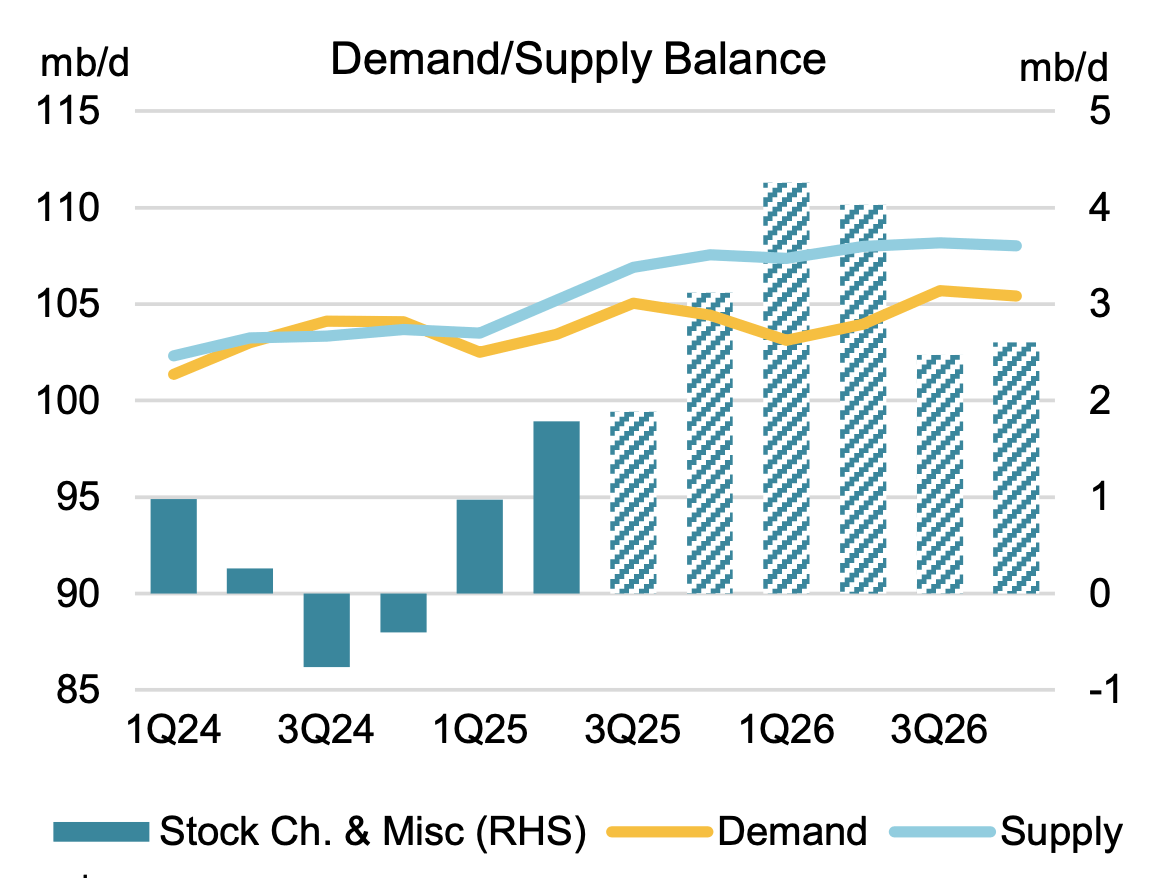

Markets have a funny way of changing the prevailing narrative via the price action. We are now at the start of Q4 where sell-side analysts are expecting monstrous oil inventory builds to the tune of ~3 million b/d. IEA, infamously, published in its recent oil market report that Q4 and Q1 2026 oil market surpluses will be as high as +3 and +4 million b/d, respectively.

Source: IEA

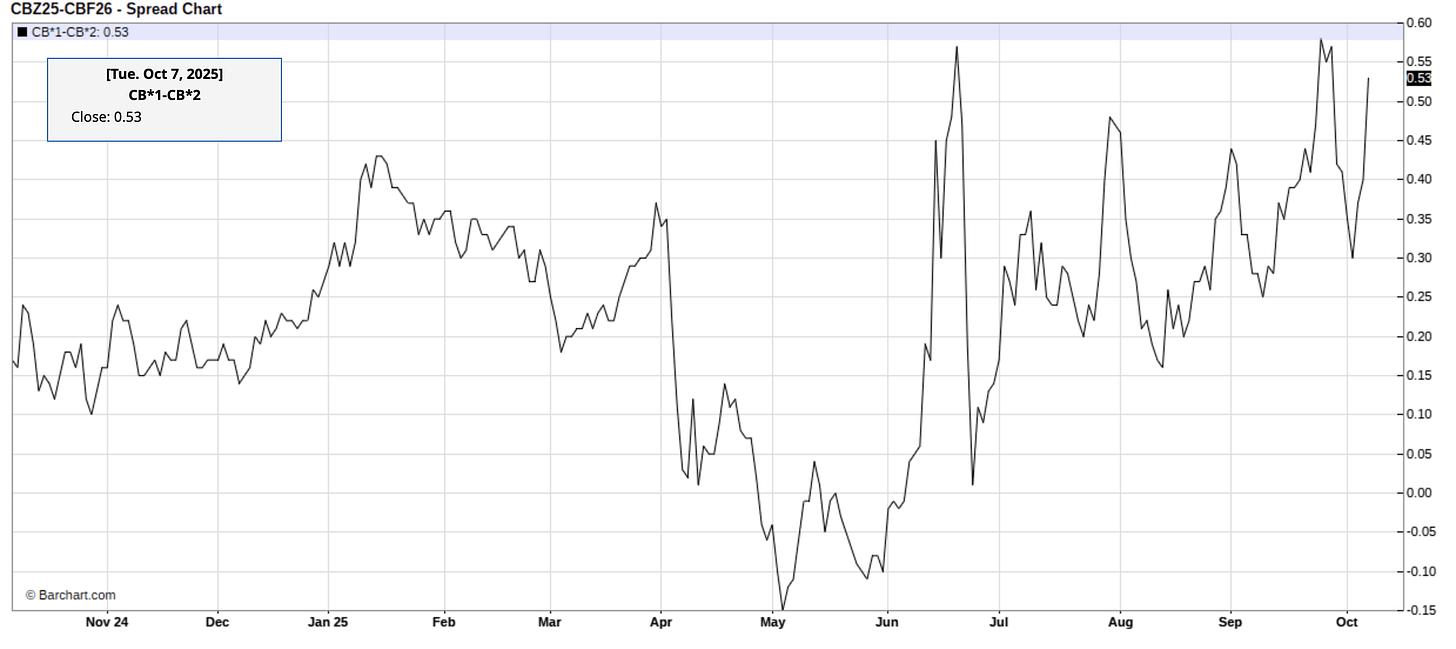

On the surface, if these builds were real, Brent timespreads would be so far in contango that you need an elevator just to climb out of it. Yet, the market is telling you something starkly different.

Source: Barchart.com

So, exactly where will this surplus come from? If the IEA and sell-side are wrong, shouldn’t oil prices go higher?