(WCTW) Asking For A Friend, Does The OPEC+ Production Cut Really Matter?

OPEC+ announced that the voluntary production cuts will be extended to the end of June. But a more important question I think everyone should ask is: does the production cut even matter?

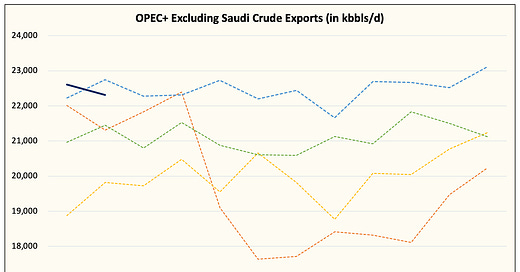

Yes, I understand production does not equate to exports. Domestic demand has a material fluctuation on how much OPEC+ can export on a month-to-month basis. Seasonality also plays a role along with maintenance, but from the market's perspective, without the Saudis, is this even a production cut?

If you look closely at the data, the only country really cutting production is Saudi.

Y-o-y, Saudi crude exports are ~500k b/d below. At ~9 million b/d of production, we think the Saudi cut is real. As for everyone else, well, it's not showing up in crude exports.

The biggest offender of all of this is Russia, once again. Looking at Russian crude exports, it's clear that weather and maintenance impacted crude exports in February. A similar drop was seen last year, so the new announcement that they will cut production by ~471k b/d to the end of June just seems like more posturing.

Since the voluntary production cuts have been announced, Russia has effectively not reduced supplies to the rest of the world. No matter how you slice and dice the production does not equal to export argument, the reality is that the availability of crude from Russia to the rest of the world is higher, not lower.

And for the market, that's the only truth that matters.