US Oil Demand Is Starting To Surprise To The Upside And What It Means Going Forward

A month ago, we wrote a piece titled, "US Oil Demand Is Not As Bad As It Looks." In it, we noted that the heating component masked the underlying strength we saw in gasoline and jet fuel. Fast forwarding to today, we are really starting to see gasoline and jet fuel outperform.

As you can see in the 4-week average implied demand charts above, gasoline is now firmly above 2022 and on pace to reach 2019 levels by this summer, while jet fuel is firmly above 2020 and 2022.

Both implied demand figures suggest to me that 1) the market found a price level where demand starts to rebound and 2) we are not in a recession.

I believe the first point is the most important. For those of you that have been reading our articles since June of last year, we pointed out that the market figured out where demand destruction starts to take place. (Article here)

Once the market figured out the "ceiling", it implied an asymmetric downside scenario. If you put yourself in an oil trader's shoes, you had 1) the price range in which demand was being destroyed, 2) China's continued COVID lockdown, and 3) a slowing US economy. This meant that the upside was capped, and the downside wasn't priced in. As a trader, you would be biased to the bear side, thus prompting you to sell every rally.

Now fast forwarding to today, as an oil trader, you now have the exact opposite playbook:

You know the price level at which demand starts to rebound (here).

OPEC+ cut production providing a "floor".

China's reopening on the way (no more zero COVID policy).

This brings about an asymmetric trade to the upside. Every dip should be bought because you know precisely where demand starts to rebound, but because of last June, you also have an idea of where the price cap is.

As a result, if US oil demand continues to recover, there's a good chance the market starts to push against that ceiling again. We would need to see consecutive reports of improving demand, which would then fuel the fire for this push to the ceiling. A vicious cycle would take place, and high prices creating demand destruction would be the inevitable next step.

But first, let's not get ahead of ourselves. While it is important to note the improving demand, we are still not above 2019 just yet.

The heating components are still masquerading the total demand figure. In addition, incorrect 2022 data is making the comparison look even worse. But as we go into Spring and Summer, we think total implied oil demand should surpass 2019 if WTI remains below $95/bbl. Given all the macro concerns still persisting, we think speculators will remain on the sidelines, while fundamentally speaking, oil demand will surprise to the upside.

For oil bulls, this will be the best-case scenario. What you don't want is for prices to run ahead of fundamentals creating a demand destruction scenario, while simultaneously, inventories haven't drawn nearly as much. The best case scenario is for oil demand to surprise to the upside because the market remains apathetic, and inventories draw faster than expected.

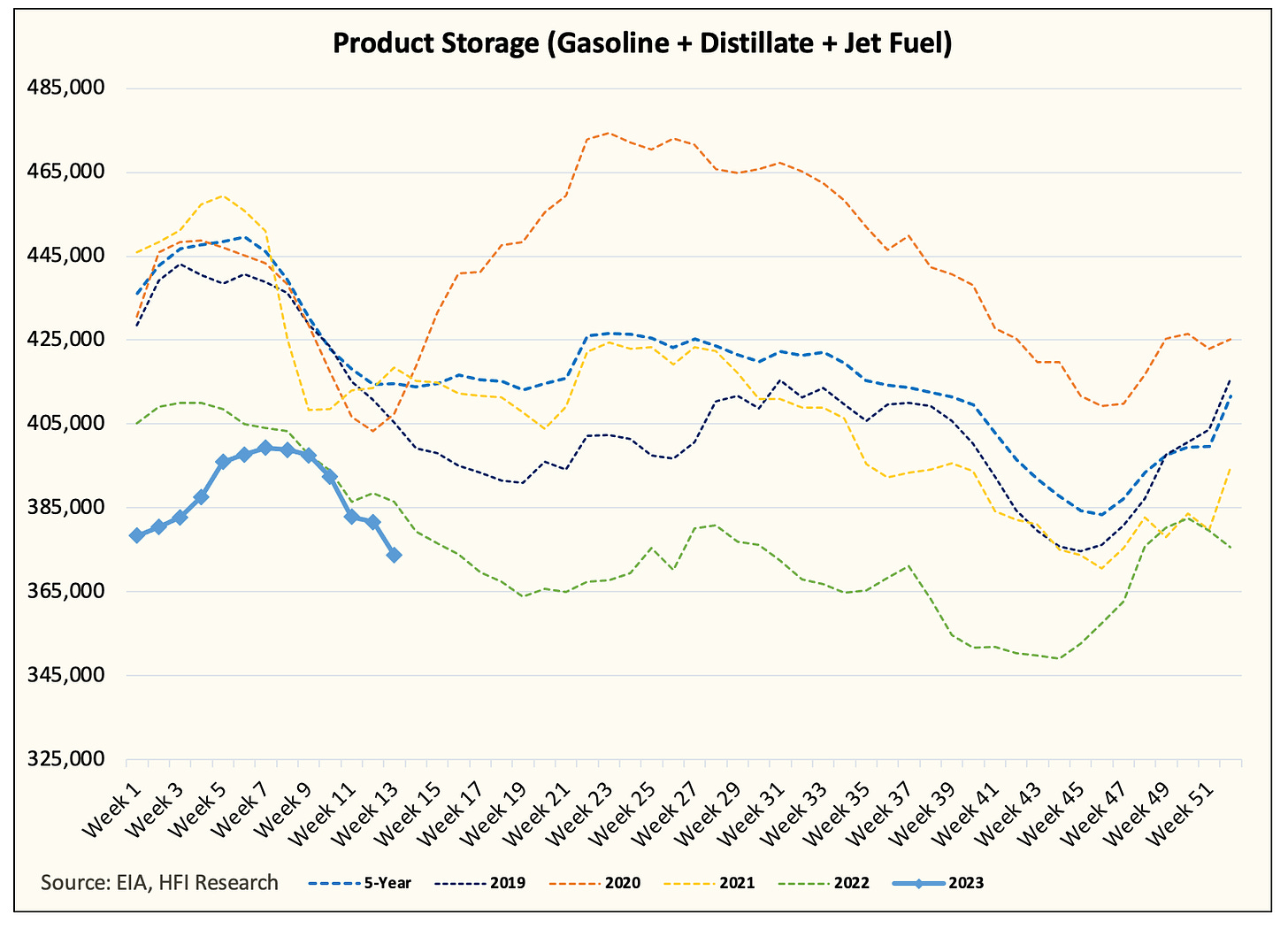

And looking at product storage, we are going to hit a new low this summer if refinery throughput doesn't pick up soon.

In addition, gasoline storage is already sitting at the lowest level for this time of the year.

In essence, if demand continues to rebound, something will have to give. The market may continue to be apathetic about oil, but refining margins are likely to strengthen, prompting more crude buying, and thus pushing WTI/Brent higher.

The physical market at some point down the road will firmly take control, and financial speculators will be playing catch up.

Conclusion

US oil demand is recovering. The oil market figured out at what price demand started to rebound. That's great news for the oil bulls because we are about to enter into an asymmetric upside trade scenario.

Something will have to give this summer. The market may remain apathetic on the heels of the macro issues, but product storage will get very tight, and the follow-on effects will push crude prices higher.

The market will need to push prices back to the point of demand destruction again. Until then, the physical market will regain control and overwhelm the apathetic financial speculator community.

For oil bulls, we need the following two things to keep happening: 1) bullish inventory draws to continue, and 2) demand to keep rebounding. If so, energy stocks and oil prices will go higher. Focus on what's important, and we will get through this.

Analyst's Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.