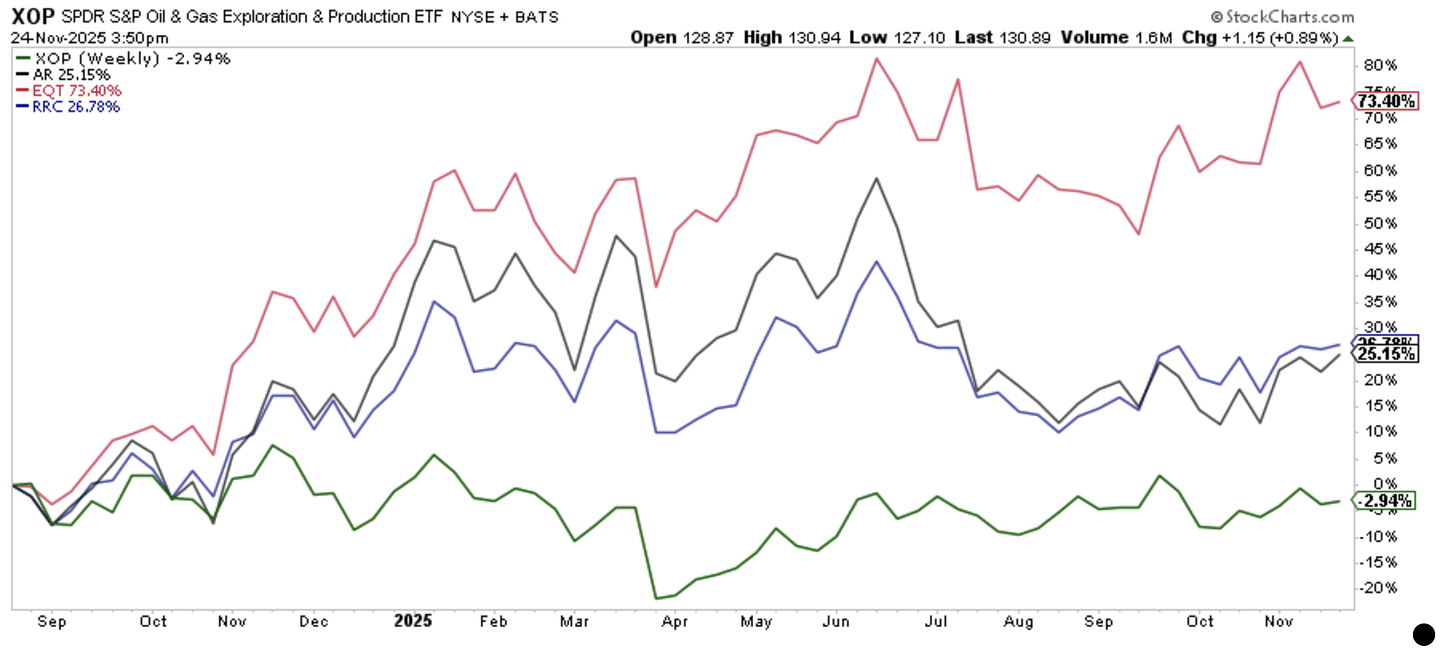

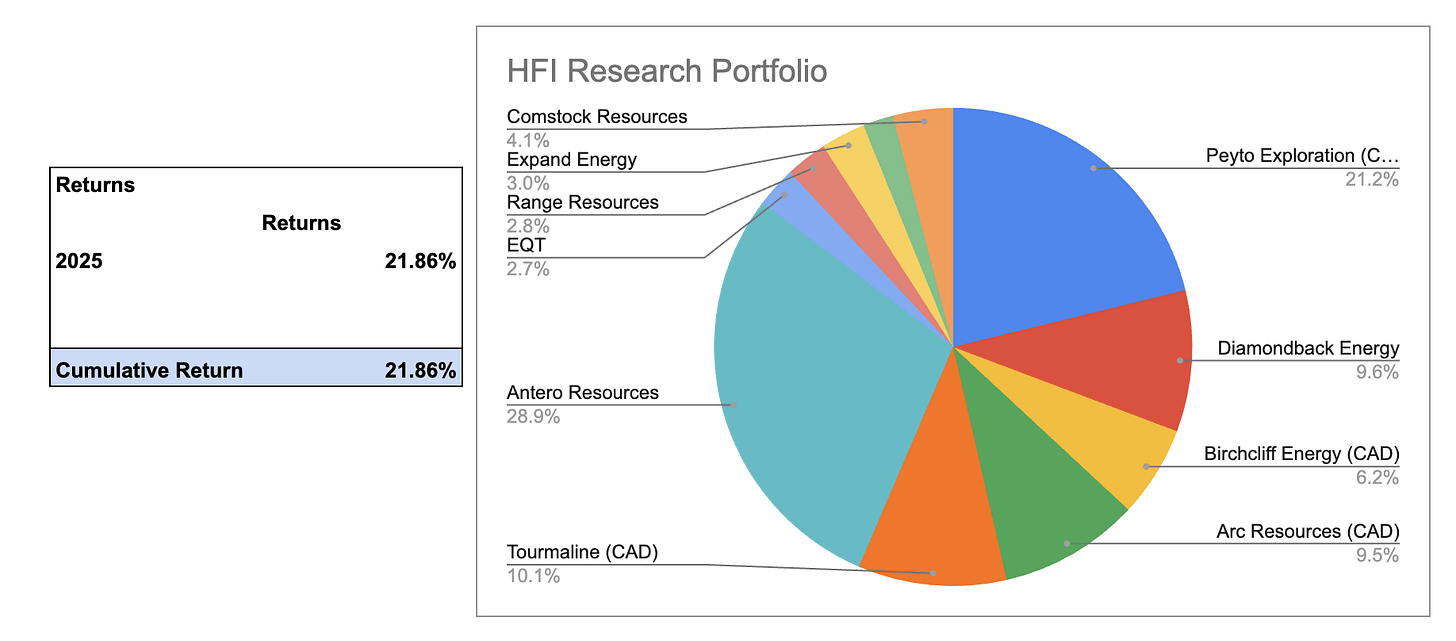

At HFI Research, we have been very bullish on natural gas since August 2024 when we published this “important” piece. Since then, natural gas equities have performed far better than the broader energy sector, and the HFIR Natural Gas Portfolio, launched in March, is up ~21%.

Natural Gas Producers vs XOP

HFIR Natural Gas Portfolio

Over the next 12-15 months, we are strong believers that the natural gas bull market will continue thanks to a combination of 1) slower production growth, 2) an increase in structural demand, and 3) higher appreciation from investors that natural gas is needed to meet the incoming power burn demand needs.

But like anything in the market, there will come an inevitable “road bump” period that will reset market dynamics. In this case, we do see a reset period in late 2026 that will result in another round of oversupply in the natural gas market.

Readers familiar with our thinking can reposition from natural gas producers into oil producers by the end of 2026 to take advantage of this “energy playbook”.