US Oil Production Surprised To The Downside, So Where Is It Headed?

EIA 914 was published today with US oil production for May surprising to the downside. EIA reported that US oil production fell from 11.652 million b/d in April down to 11.595 million b/d. One thing to note is that most of that decline came as a result of -157k b/d from the Gulf of Mexico. Assuming maintenance-related issues, US oil production today is close to ~11.75 million b/d.

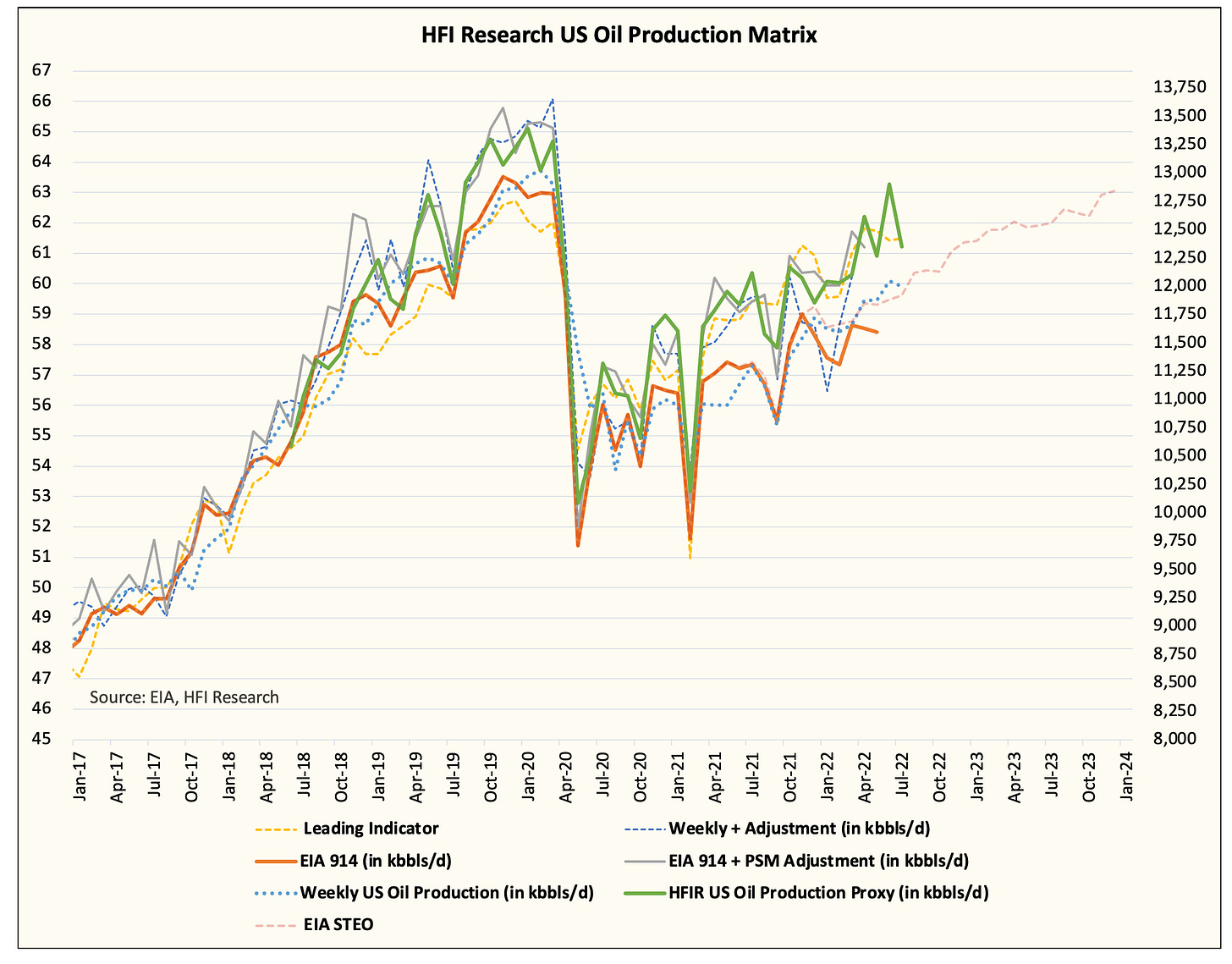

This is still lower than we had previously expected. Looking at our US oil production tracking matrix, you can see that June US oil production is expected to show an uptick, while the July data is saying that the June data was unsustainable.

Using our leading indicator (i.e. associated gas production), there's also no real meaningful pick up since April/May. This means that if you include back maintenance-related issues, US oil production today could be around ~11.8 to ~11.9 million b/d.

While we would prefer to err on the side of caution and use ~12.1 million b/d as a gauge for today's production, the data is suggesting that US oil production is meaningfully disappointing to the downside.

Another way we gauge where US oil production is today is by looking at our real-time proxy. As you can see, while the data has been volatile as of late, we saw an uptick followed by a severe drop in July data. Many readers will remember that EIA had data issues for 2-weeks, so the July data may just be reversing some of the errors that occurred in June. As a result, we would conclude that June saw an uptick in production but not by much.

Again, our real-time proxy is showing ~11.8 to ~11.9 million b/d.