On June 7, we published an OMF titled, "It's So F***Ing Beautiful." The title of the article was inspired by the severe dislocation we saw in the price of oil and money manager oil future positioning. At the time, WTI closed the week at $75.53, and our reasoning why it was so f***ing beautiful was that:

OPEC+ can always extend the voluntary production cut past Q3 if needed.

Oil inventories are starting to draw, so market participants are overly bearish.

Oil demand is healthy and trending higher.

While there were some notable headwinds like lower refining margins forcing refinery run-cuts in Asia, we noticed that the drop was too severe to be explained by fundamentals. So thankfully, the CFTC positioning report was revealing of the main driver of the price drop.

Since then, WTI has managed to recover to $83/bbl, and future positioning has normalized. Most of the short-covering is finished, so the next leg higher will have to be driven by fundamentals. For now, we think prices are ahead of oil inventories, so let the draw season begin, but don't be disappointed if crude trades rangebound for the next few weeks.

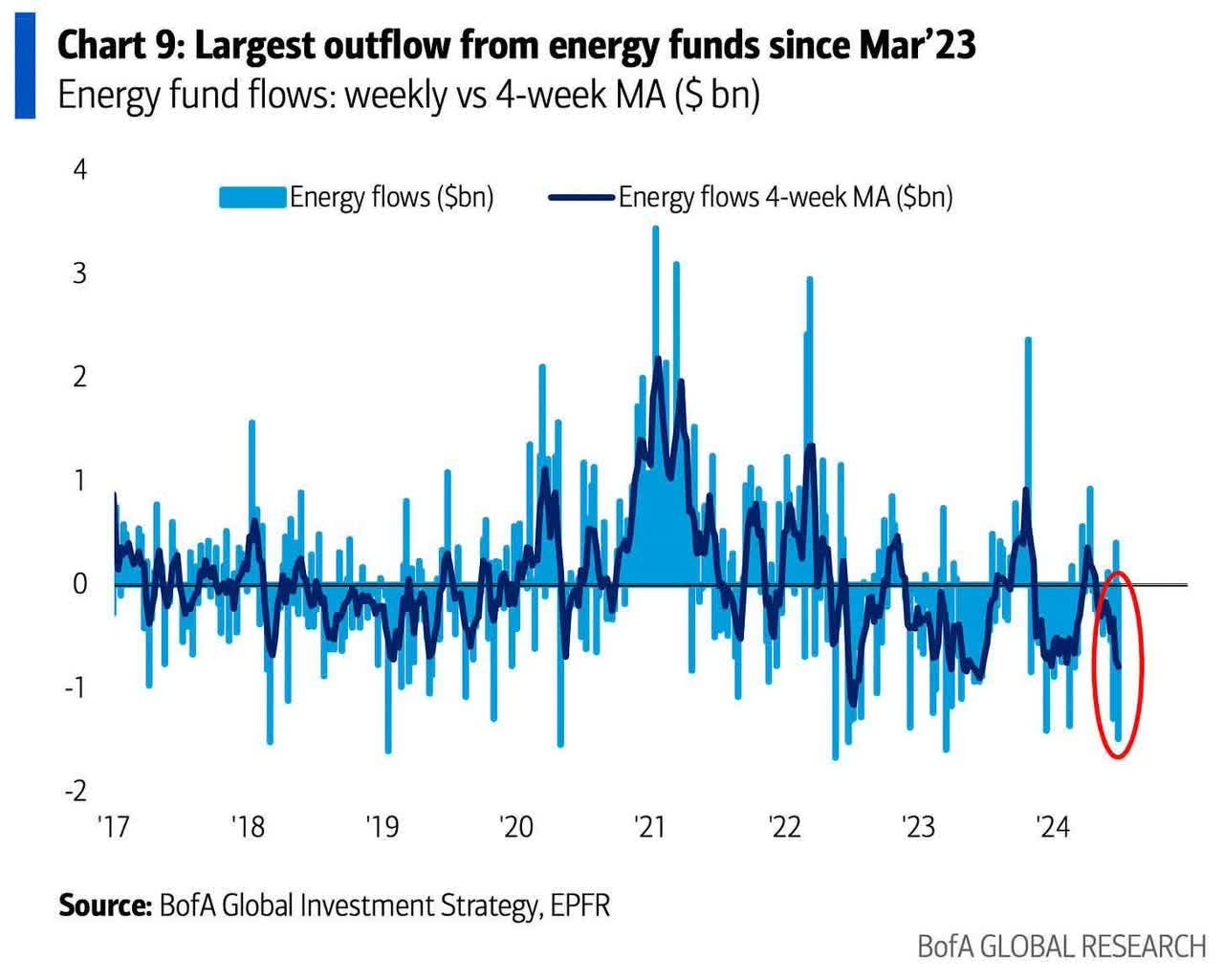

So why are we writing part 2 of this series? Because this chart is just so f***ing beautiful.

Source: BOFA, Brandon Beylo