US Oil Data Is A Lot Better Than It Looks

You wouldn't know this by looking at the latest oil price action, but the US oil data is far better than it looks.

Gasoline demand, while not as strong as we would like, is up ~476k b/d y-o-y. On a 4-week basis, we are now 1.3% above last year.

Total oil demand is up ~900k b/d y-o-y. And on a weekly basis, it's up 1.826 million b/d y-o-y.

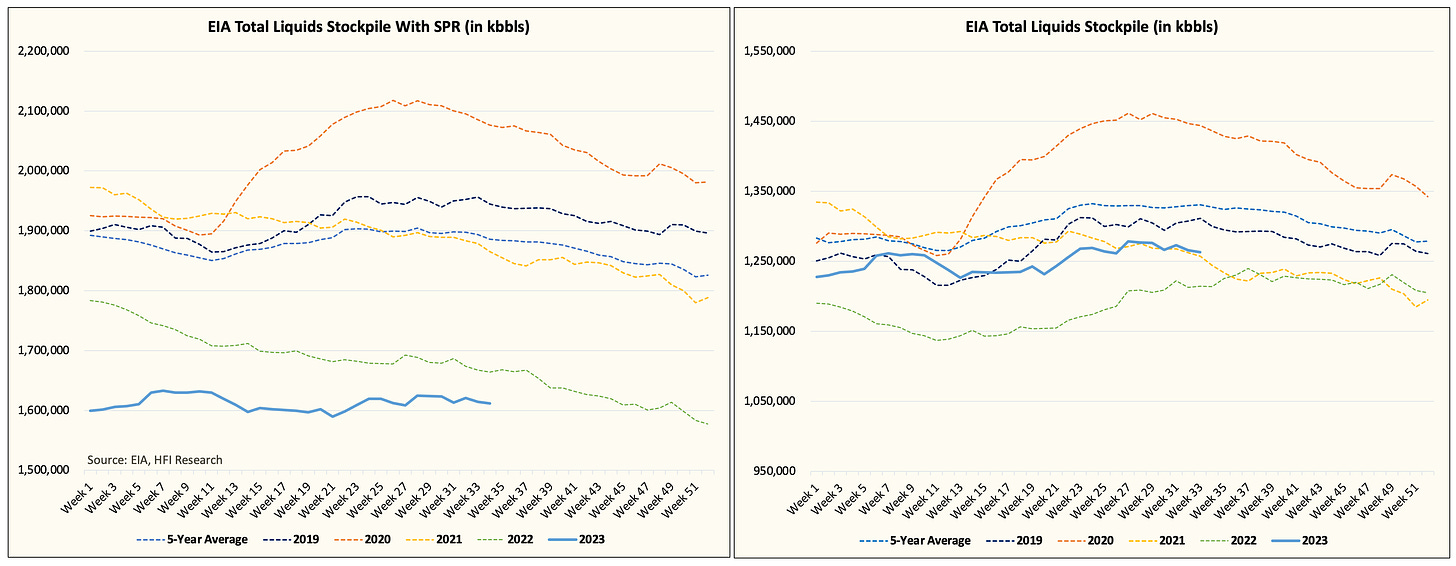

Total liquids are drawing, and the pace of the draws will likely follow that of 2021 into year-end.

US crude storage is set to move much lower with Cushing looking to match 2022 levels soon.

Demand

For us, it's the velocity of the demand improvement that matters more than the absolute figures. For 2022, we started to see demand trend lower by this time of the year. For 2023, we are not seeing that same downtrend, so the delta in demand figures will only improve from here on out.

So while one could argue that US oil demand is not strong, on a relative basis, we are seeing much better demand figures vs last year, and that should aid inventory draws.

In addition, you can see the impending slowdown in demand in 2022, while this year, we should diverge strongly over the coming weeks.

The combination of better demand and lower supplies should help push US total liquids lower.