(WCTW) Oil Market Is Back To Its Regularly Scheduled Programming

On September 5th, we published an article titled, "Saudi And Russia Announces Production Cut To Year-End, What Happens Now?" At the time, we thought a 3-month extension was a mistake. Here's what we said:

I believe it was a mistake to announce an extension for 3 months. Why? It was in Saudi's advantage to keep it at a monthly interval to surprise the market. While the consensus coming into this meeting all expected the Saudis to extend the cut into the end of October, I think the fact that the market doesn't "know" know is what gives Saudis the control element.

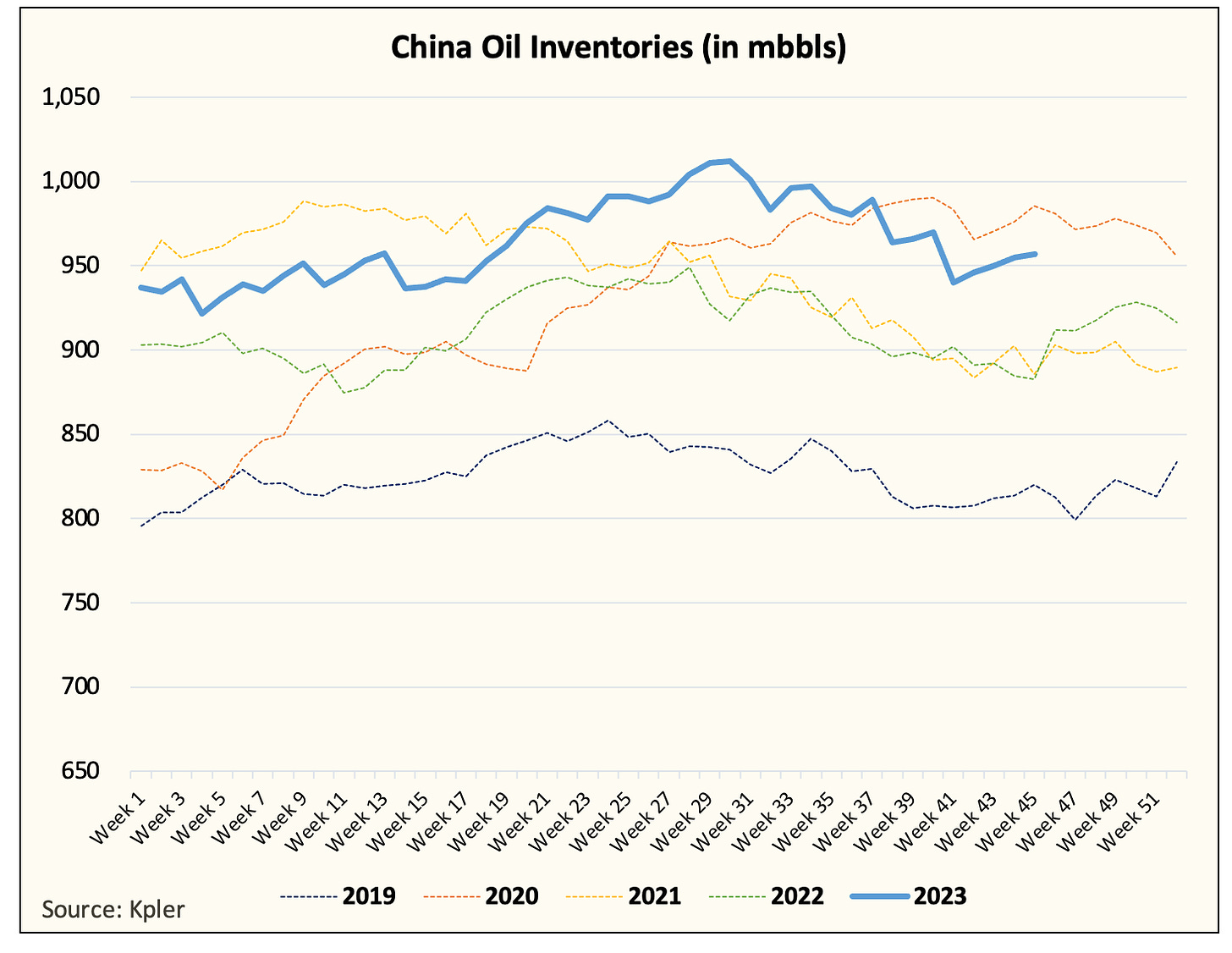

So by announcing a 3-month extension, the market participants can plan accordingly. In addition, with China possibly now looking at simulating domestic demand consumption, higher oil prices will be a headwind, so there's a good chance China will use SPR. This would imply lower physical buying and thus keep a headwind on oil prices.

This is why by keeping it a surprise, Saudis could keep draining inventory, which is the key point of this voluntary cut. Once inventories drain, oil prices will naturally rise.

Going forward, I fully expect lower Chinese crude buying. I think we will see a gradual decline in Chinese onshore crude inventories into year-end.

And since that 3-month extension announcement, the physical oil market has gone through a wide array of emotions.

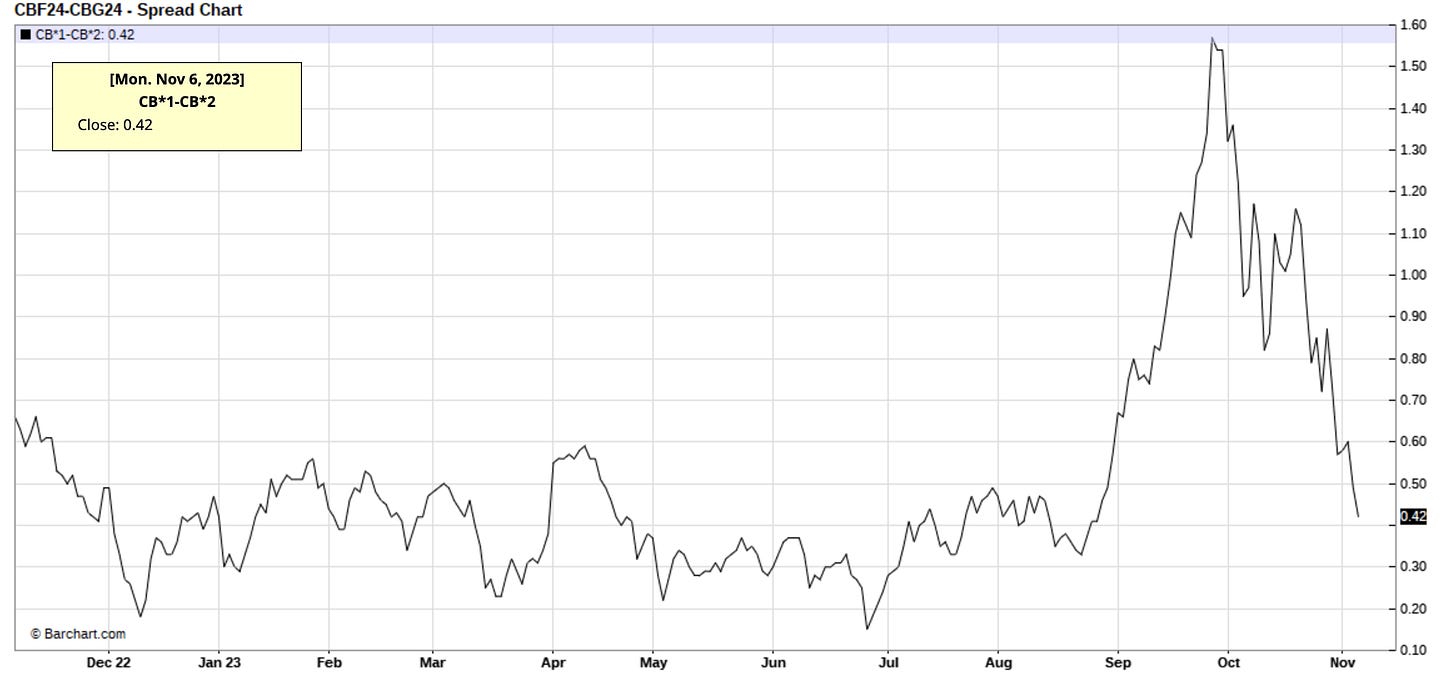

Not only are the timespreads back to where we started this, but refining margins have been compressed as well.

And what about China?

China started reducing its onshore crude inventories around the same time.

So looking back, was it a mistake to announce the cut extension well in advance? Yes. Not only did it prompt a more volatile oil market (a spike then a fall later), but it gave market participants time to plan. In a perfect world, the Saudis need to keep everyone at bay, and by doing so, it can more meaningfully impact the physical market and inventories.

But as we had warned previously, China was able to plan. Physical oil traders saw that the cut was going to be extended and could play accordingly. Global refineries, facing refining margin pressure, were able to plan for the lower crude supplies by reducing throughput. In the end, what was supposed to be a monthly cut surprise turned into a planned affair.