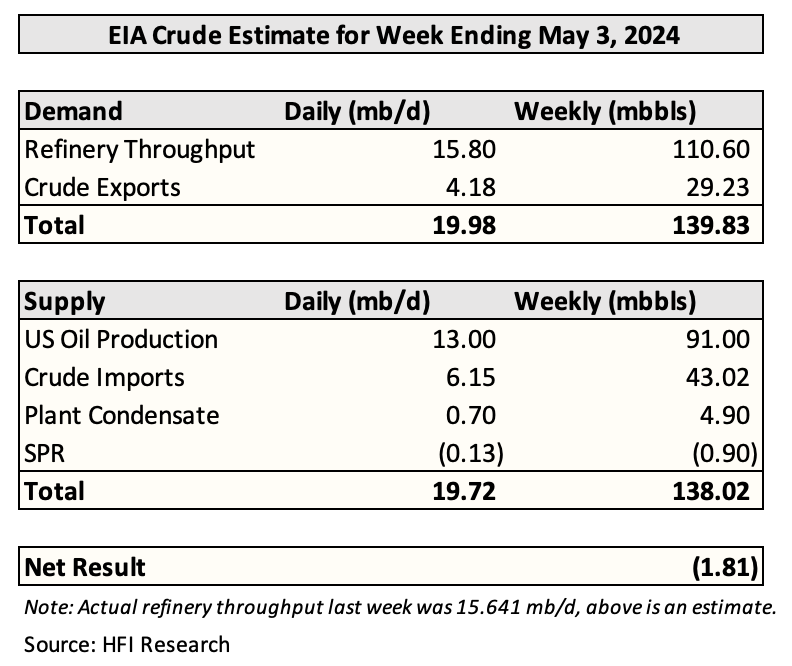

For the week ending May 3, we have a crude draw of 1.81 million bbls. Relative to the 5-year average build of +1.729 million bbls, a draw would be perceived bullishly.

The issue, however, we see in the market today is the market's perception of oil demand. With refining margins falling as of late, traders will want to see a pick up in implied demand, which should translate into a further drawdown in product storage.

But going back to the crude storage draw estimate, the modified adjustment blew out again last week resulting in a massive disconnect of ~8 million bbls. If we are correct that EIA counted imports early, then this week's crude draw should be higher than 1.81 million bbls.

Looking at our US crude storage projection, this is what we are seeing: