(WCTW) On Edge

Energy investors are on edge. Following a volatile but relatively positive first week to 2024, oil prices have given back all of their gains in just one day.

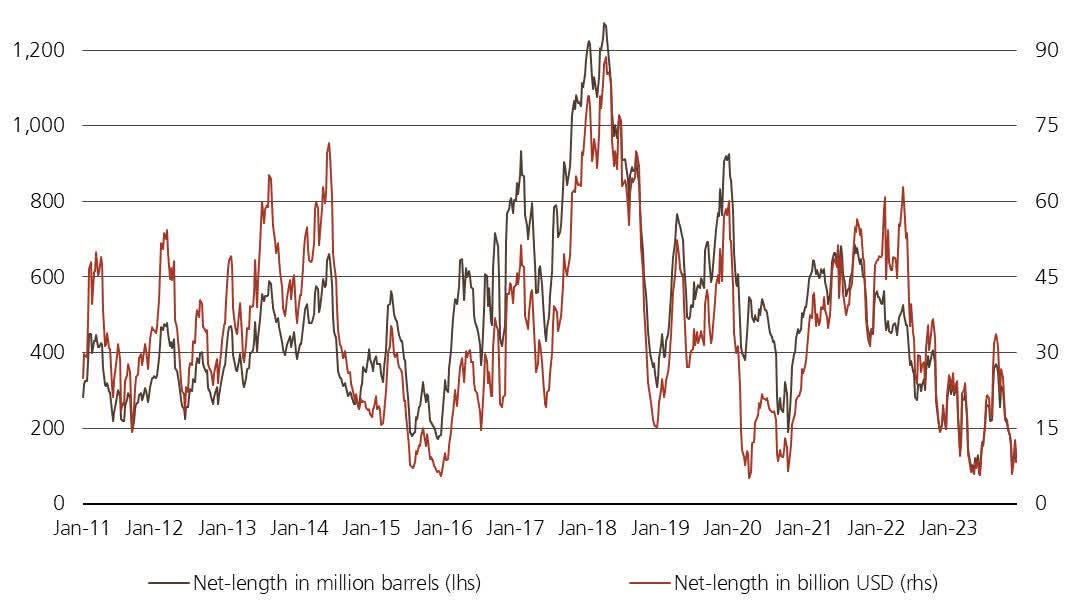

In addition, CFTC reported that oil speculators are back and the first week of 2024 saw one of the largest short position increases since 2017.

Positioning

Source: Giovanni Staunovo, CFTC

How Fast

Source: Jesse Felder

Now on the oil-specific news front, Saudi Aramco announced large official selling price cuts across the board. The physical oil market has weakened considerably since November 2023, and Saudi has so far kept its prices well above the market. But with trader surveys expecting a large cut in early January, Aramco has finally brought prices in line with market expectations.

This does not imply that the Saudis will sell more of their oil. For Q1 2024, we expect Saudi crude exports to average ~5.8 million b/d.