Editor’s Note: I want to apologize to everyone who subscribed to us because of our natural gas content. Over the past few weeks, the traveling schedule and idea-related drama have occupied too much of the brainpower. I was very thankful to Jon for publishing his well-thought-out bear case for natural gas. In this article, I will make some counterarguments to what he said and explain the potential timing path for our long natural gas equity investments.

It’s been a while since we’ve done a comprehensive natural gas market update detailing our thoughts on the near-term and the long-term. In this piece, I will give you some of the latest natural gas fundamental updates, along with thoughts on how we should navigate through this winter. In addition, I will explain some of the bearish and bullish things I’m seeing in the market and how that could help you position in your portfolio.

Near-Term (1-2 months)

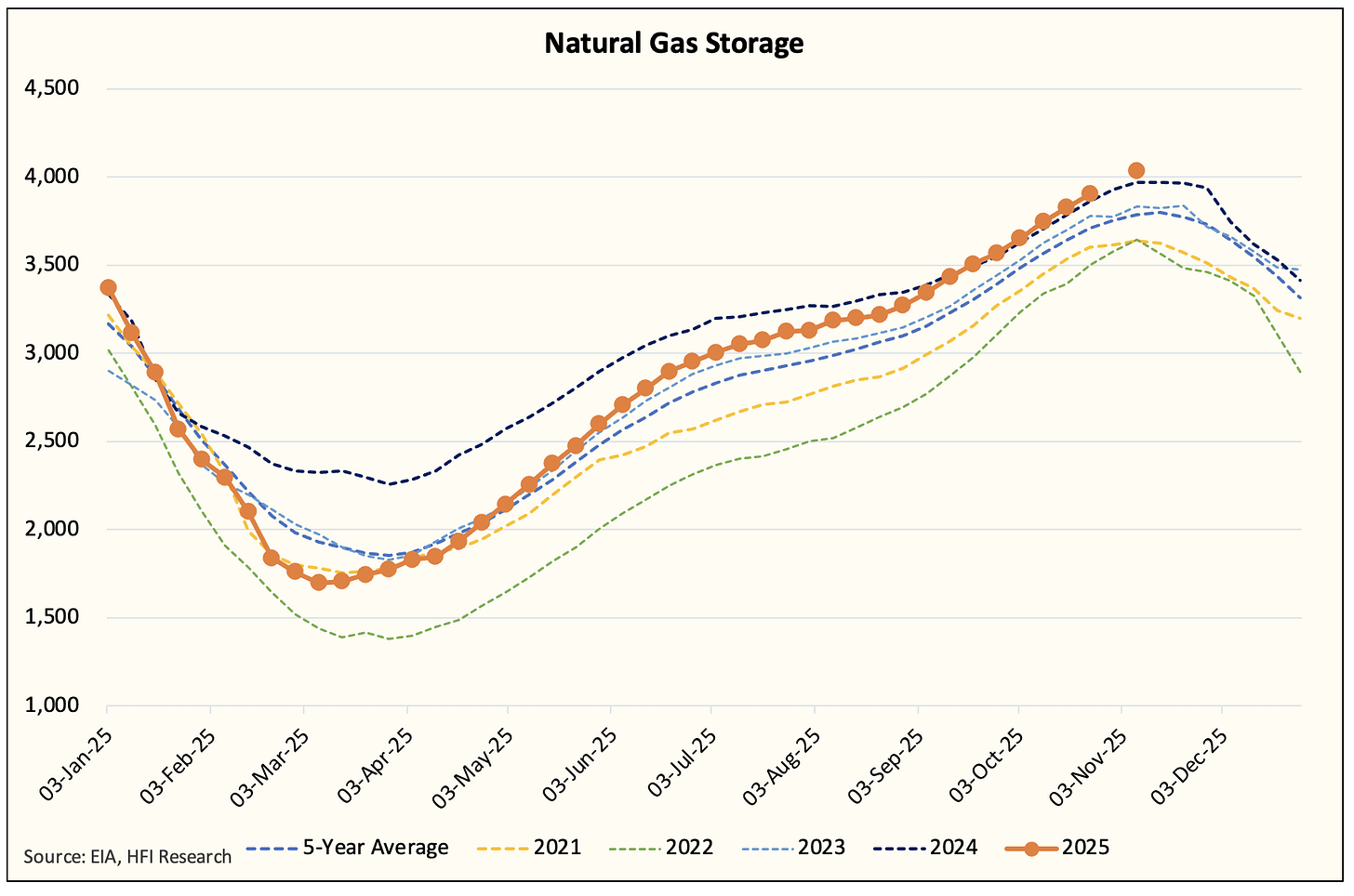

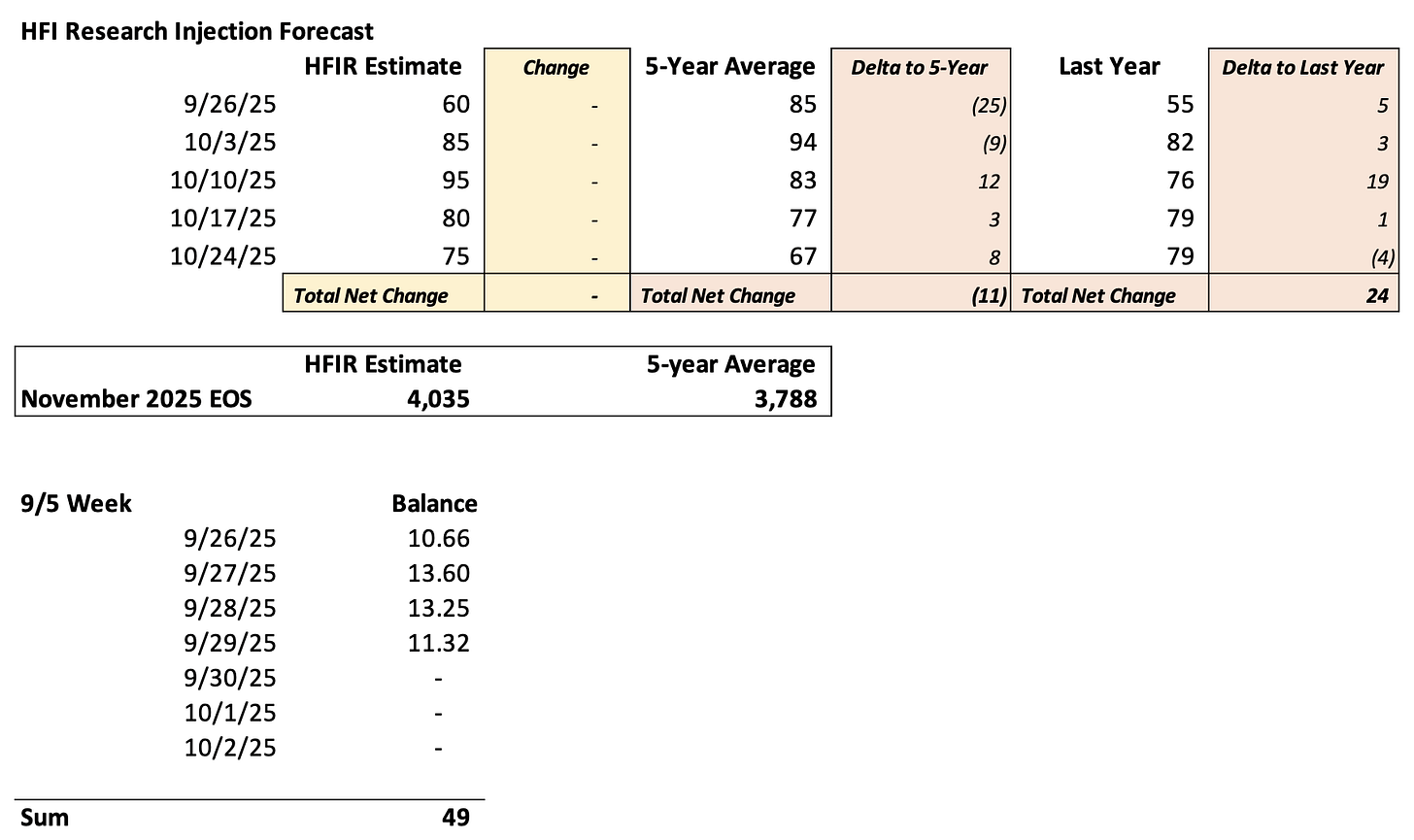

With only 5 weeks left until the end of injection season, natural gas storage will finish this injection season above the ~4 Tcf mark.

The market is already fully expecting this, so there won’t be any downside surprise to the price.

As we approach the end of the injection season, the market will start to shift its focus to the potential of an early start to heating demand. It won’t be until early November before we start to see weather volatility return.

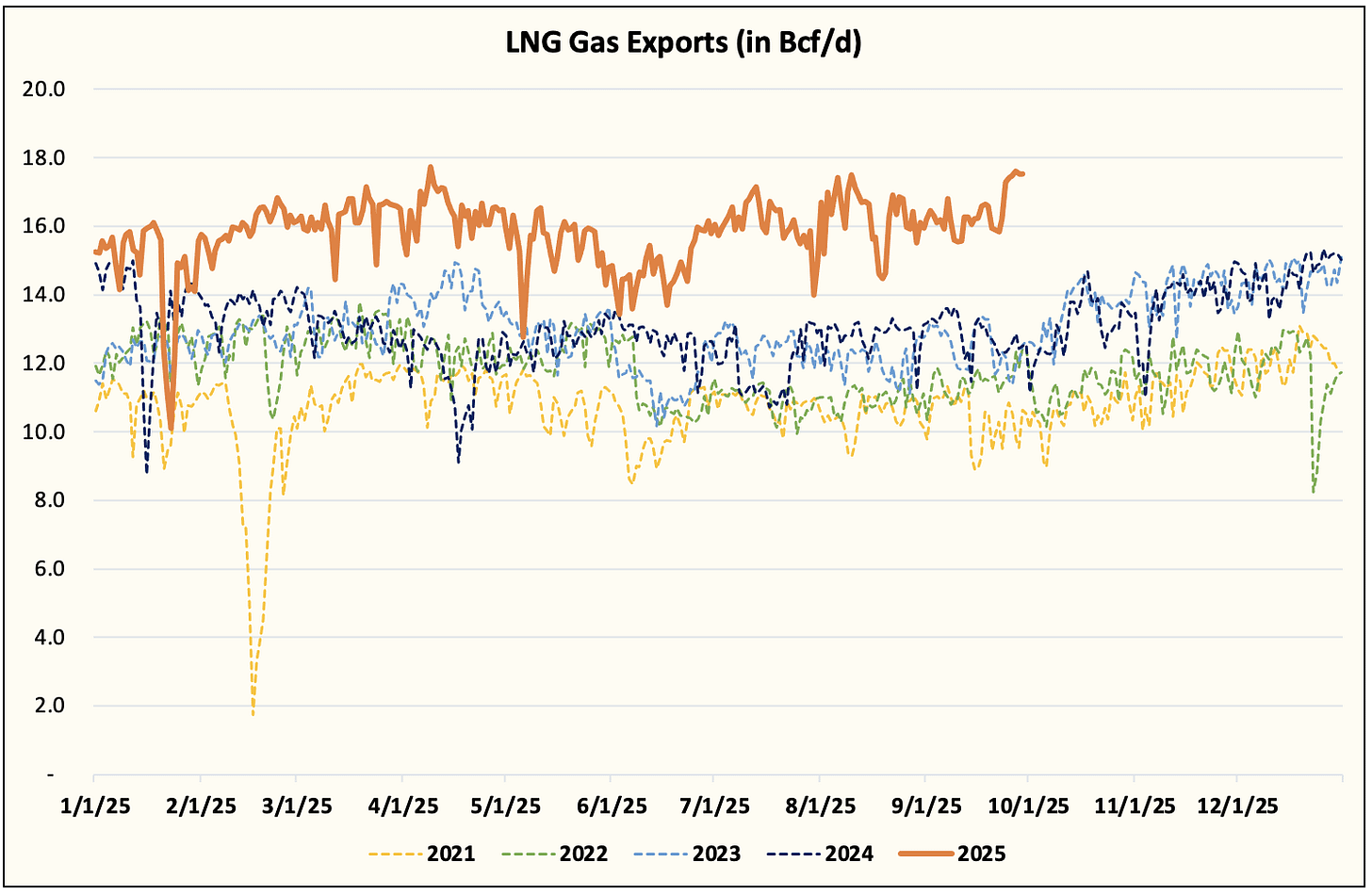

On the demand front, LNG feedgas demand is near ~18 Bcf/d, and projections are for demand to reach close to ~19 Bcf/d by year-end.

The increase in LNG, coupled with stagnating Lower 48 gas production (thanks to very weak regional gas prices), has pushed the implied natural gas balance to a small deficit.