US Oil Data Is Far From Great, But It's Also Not As Bad As You Think

I guess this question depends on what type of bias you have when it comes to the oil market. If you are a glass-half-full guy, then US oil data is trending in the right direction with pockets of strength and pockets of weaknesses. If you are a glass-half-empty guy, then US oil data looks terrible with demand weaker y-o-y and product storage bloated despite low refinery throughput.

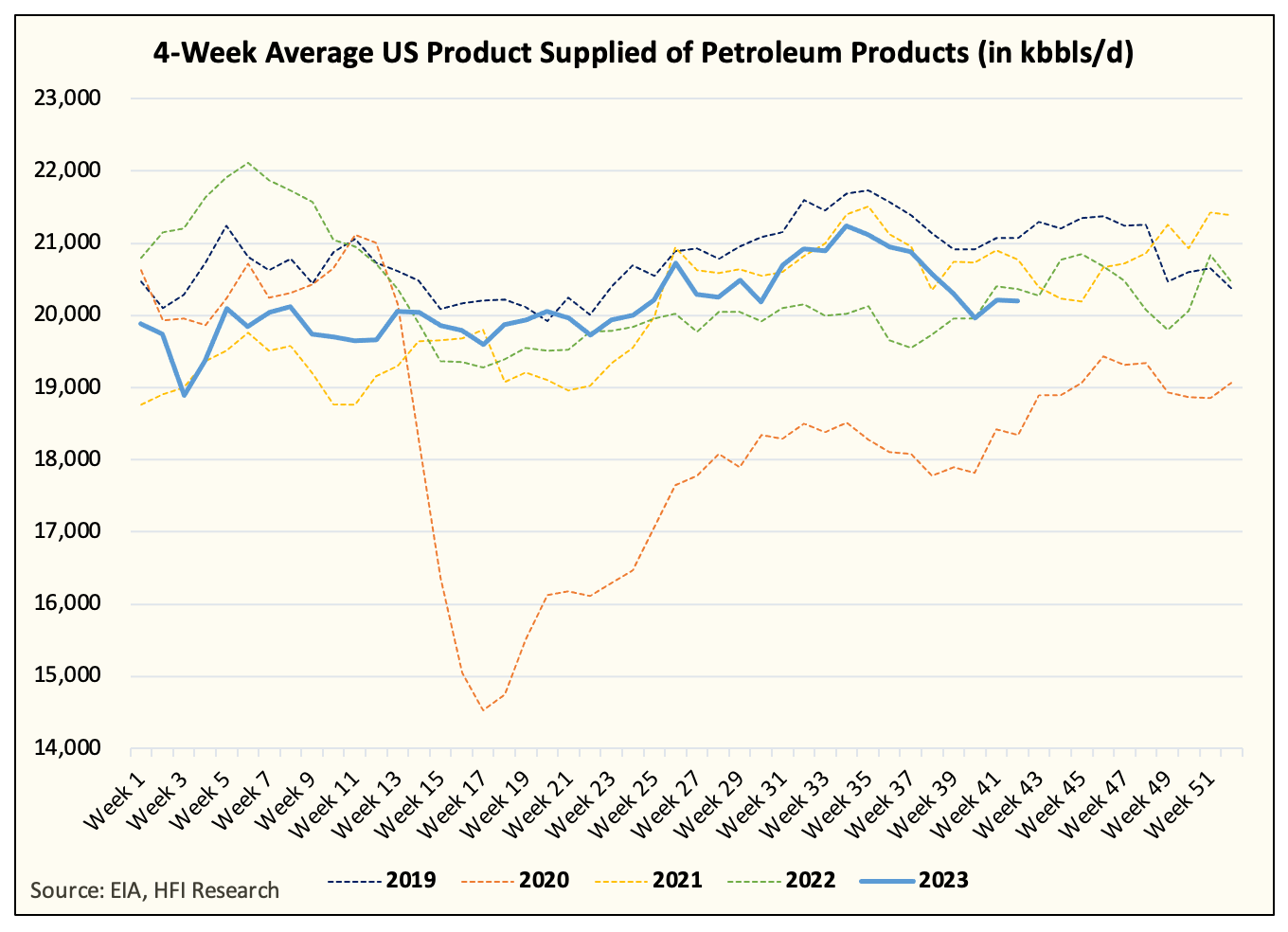

For us, we are somewhere right in between the two. US oil demand is weak, there's no denying the data.

And while the implied weekly figures are not exact, the trend has been on the weaker side. Crude storage is tight and will remain tight.

Crude

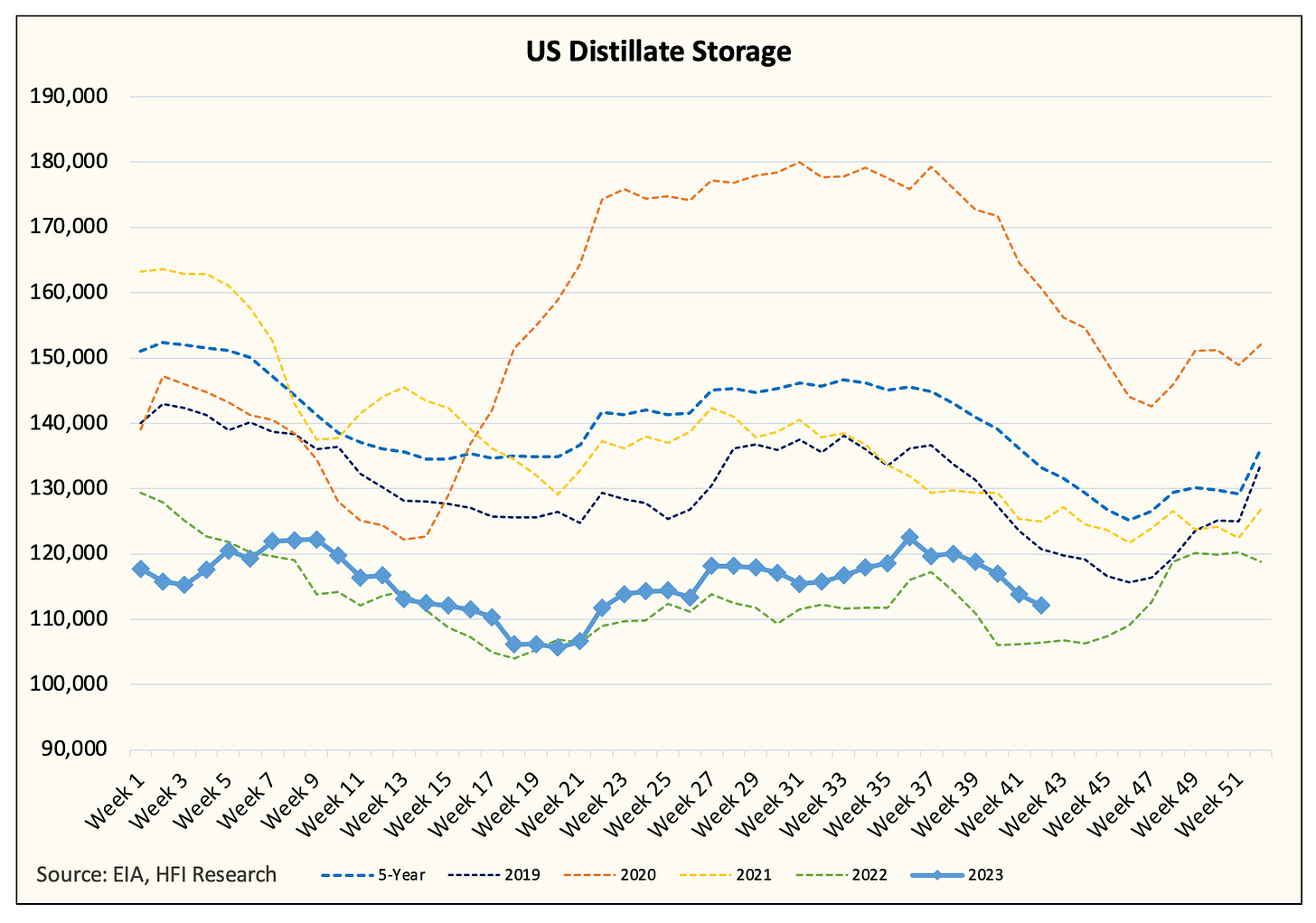

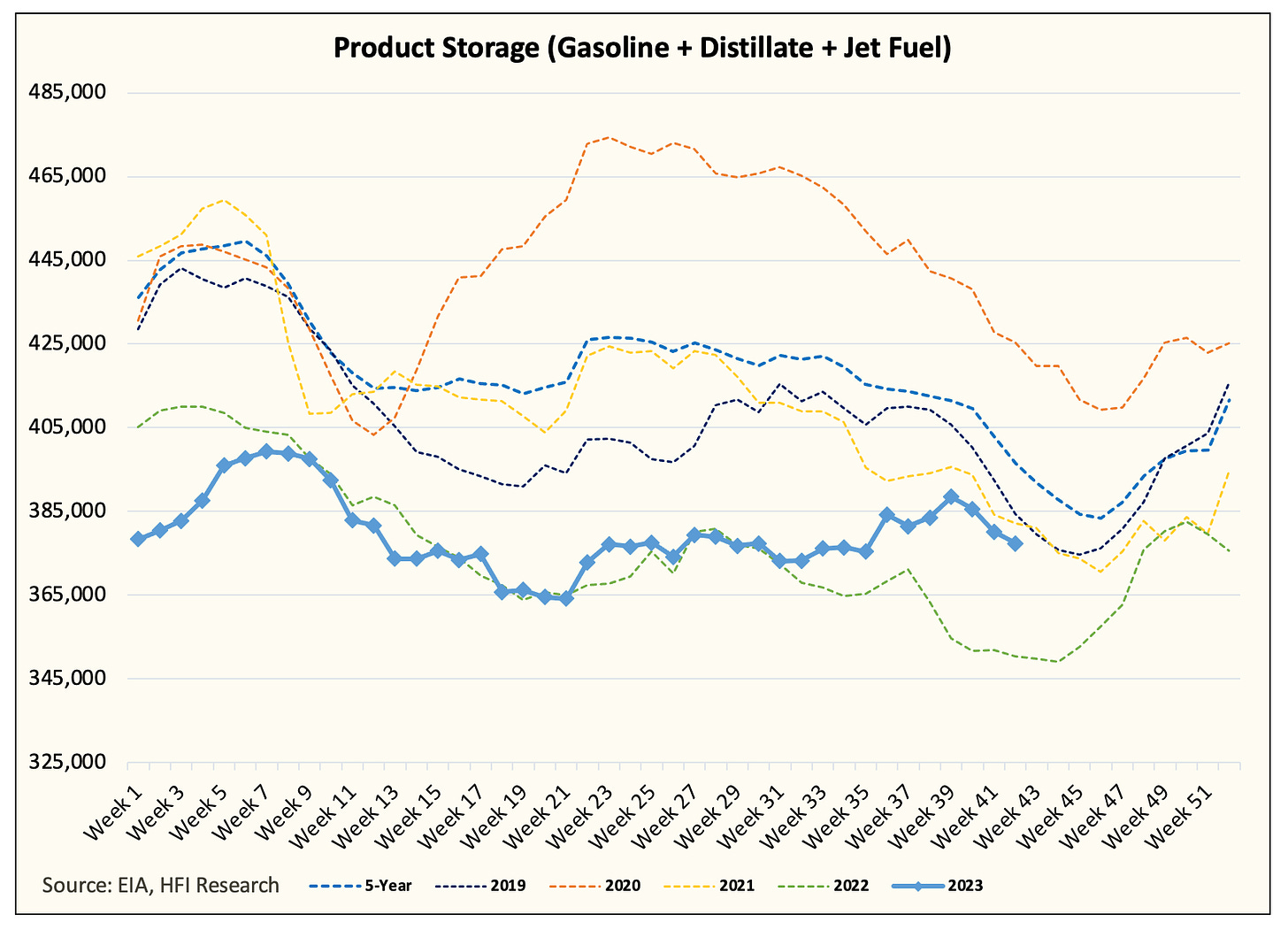

While product storage is tight in some areas (distillate) and normal in others (gasoline/jet fuel).

Distillate

Gasoline

Jet Fuel

The reality is that if you look only at US oil data, the conclusion is mixed. Yes, inventories are drawing, but they are drawing at a slower clip than the bulls would like. Despite another week of low refinery throughput (sub ~15.2 million b/d), US product storage only drew 2.822 million bbls. Seasonally speaking, we usually see a draw of ~5 million bbls.

So while on an absolute level, product storage is trending lower, the bulls shouldn't be excited as this is not the type of "tight" environment you would want to see to support significantly higher prices.

But it's not all bad news. As we wrote in our US crude storage outlook yesterday, US crude storage won't see much of a build this refinery maintenance season. For our preliminary estimate next week, we expect to see a build of ~5 million bbls, but that's primarily because US refinery throughput is low. Our latest forecast shows the following US crude storage setup: