US Oil Demand Is Shockingly Bad

This needs to be said: US oil demand is shockingly bad. While I want to disagree with IEA's report today about demand destruction and the bad US oil demand data, the reality is awful. US oil demand since June has disappointed to the downside and the latest series of weekly data further validates the trend we've seen.

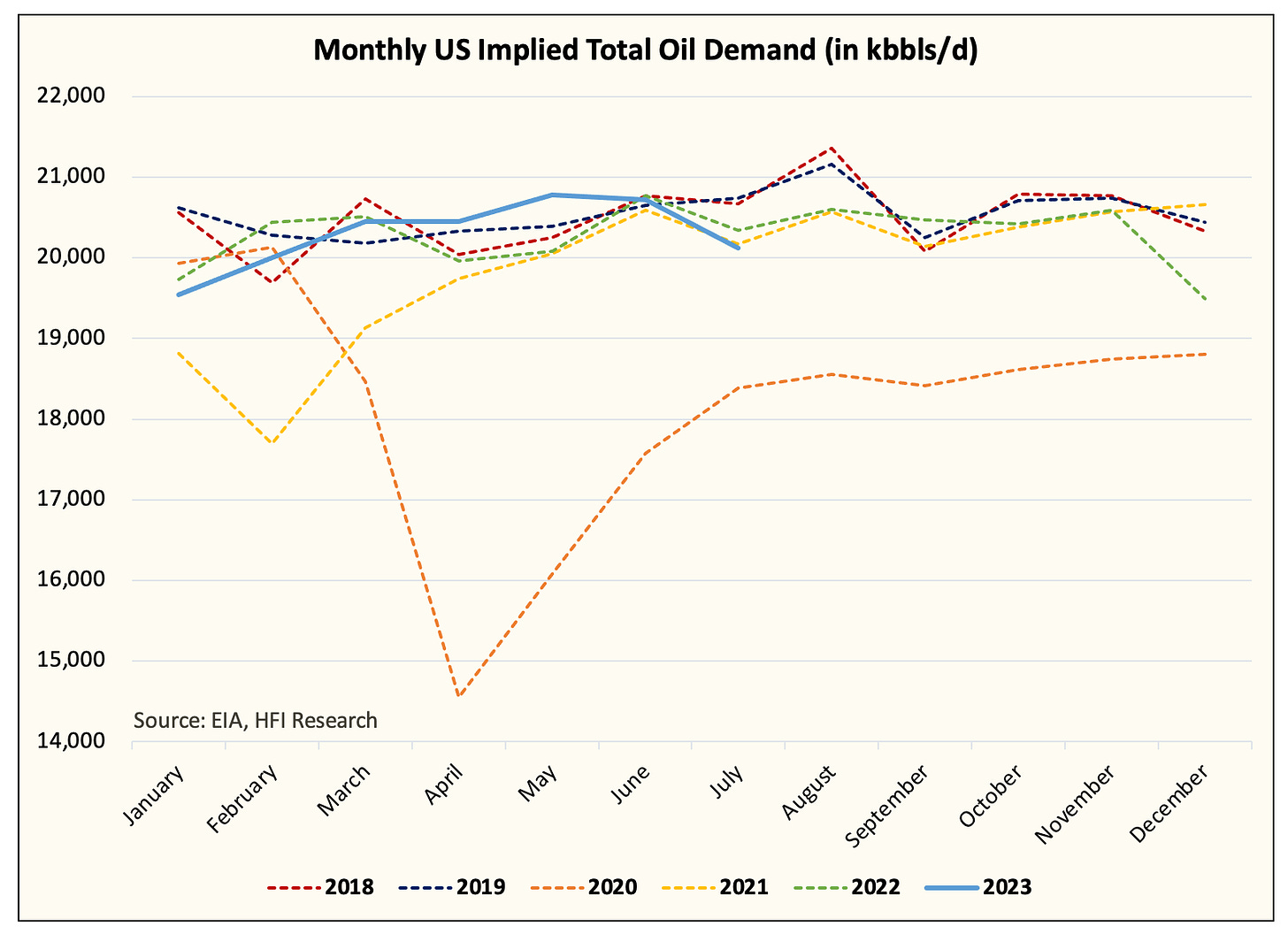

First, let's look at the more accurate monthly data.

Monthly US oil demand

As you can see, after hitting a multi-decade high in oil demand in May, US oil demand has noticeably lost momentum. July US oil demand figures are in-line with 2021 and below 2022.

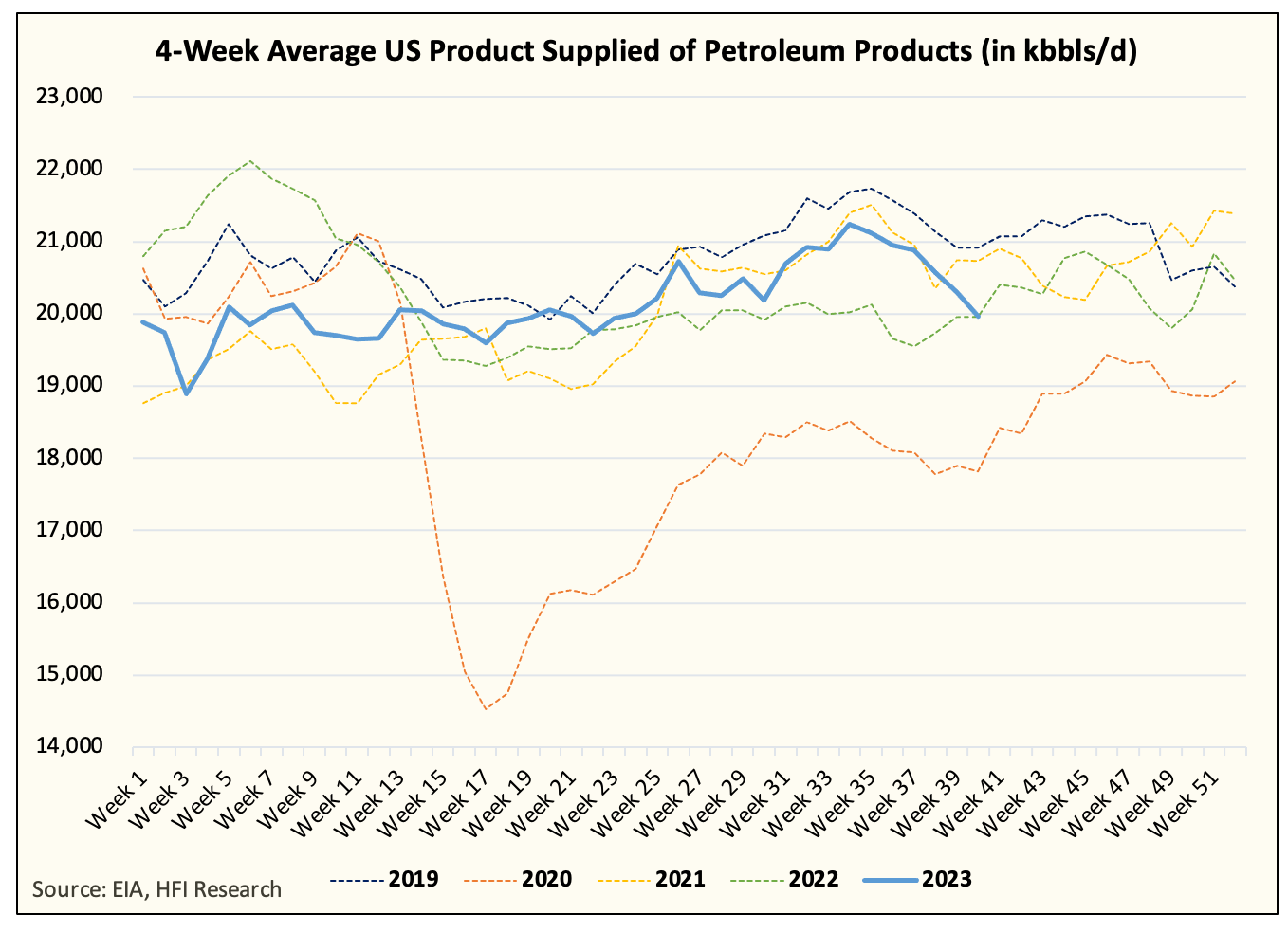

Now if we circle this back to the high-frequency weekly data, you can see that we will see a pick-up in demand again before falling. While this does not capture the entirety of the picture, the trend is a bit obvious. US total implied oil demand is likely still stuck between 2021 and 2022.

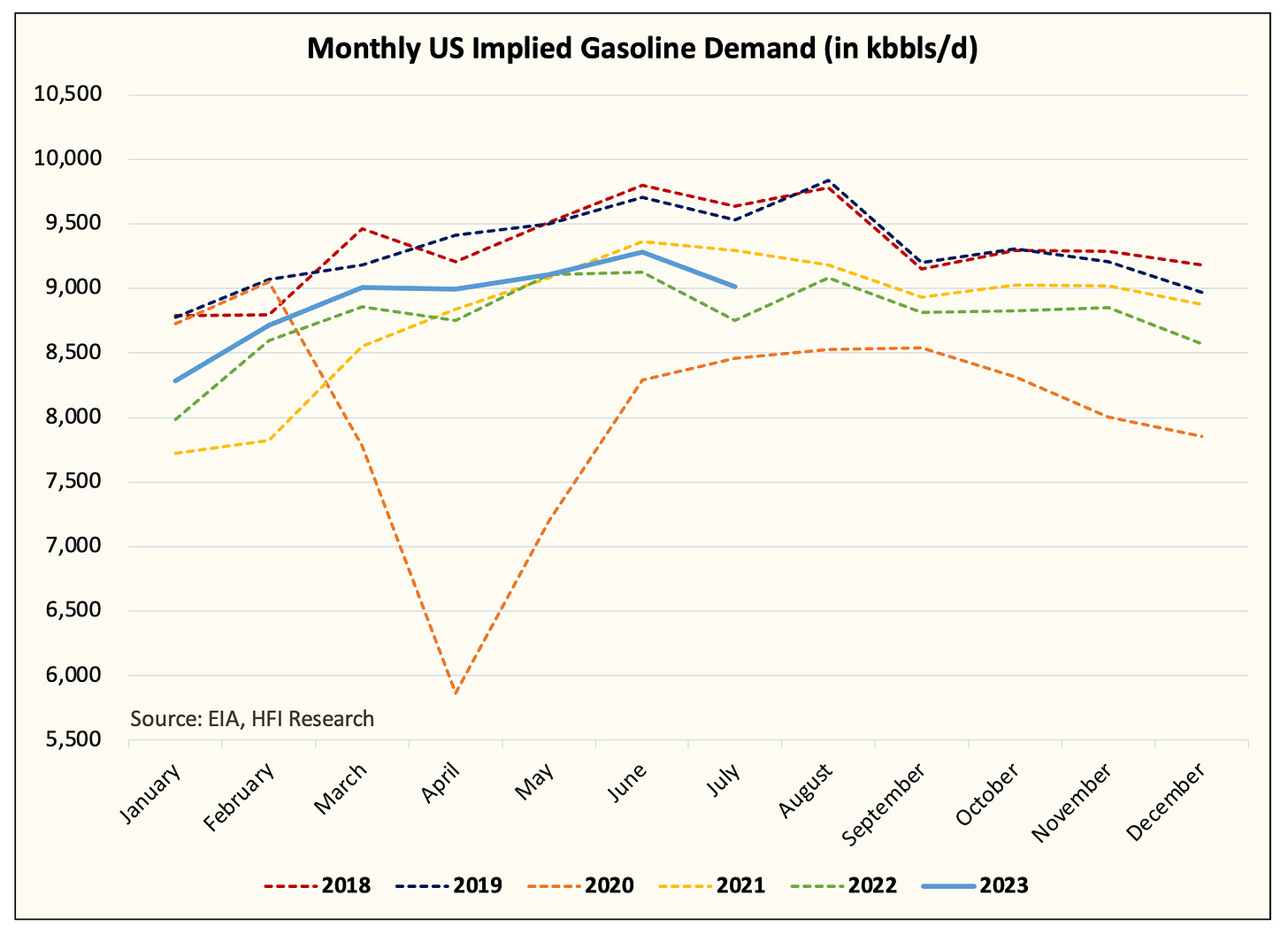

Gasoline

More notable is the weak gasoline demand figures we are seeing.

Here's the monthly chart: gasoline demand was higher than in 2022 but lower than in 2021.

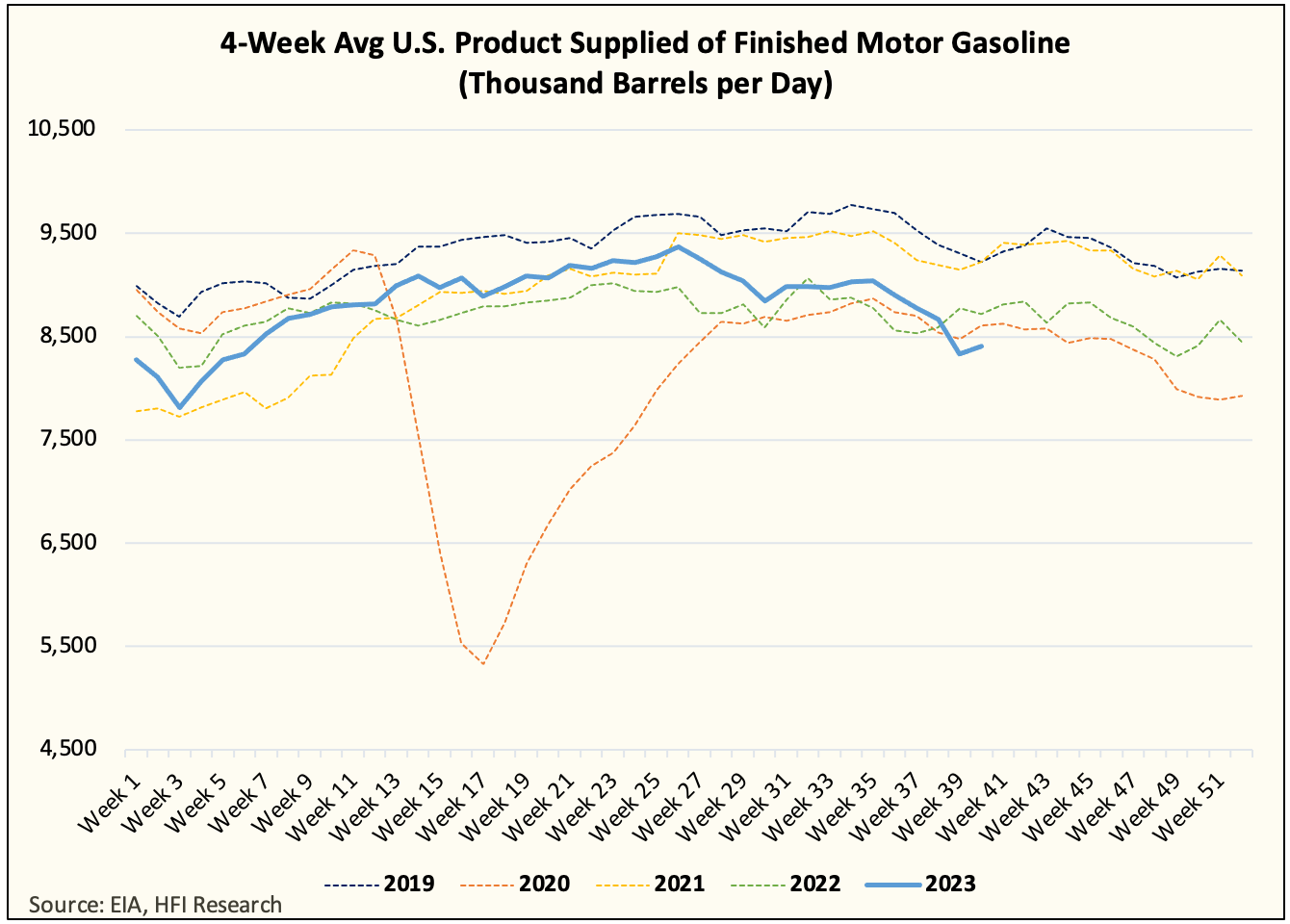

And here's the high-frequency weekly data. As you can see, we've trended lower in gasoline consumption since July, and are now firmly below 2022. Again, we don't think the weekly figure captures the entirety of the picture, but it's never been wrong directionally speaking. As a result, the truth lies somewhere in between. US gasoline demand is likely between 2022 and 2020 right now.