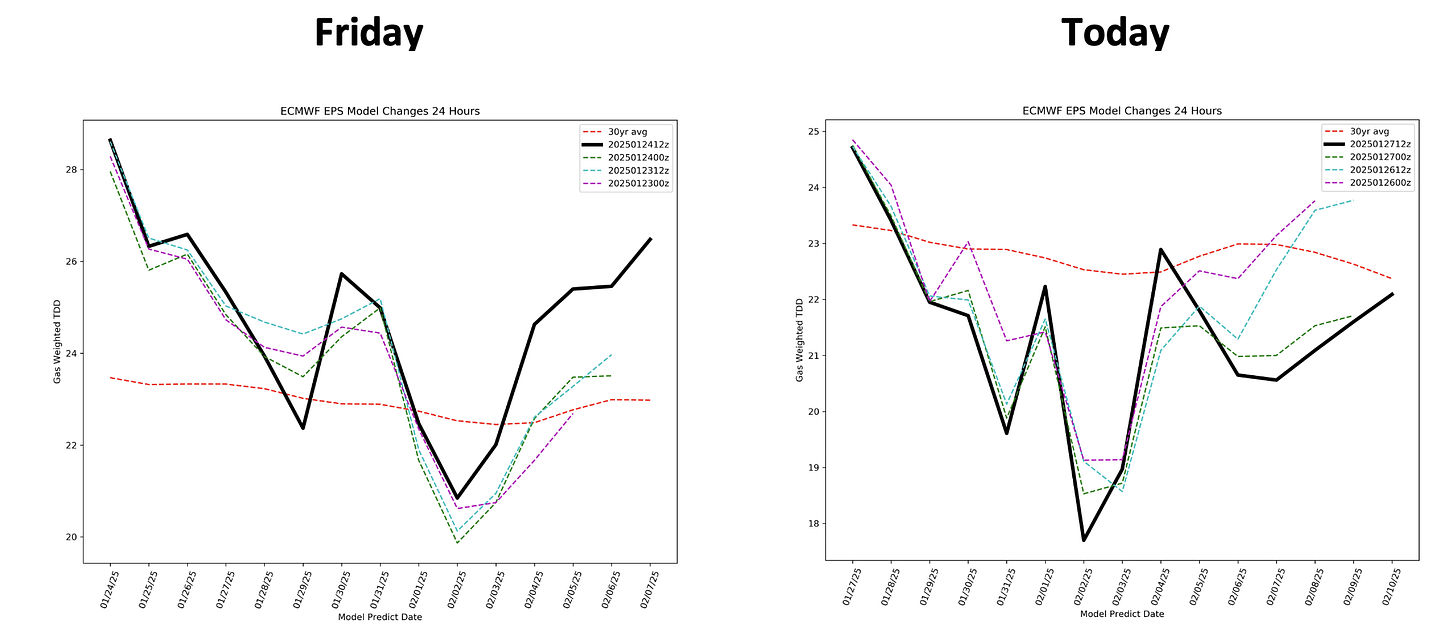

Natural gas trading is difficult. It is more difficult when weather models flip-flop like we saw on Friday. Following an immensely bullish ECMWF-EPS 12z update on Friday, we took our KOLD long position (short natural gas) off just before the weekend.

For those of you who have traded natural gas with us for a long time, you will know that 1) weekend weather model roulettes prevent you from getting a good night's rest and 2) it's gambling at its finest.

As a result, we closed our KOLD trade at $32.81 for a gain of 6.53%. Don't ask us what KOLD is trading at today (haha).

But for the readers who didn't execute the trade alert on time, this article will help inform you of what to do next as we re-evaluate the short-term outlook for the natural gas market.

Natural gas trading, is it profitable?

First, I want to address some questions readers had in regards to natural gas trading. Is it profitable?

The answer is yes but with a caveat.

We have been trading natural gas since 2018 and our trading record can be seen on the tab at the end of the article. After a successful year in trading natural gas in 2018, I noticed the "edge" in trading natural gas was quickly disappearing in 2019. It was becoming harder and harder to trade profitably with frequency.

This came to a grinding halt in 2020 when we had to claw back from losing trades in the early part of the year. After 2020, we changed our methodology to only trading natural gas when 1) the obvious was too obvious to ignore and 2) the risk/reward made sense.

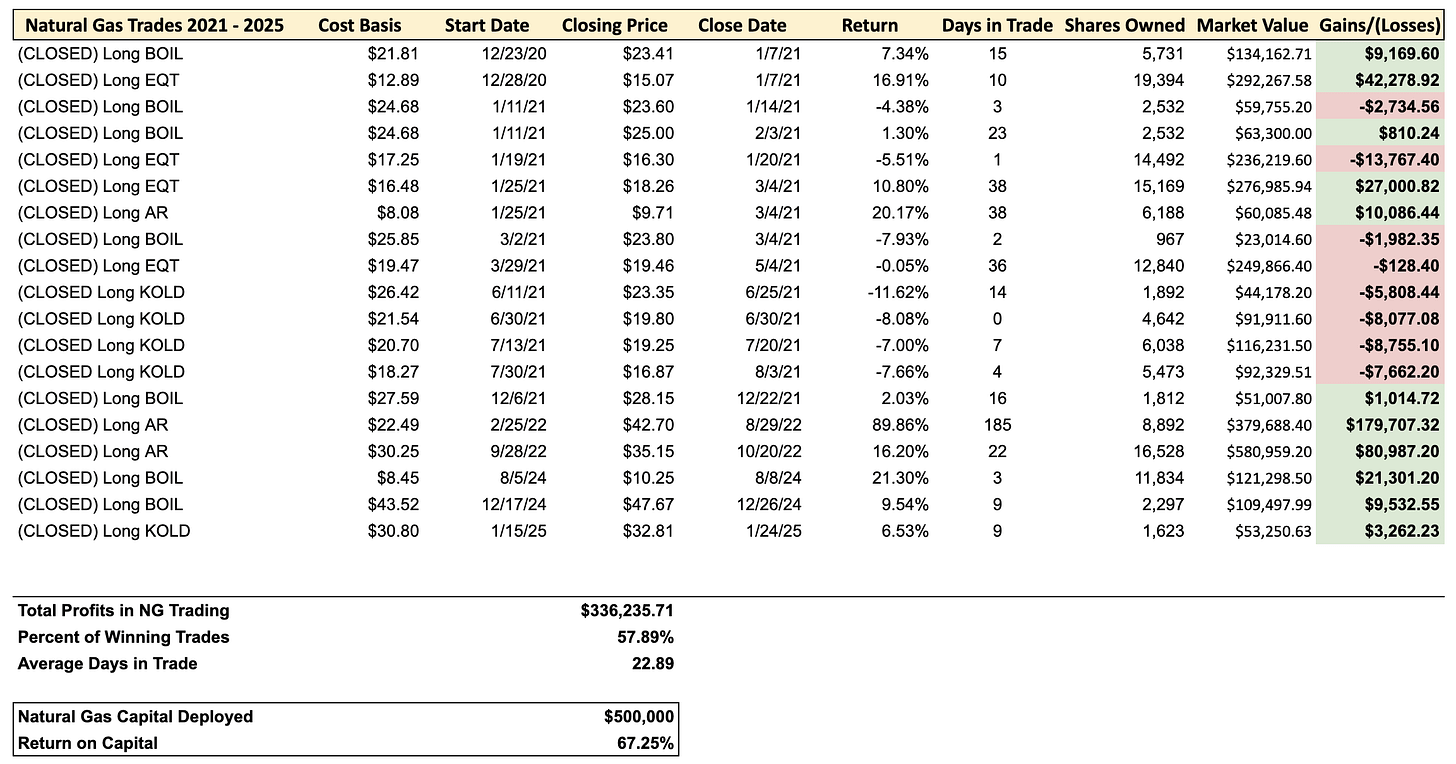

Since the methodology change, here are all the trades we've done in natural gas and natural gas-related equities.

Source: HFIR Portfolio

Overall, the patient approach in natural gas trading is a better approach than the frequent trading approach (for us).

While it may feel like we are leaving money on the table by taking profits, you can see that the big gains are made from the equities. You want to wait for a favorable market tailwind and ride natural gas equities higher (like the one we are seeing later this year).

With that, let's move on to the meat of this article.

Weather, weather, weather

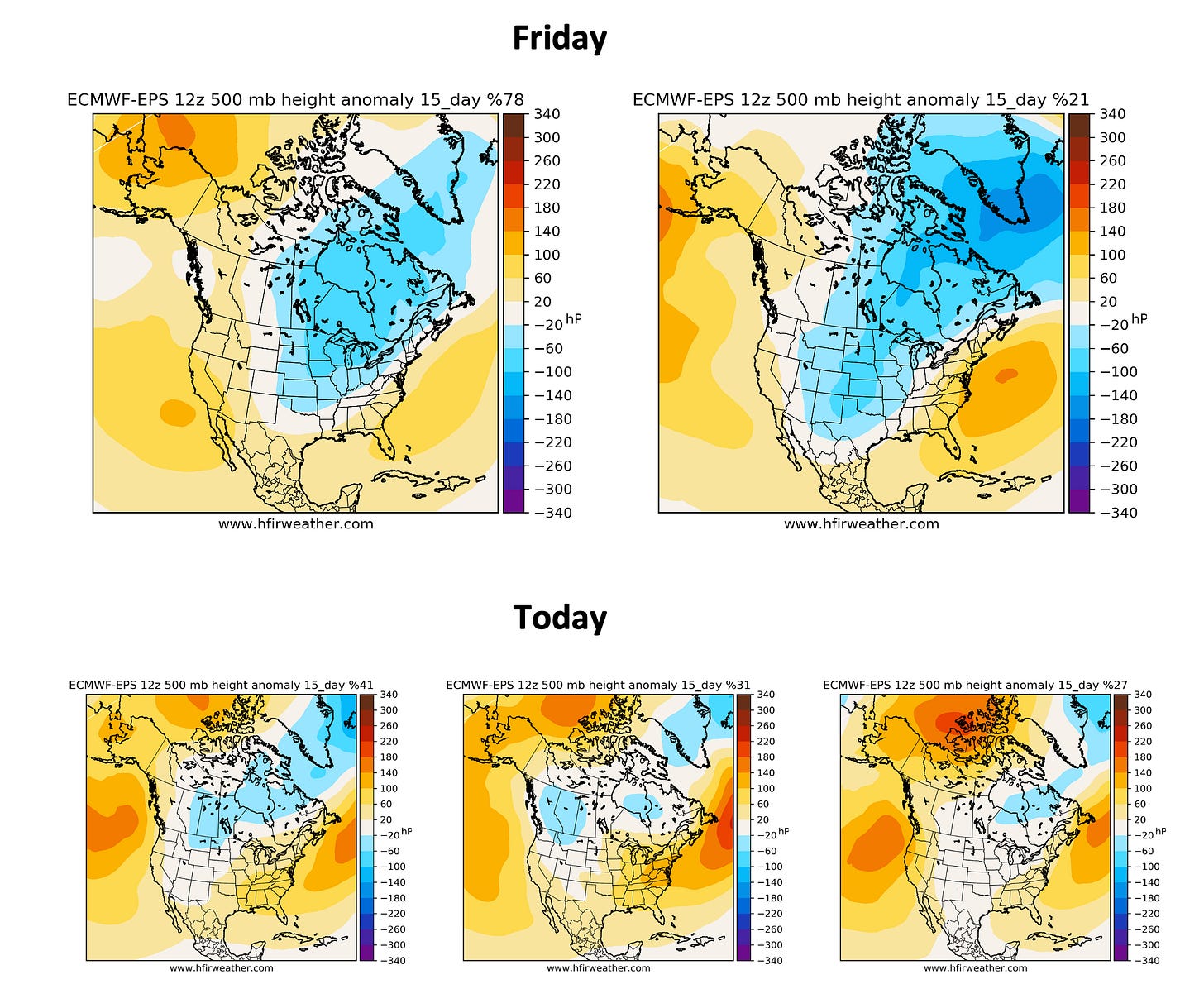

The difference between Friday and today's latest weather model update is night and day. The outlook is very bearish with the 15-day going from a "cold blast" potential to warmer than normal.

The issue right now is that the weather models are a coin-flip from being very cold and being very warm. This tweet from Commodity Wx Group best highlights what's going on:

Source: CommodityWxGroup

And if you look at the latest 15-day outlook, the trend is still for warmer-than-normal weather to continue, so I think the bears are in control for now.