(WCTW) Is The Natural Gas Bull Thesis On Track?

With the recent price drop, even the most logical person would question the bull thesis. But it is on track and here's why.

With August Henry Hub contracts expiring on July 29, the natural gas market is in for another day of craziness. The recent drop in natural gas has managed to drag down the producers with it, and we saw an opportunity to load up on our favorite US gas producer, Antero Resources.

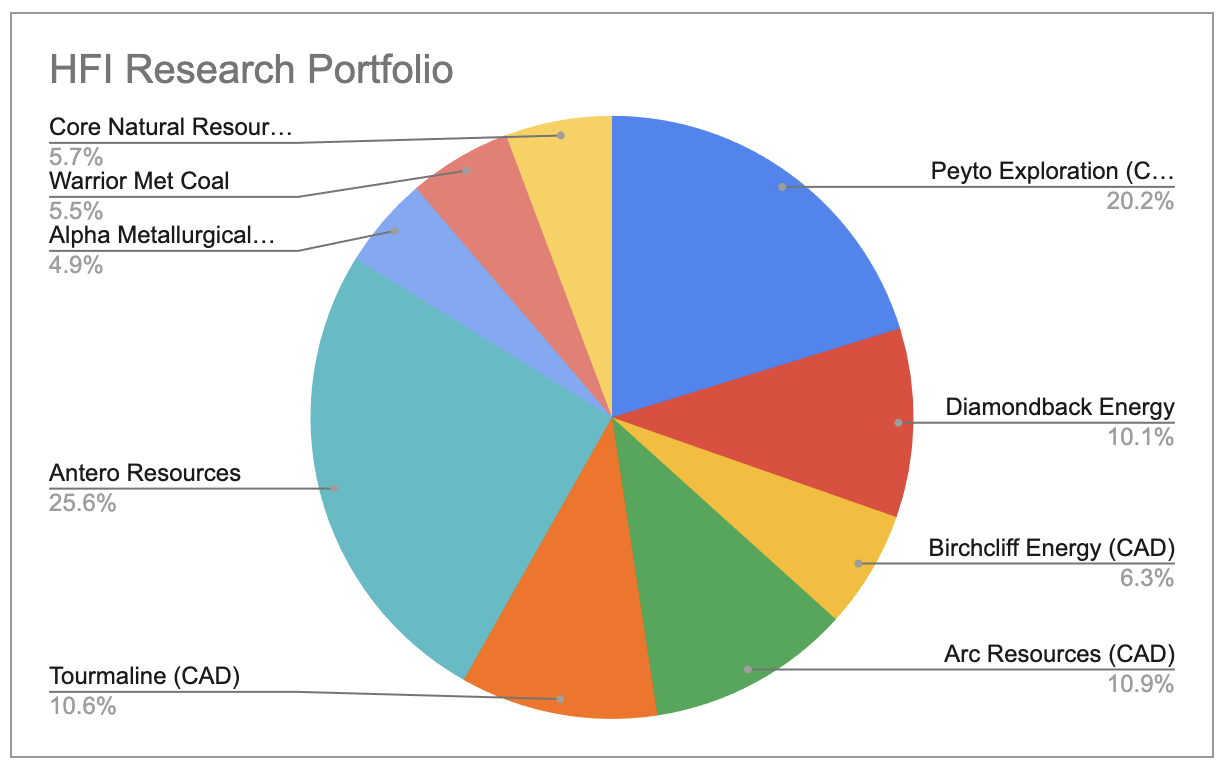

For the HFIR Natural Gas Portfolio, Antero is now the largest position with Peyto as the 2nd largest.

Given the allocation into AR today, it's clear that we remain bullish on natural gas, but why?

There have been some recent bearish developments in the natural gas bull thesis:

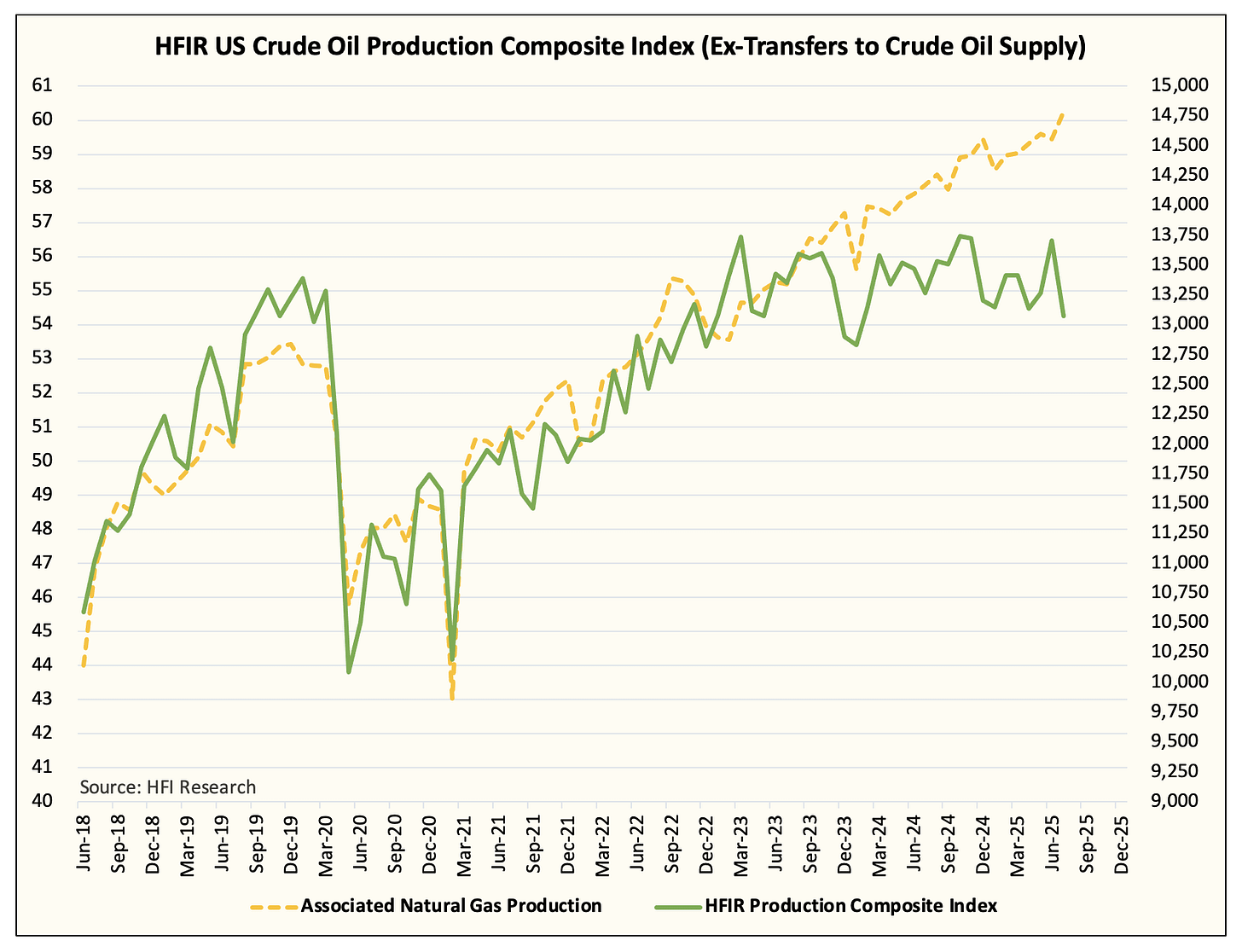

Associated natural gas production is starting to meaningfully outpace crude production growth. Gas-to-oil ratio is ballooning out of control in US shale oil basins.

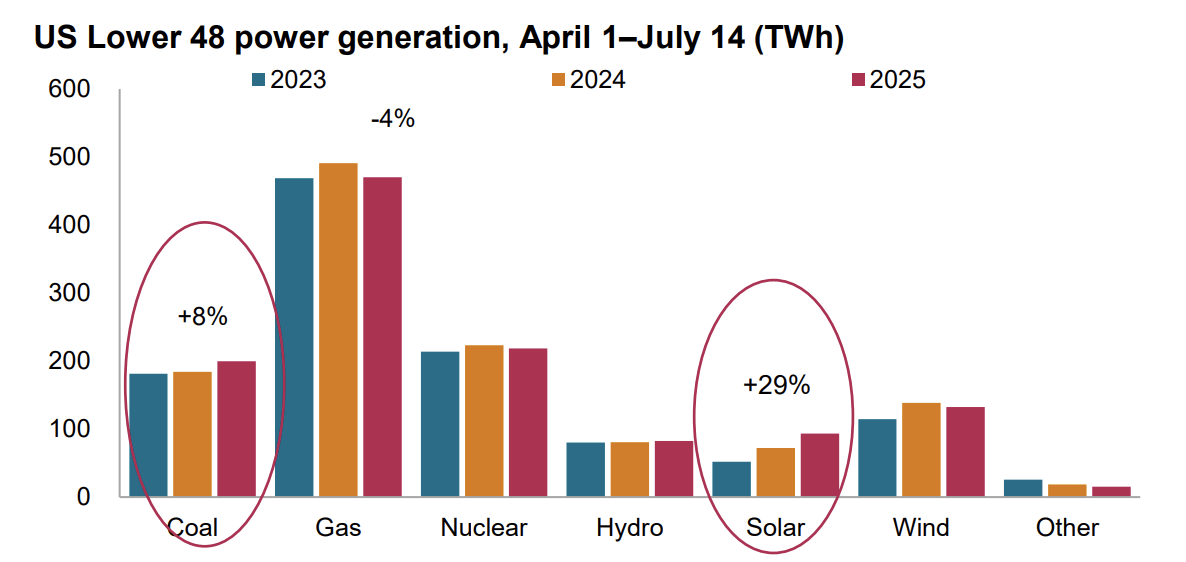

Power burn demand weakness this summer was the result of 1) higher renewable penetration and 2) higher coal market share. Higher natural gas prices have resulted in some displacement from coal, so this is a potential headwind going forward.

Source: S&P

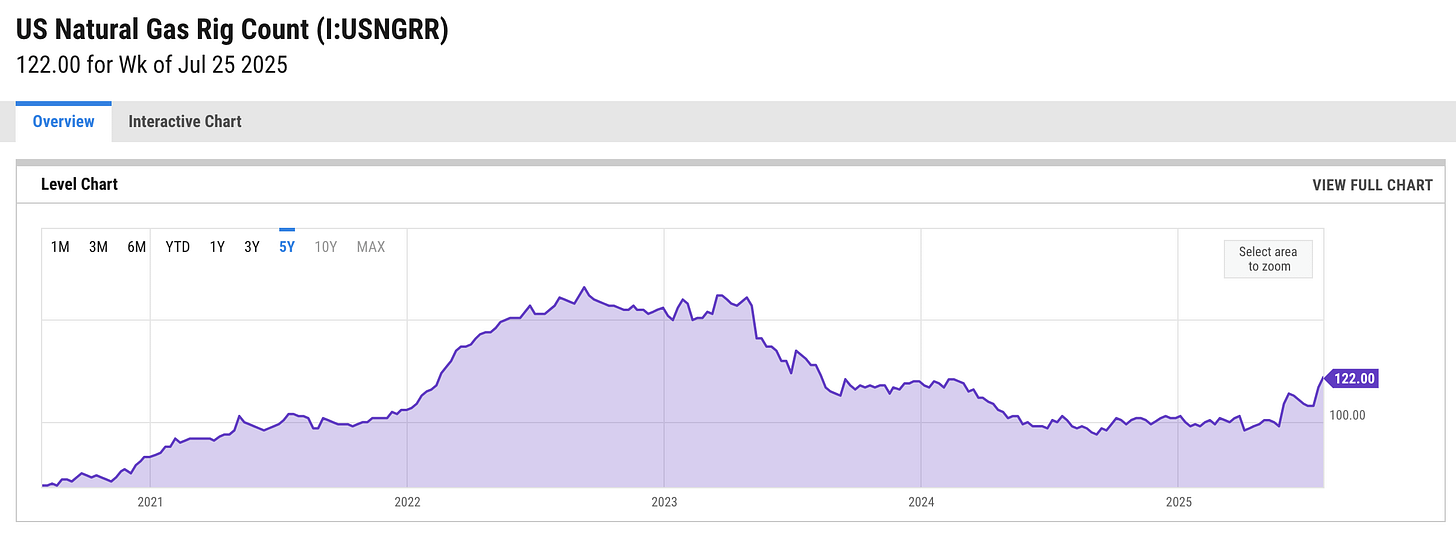

Most importantly, natural gas rig counts are starting to climb leading market participants to believe that natural gas producers are going to commit the same grave sin they did in the past: overproduce.

But despite the sell-off we've seen in the prompt month, I see the natural gas bull thesis intact. Here are some high-level bullet points as to why:

The newly announced US/EU trade deal will give a clear demand channel for the incoming LNG export boom. One key concern for the US LNG market was that a global LNG surplus could result in liquification facilities in the US not operating at 100%. But the opposite might be true instead; we might not have enough exports to meet what Europe is agreeing to buy.

Natural gas production growth is needed to meet the incoming export demand increase. Higher rig counts are needed as producers have reduced DUCs (drilled but uncompleted wells). Haynesville production growth is needed, but excess growth will result in oversupply. We need to watch this carefully.

Power burn demand growth will continue. Higher renewable penetration will not result in an absolute decline in power burn demand into 2030. AI datacenter demand is real and will continue to fuel a big part of the demand assumption.

With that said, let's dive deeper into the various topics.

Natural Gas Bull Thesis

If I had to describe the natural gas bull thesis in one chart, it would be this chart below: