(WCTW) Energy Stocks Set To Materially Outperform Their Tech Counterparts

The market does funny things near tops and bottoms. For me personally, the last few months have been nothing but torturous. On Jan 16, I published a WCTW titled, "Disappointment." In it, I wrote:

Disappointment

There are days, like today, where I just sit in front of my computer screen pondering what life would be like if I just had a time machine. What would my life be like if I just traveled back into 2015 and stopped myself from looking at oil and gas. What life would be like if I never started HFI Research, and what life would be like if I just kept investing in tech.

Would life have been that much easier? Clearly, my investment returns would have fared much better. And I guess it would have saved me from the deep agonizing pain I had to go through in 2018, 2020, and now.

But then I stop myself during these moments of fantasy drift. Is that what I live my life for? Is the purpose of my life to pursue to make money for just the sake of making money? Hell yes, I think. What the hell else is the point of investing if it isn't just to make money?

So yes, sometimes I am human.

Fast forwarding to 2-months later, it doesn't feel all that different (personally). But from a market perspective, things look vastly different. Oil, which started the year fluttering around the low $70s, is finally starting to turn. With WTI now above $82.50, many of the names we own and cover are going to prosper this year with their earnings.

And more importantly, I think there's a seismic shift coming for the broader market. Like the MEMO I published on March 8 titled, "Closer to the end than the beginning." The tech relief rally we've witnessed since the start of 2023 is coming to an end.

For us, one of the most important cycle charts we've been paying attention to is the Nasdaq vs Energy.

It will be important to pay attention to this chart as the Nasdaq vs Energy chart retested the 2000 highs. From a market structure standpoint, with many of the FAANG composite names now starting to lose their YTD gains, it will be interesting to see how momentum begets momentum.

And if you look at the FAANG composite versus the S&P energy sector, we have not retested the lows we saw in 2021 to 2022. If it fails to break out, then we see our target hitting sometime in 2025, which suggests material underperformance in tech vs energy.

Fundamentally speaking, the only reason why we have seen such a stellar rally in Nasdaq since 2023 is largely on the artificial intelligence frenzy. The moment this fizzes away, as all fads and trends do, Nvidia and the rest of the AI cohorts will take the tech sector down with it.

Cycles, it's always the cycle...

Nothing in the market goes up in a straight line. If it does, it's more likely to pop than end well. The tech bubble of the 2000s has served as a historically good lesson for people seeking to learn from other people's mistakes. But people are once again not learning this time around with the AI frenzy.

Did you know that if you had bought Microsoft in March 2000, it would have taken you 14 years for the stock to regain its previous peak? And that's with a strong company like Microsoft!

But during manias and euphoria, people tend to forget that markets ebb and flow, and things always mean revert. This time is no different and while AI may end up changing the world in the future (like the internet did), investing in such a frenzy may not turn out to be so profitable.

Sentiment...

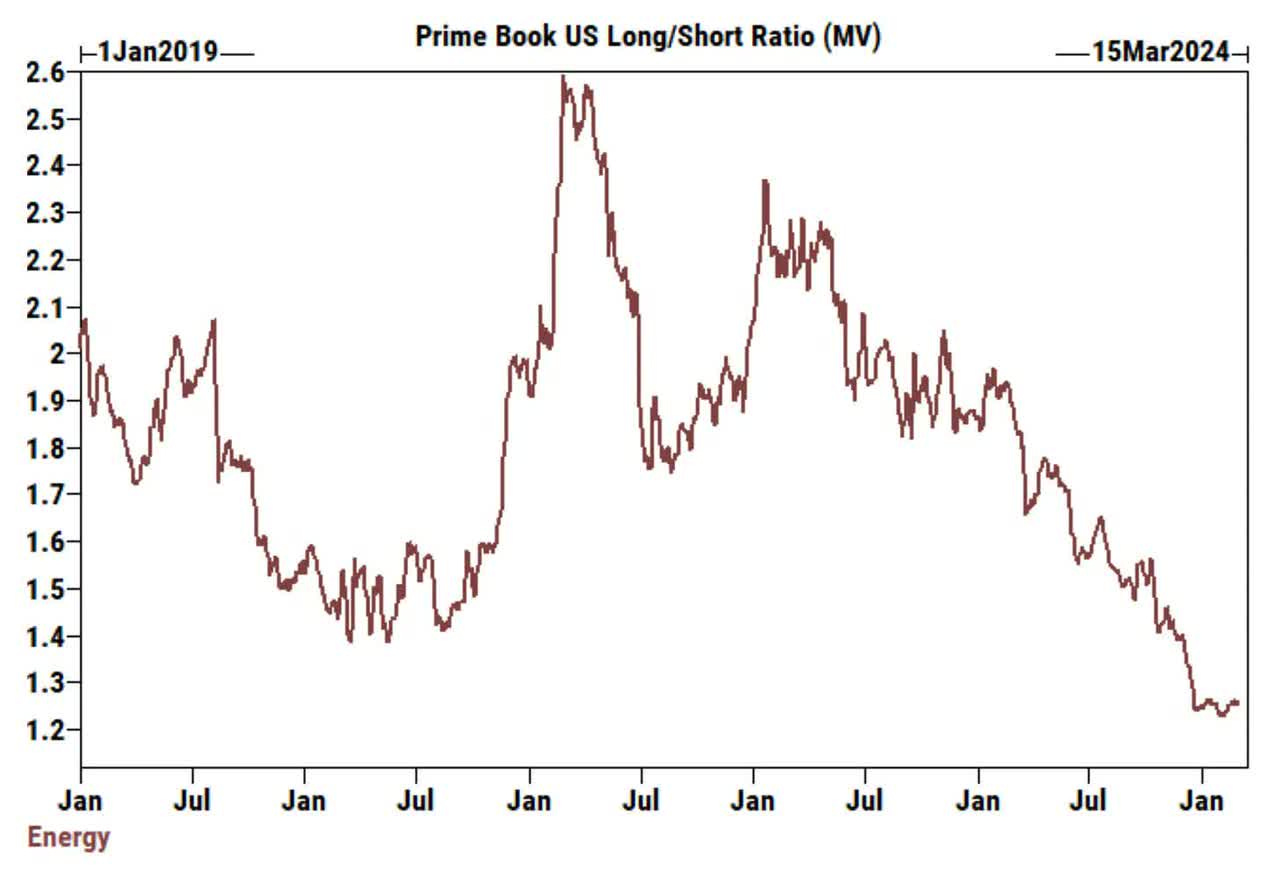

For energy stocks, the fundamentals are only improving with each passing day WTI is above $80/bbl. And from a positioning standpoint, hedge funds have never been this bearish on energy stocks.

Source: Daily Chartbook

Meanwhile, tech stocks continue to attract an unbelievable amount of inflows.

Source: Topdown Charts

For investors, this is no longer a mental exercise of disciplined investing, this is just trend-following/momentum investing. Instead of buying energy stocks with free cash flow yields close to ~20%, investors are willing to buy something with the possibility of growth of 30% at a free cash flow yield of 2%. In some cases, companies like Apple are projected to grow revenue at just 1%, yet, it has a free cash flow yield close to 4%.

FCF Yield

As the saying goes, "What the wise do in the beginning, fools do in the end."

What's obvious to me today is that tech is exceptionally overvalued, and energy is exceptionally undervalued.