(WCTW) Endgame

It's like the dot-com bubble all over again, except it's a lot worse this time. No one wants value, and they definitely don't want energy stocks.

What we are witnessing in the crypto and tech markets won't end well.

Ok, the end. Bye.

But if you want to read on, I will share with you some of the things I'm seeing that would persuade you to see my view. You see, I'm a student of history and the 1999/2000 dot-com bubble could easily be replaced with some buzzwords today like artificial intelligence and crypto.

Below, I want to share with you this article written on Dec 1999 by Mitchell Martin.

It is easy to overlook amid the current Wall Street frenzy, but most U.S. stocks fell in 1999. The major market indexes are closing out the year at record levels, but most of the big winners have been related to the Internet.

What is unusual, however, is that even with the Dow Jones industrial average and the Standard & Poor's 500 showing double-digit gains, most U.S. stocks were down. With less than a week left to go in the year, falling issues outnumbered advancers 3,780 to 3,213 on the New York and Nasdaq markets combined, according to Birinyi Associates Inc., a company in Westport, Connecticut, that analyzes investor activity.

"I think that the stock market has been taken over by the individual investor," said Edward Yardeni, chief economist of Deutsche Bank Securities. This individual "has concluded that valuation does not matter, that we are in the new economy with no prospects of recession anytime soon and expectations that perpetual prosperity is here to stay."

Fast forwarding to a year later, the dot-com bubble popped, and here was an article from Dec 2000.

A year ago Americans could hardly run an errand without picking up a stock tip. Day-trading manuals were selling briskly. Neighbors were speaking a foreign tongue, carrying on about B2B's and praising the likes of JDS Uniphase and Qualcomm. Venture capital firms were throwing money at any and all dot-coms to help them build market share, never mind whether they could ever be profitable. It was a brave new era, in which more than a dozen fledgling dot-coms that nobody had ever heard of could pay $2 million of other people's money for a Super Bowl commercial.

What a difference a year makes. The Nasdaq sank. Stock tips have been replaced with talk of recession. Many pioneering dot-coms are out of business or barely surviving. The Dow Jones Internet Index, made up of dot-com blue chips, is down more than 72 percent since March. Online retailers Priceline and eToys, former Wall Street darlings, have seen their stock prices fall more than 99 percent from their highs.

Now if you took these excerpts, and replaced dot-com with AI and crypto, you will realize history is repeating itself again. Everyone that's participating in the bubble believes this time is different, but it never is.

In my MEMO yesterday titled, "Gold Rush In Crypto." It really is the wild wild west again, but while crypto enthusiasts are clamoring on the belief that Bitcoin is revolutionary and will change the world, what they fail to realize is that Bitcoin is just a higher beta bet on the Nasdaq.

You don't have to be a rocket scientist to see how shockingly aligned the two charts are. And this is not a short-term pattern either, this has been going on for 6 years. Meanwhile, hardcore believers will tell you that Bitcoin is finite as there will only ever be 21 million of them. Never mind the fact that you can now buy 0.000000000001 Bitcoin... I think you get the point.

But maybe Bitcoin is destined for $1,000,000 one day, or maybe, it could crash 90% first before getting to that $1,000,000 target. I have no idea, but what I do know is that trees don't grow to the sky, and human emotions create boom and bust cycles. Financial markets go into bubbles, and victims are usually the ones who get in late.

Endgame

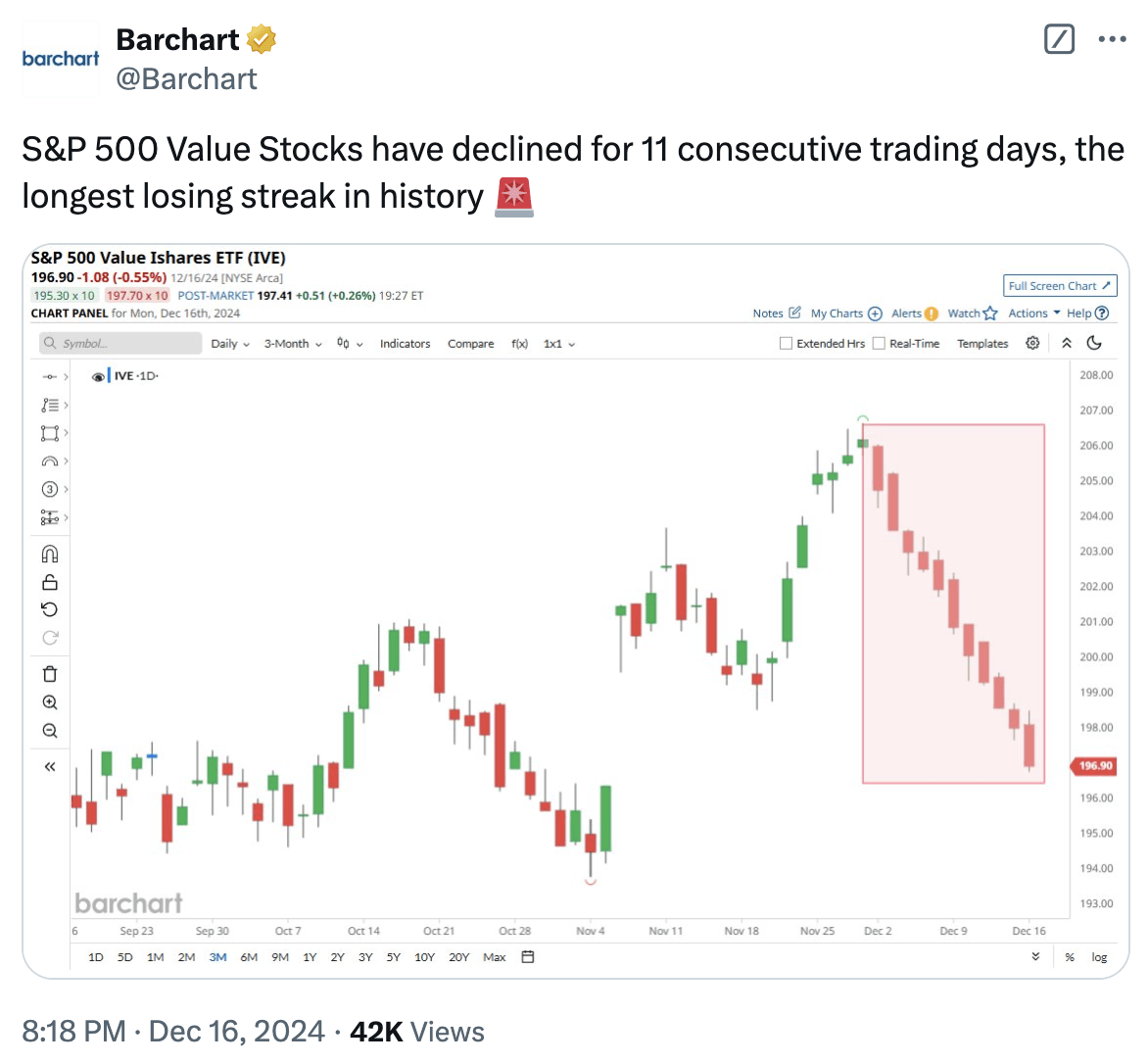

What we are witnessing today is the endgame. Value stocks are being discarded left and right. In fact, I had no idea that value stocks fell for 11 consecutive trading days.

No wonder I feel like Leonardo Dicaprio after fighting a bear.

But from everything I'm seeing in energy-to-value stocks, I can confidently say that this is similar to what we saw in the dot-com bubble. People have no regard for financial modeling or value. To make matters worse, there have been indiscriminate sellers in many of the stocks we are watching just because we are approaching year-end.