(WCTW) Follow The Process (Part 3) - Oil Correction Is Coming To An End

Please read part 1 and part 2 of "Follow the Process."

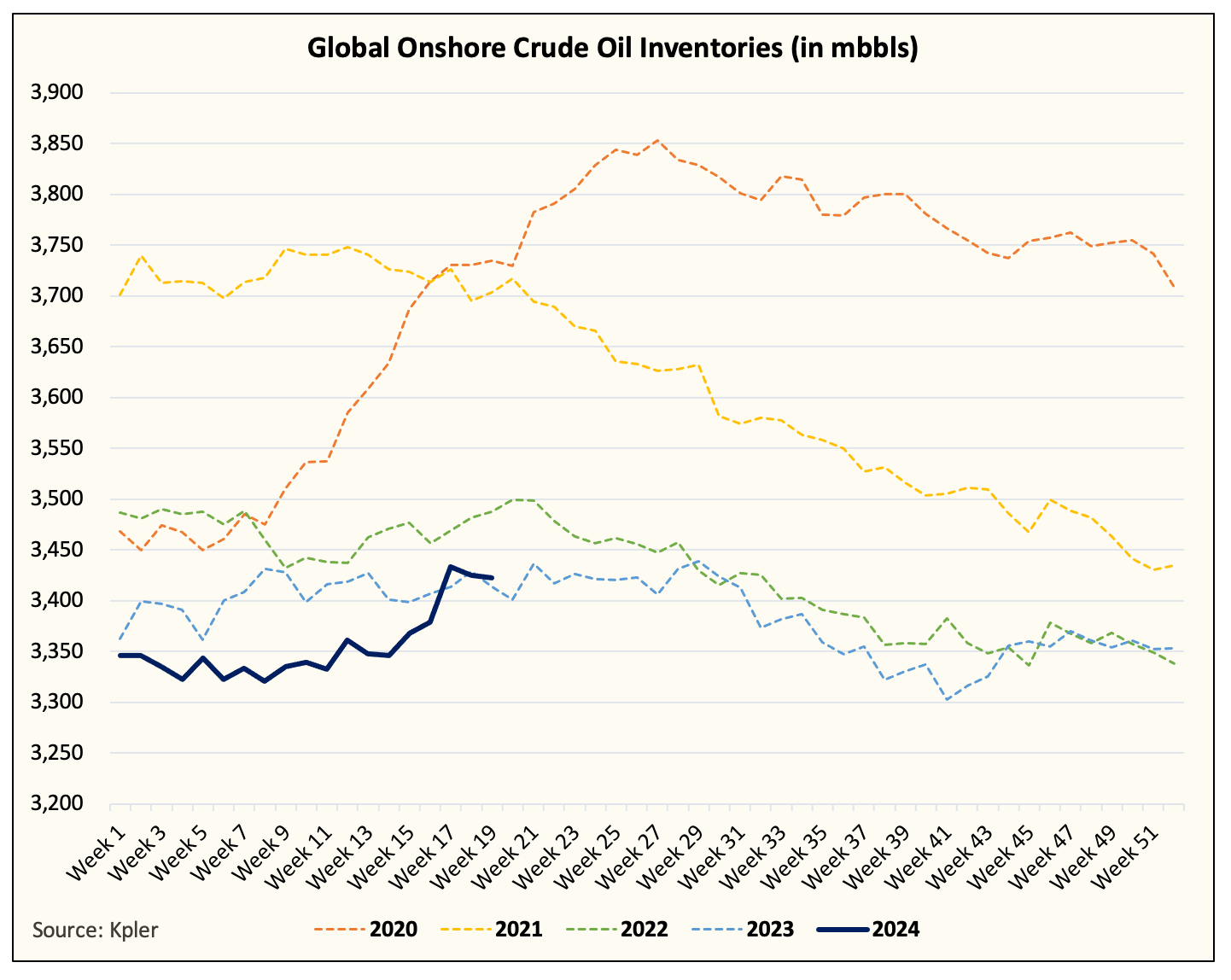

In early April, we saw signs that oil prices were getting ahead of itself. Physical market conditions were starting to peak, financial speculator positioning got stretched, and global oil inventories were going to build in April due to peak refinery maintenance.

Since then, WTI has corrected from $85/bbl down to $78/bbl. The correction is mild compared to historical drawdowns, and given the fundamental setup we see this year, the trading range should be very narrow, giving readers an understanding of this market an edge.

Follow the Process

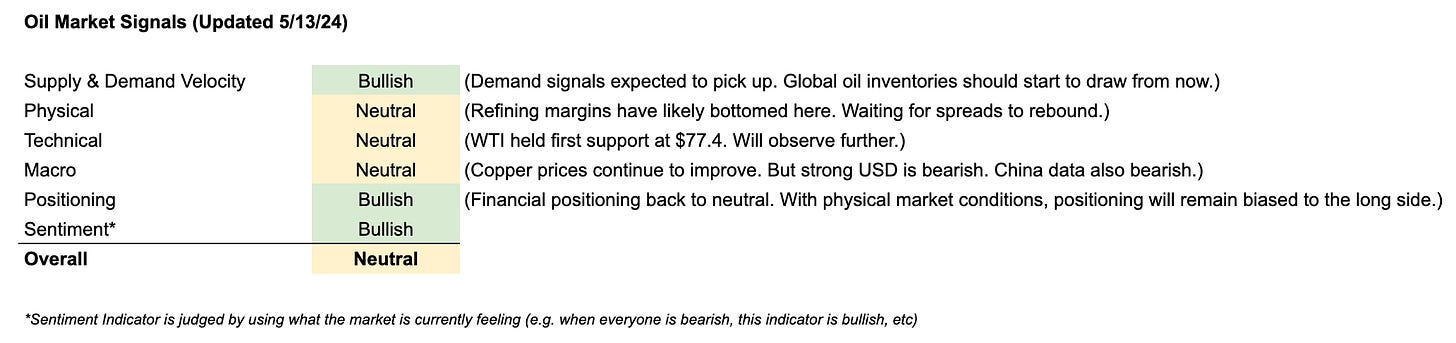

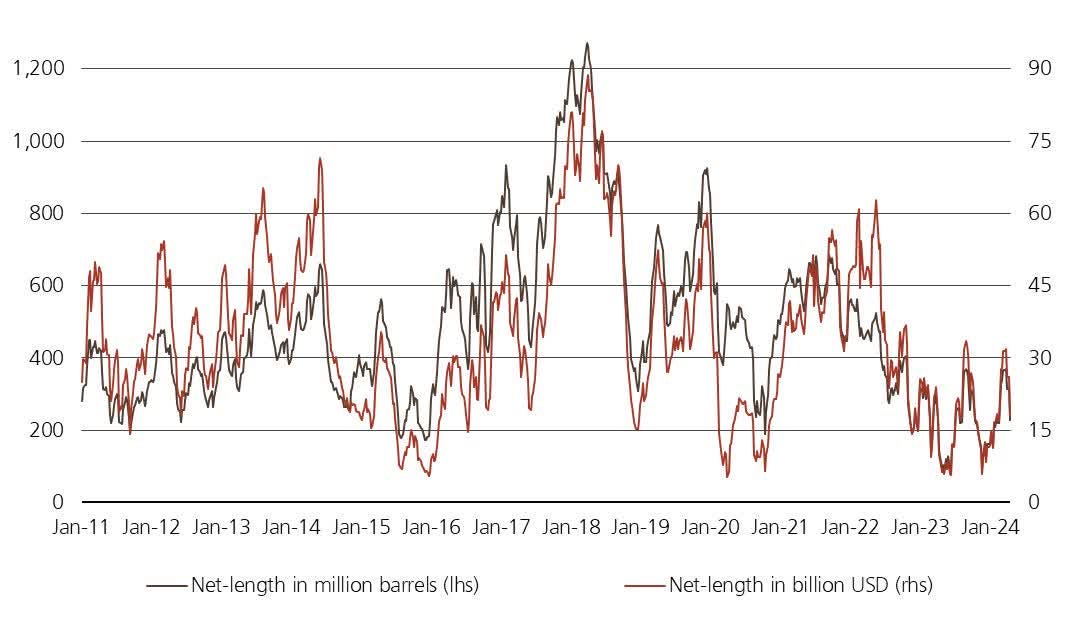

Looking at our latest oil market signals update, things have turned mildly bullish. Last week Friday's CFTC positioning report saw a dramatic drop in net-long positioning in oil futures.

Source: CFTC, Giovanni Staunovo

Gasoline future positioning has also meaningfully corrected following a multi-year peak in early April. Much of the recent refining margin weakness has to do with the dramatic positioning reset we saw in gasoline.

On the distillate front, the weakness we are seeing there appears to be the result of cheaper LNG and weakness in economic activity. If you remember in 2022, distillate was the product that led the whole oil complex higher, but this time, it will be a major headwind. For crude to structurally move higher, we will need distillate to perform.

Looking at global refinery throughput, we should see throughput pick up meaningfully over the coming weeks. According to Energy Aspects, global refinery maintenance peaked at 10.618 million b/d before falling to 5.064 million b/d in June and 3.248 million b/d in July.

The dramatic increase in throughput should reverse the global crude inventory builds we saw in April.