(WCTW) Natural Gas Is Just Nothing But Heartbreaks

I'll be honest, I'm tired of being a bear on natural gas. Jon, our head of research, has done an extensive job on some of the gassier E&P names and pointed out how much upside there is if natural gas prices move higher. But here's the problem, "if natural gas prices move higher" is the most paradoxical statement you could make.

The sad reality for the natural gas market is that if there is indeed a bull market, it's not happening this year. With weather models now pointing to bearish weather throughout the first half of February, our storage estimates continue to inch higher.

And with EOS at 2 Tcf and Lower 48 gas production outpacing demand by ~2 Bcf/d this year, there's just no way we see any real meaningful upside going forward.

Even if you take into account the possibility of a very cold 2nd half of February and colder than normal March, storage levels would fall at most to ~1.75 Tcf, which is still above the 5-year average.

Lower 48 gas production is already recovering following the cold blast, and while we do see a minor decline into the end of April, we expect production to average ~3 Bcf/d higher than in 2023.

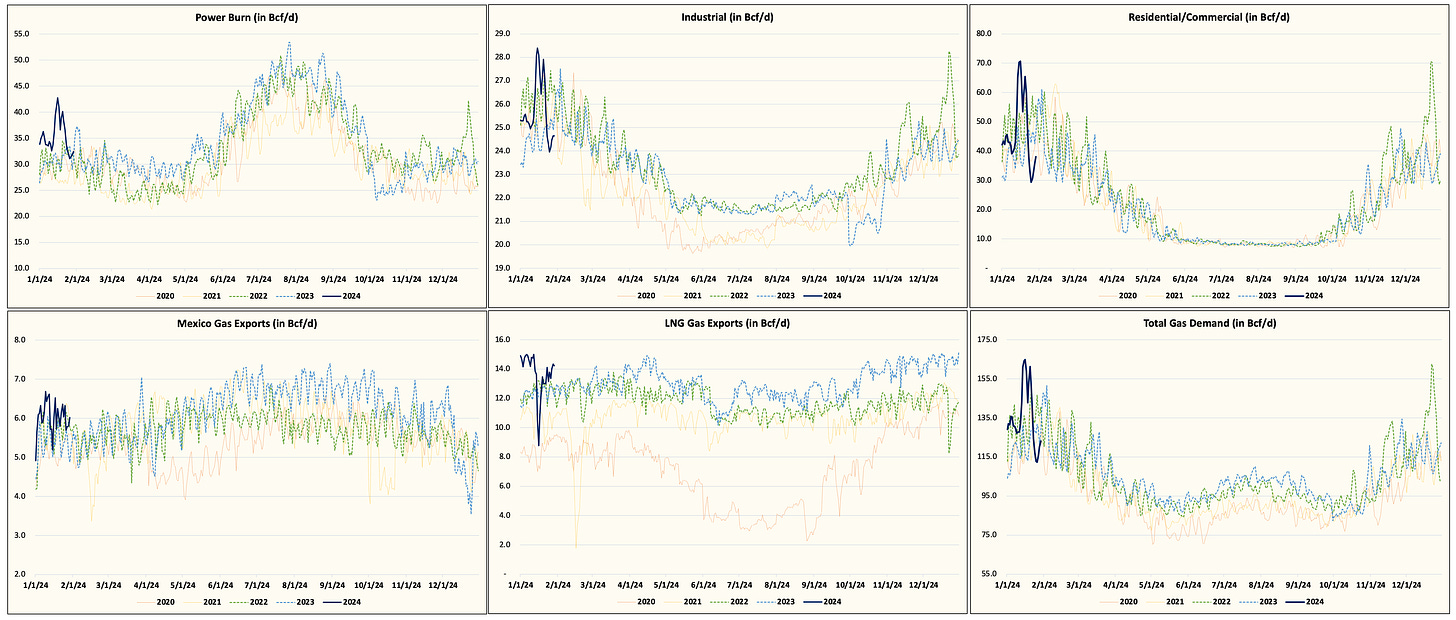

On the demand side, while power burn and LNG gas exports will notch new record highs (average) this year, the increase in demand will not be close to matching the increase in production.

This all but leaves the inevitable conclusion: natural gas is dead money this year, again. If you want to do something with natural gas, trade it, don't invest.