates later on.

With all that said, why would we see a bear market rally?

Nasdaq and S&P 500 are now mostly made up of tech. Tech stocks are the inverse of value stocks because investors buy them for the anticipated growth in the future. When interest rates rise, investors sell tech because the stream of future cash flow is worth less today versus a low-interest-rate environment.

Now if the market all of a sudden believes that the world is headed back into a low-interest-rate environment and low growth period, then investors will start buying up tech again.

In addition to the logic, we highlighted a while ago that we believe junk tech names like ARKK will stage a ferocious bear market rally.

What you will also notice from this chart is that despite the brutal market sell-off last week, ARKK held its bottom from before. When the crappiest name starts to outperform during a market carnage, the end of the sell-off is near. We think last week was a clear example of that.

Fast forwarding to today, names like ARKK have staged a nice rally. From the lows at the time of the article of 38.80, it has rallied to $49.93 or a gain of ~29%. S&P 500 and Nasdaq have both rallied as well. The rally comes at a time when it's clear that the US economy is in or headed into a recession.

For most market participants, this seems strange. How can junk tech names stage a rally while we are heading for a recession? I believe the answer lies in how the market is perceiving the narrative on inflation and the actions of the Fed.

Yesterday, Bridgewater's CIO published a report on what he believes to be the US heading into a period of prolonged stagflation. Here's the link. In the report, this was one of the most interesting topics he discussed:

The markets are discounting a very different scenario. They are discounting one sharp round of tightening—comprised of a rise in short-term interest rates to just above 3%, combined with more than $400 billion of contraction of the Fed’s balance sheet—and that this will be enough to bring inflation down to 2.5% with stable growth and no dent in earnings. From there, markets are discounting that the achievement of these goals would allow a subsequent 1% drop in rates from their peak.

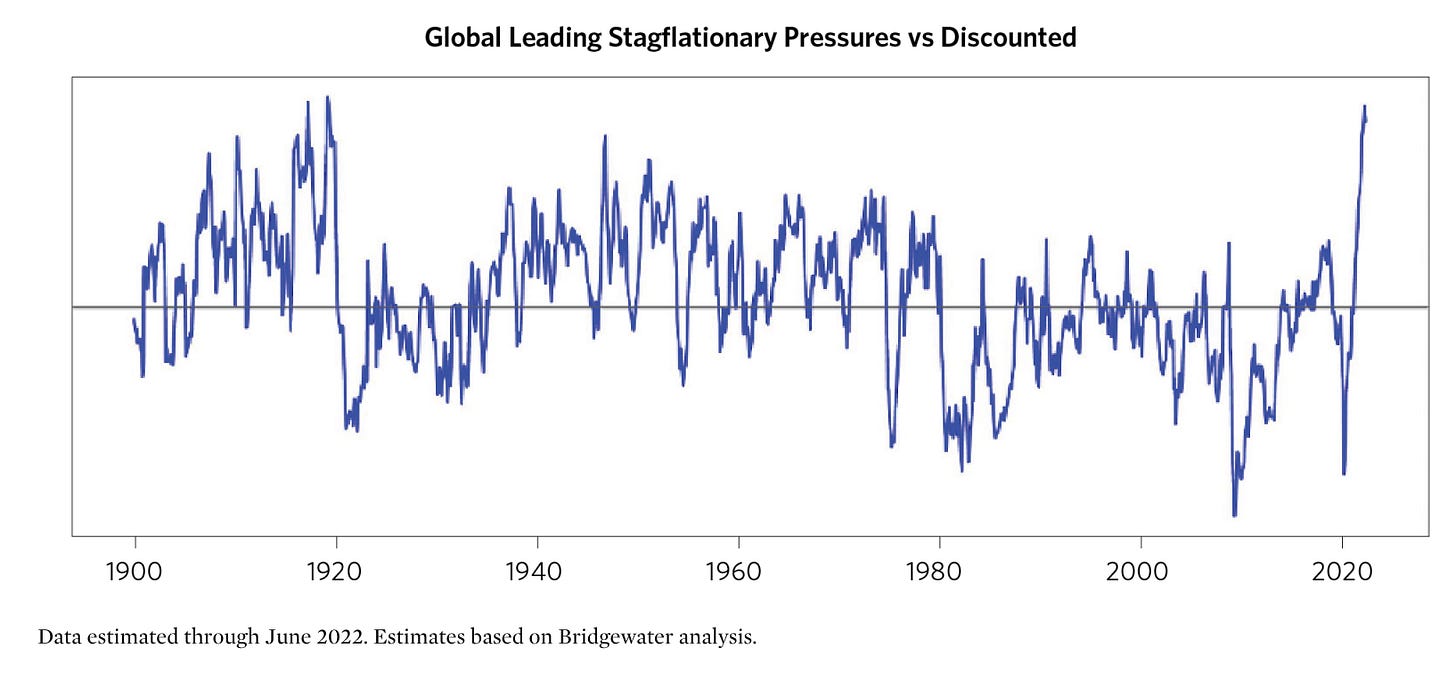

Asset returns are driven by how conditions unfold in relation to what is discounted. Our approach is to have an excellent reading of current conditions and a time-tested understanding of the cause/effect linkages, leading to a reliable probabilistic assessment of what comes next: an optimal response to known conditions. Today, our indicators suggest an imminent and significant weakening of real growth and a persistently high level of inflation (with some near-term slowing from a very high level). Combining this with what is discounted, the difference between what is likely to transpire in the near term and what is discounted is the strongest near-term stagflationary signal in 100 years, shown below. Longer term, as we play it out in our minds, we doubt that policy makers will be willing to tolerate the degree of economic weakness required to bring the monetary inflation under control quickly. More likely, we see good odds that they pause or reverse course at some point, causing stagflation to be sustained for longer, requiring at least a second tightening cycle to achieve the desired level of inflation. A second tightening cycle is not discounted at all and presents the greatest risk of massive wealth destruction.

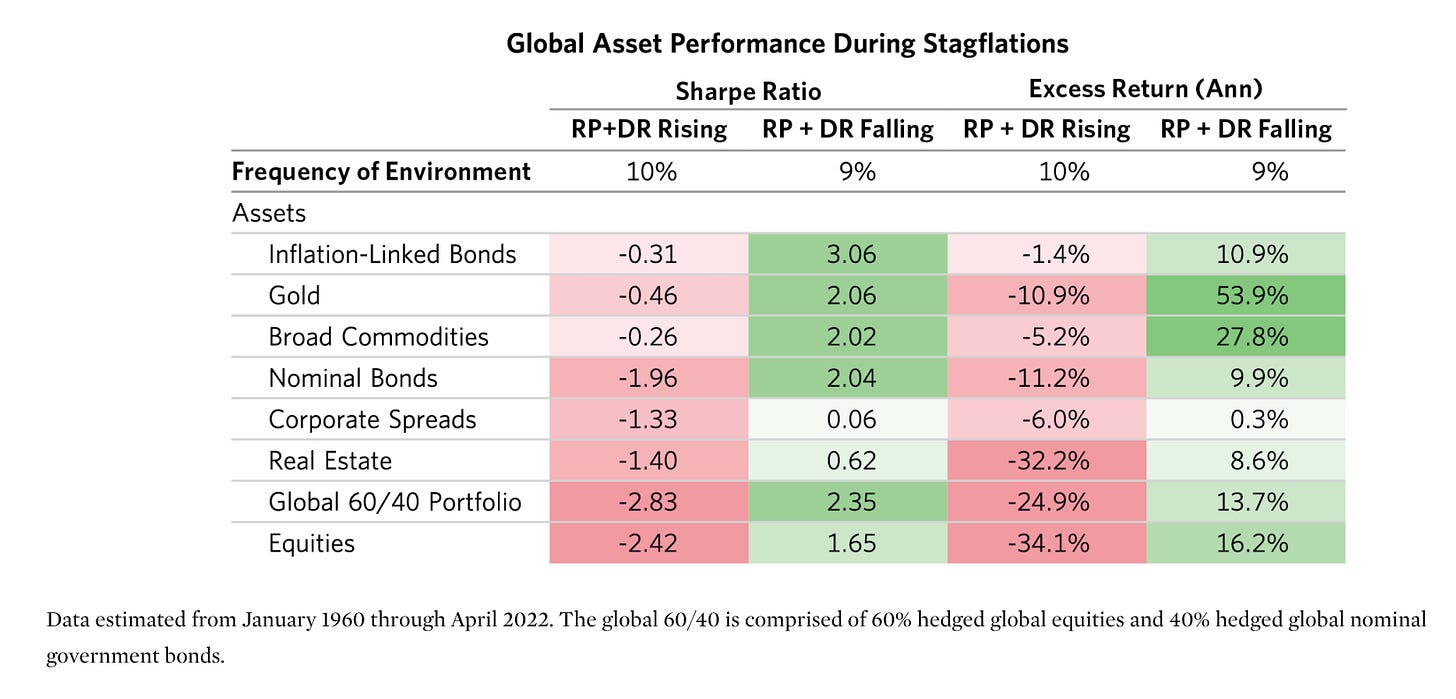

Bob Prince, the CIO of Bridgewater, goes on to highlight the asset returns during periods of stagflation and note how stocks have tended to perform the worst:

The points he made are fascinating in two folds:

The market believes that the Fed will be successful in fending off inflation, which is why it's discounting lower hikes going forward after the current hike phase.

Inflation is unlikely to go away unless the Fed is seriously willing to push the economy into a deep recession.

We absolutely agree with the two points he made, because from the bottoms-up supply-side approach, we know that the oil market, for example, is in a deep and structural supply deficit. As we noted in our 6/21 article, we said:

Why is this still a bear market then?

Because the market is wrong about what the Fed is capable of on the inflation front. The reality from the fundamental supply and demand of things is that the oil market deficit we are seeing won't end just because the Fed raised interest rates. We are talking about physical commodities here, so without proper capital investments, you won't get the needed supply.

What the Fed may induce in the short-run by jacking up interest rates is by lowering oil demand. But over time, consumers adapt, growth resumes, and oil demand picks back up. As we've said many times over the past few weeks, if high oil prices are the result of the recent demand slowdown, then low oil prices will just push oil demand back up.

The end result is a yo-yo market going back and forth. For a while, the market may believe that the Fed is effective in fending off inflation. Commodity prices drop, but then because of the price drop, commodity demand picks back up, and yo-yo supply/demand here we go.