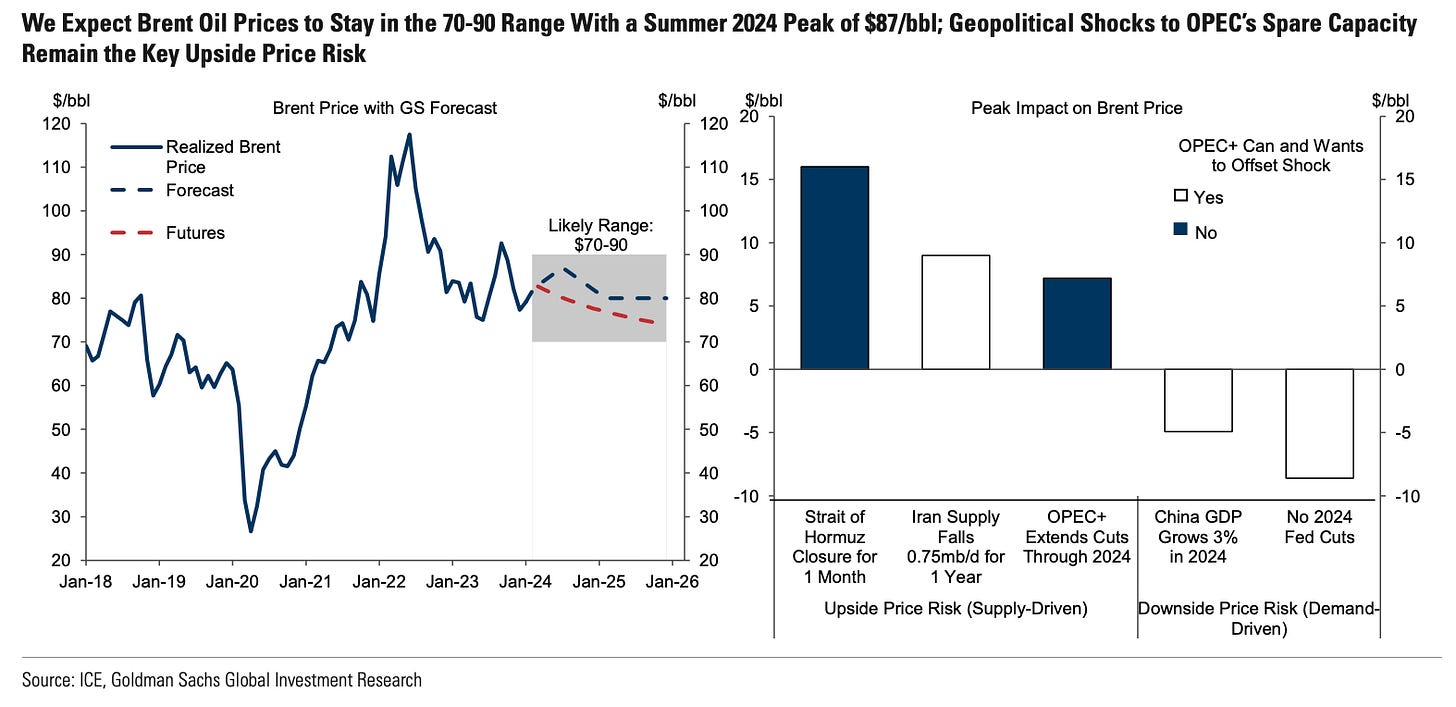

(WCTW) Rangebound Year For Oil So Invest Accordingly

Goldman released its latest oil market report today and the title was "Riding the Range." And for all the criticism sell-side reports get, we thought this one was well-balanced and highlighted many of the risk factors we see in the oil market.

Our view is as follows. From the bull side, we have these positive variables:

Lower than actual US oil production in Q4 2023 directly translates to lower base production for 2024 and into 2025. US shale will continue to grow, but headline figures will show a flat production profile.

OPEC+ is likely to remain committed to the production cut into Q2 2024. If oil demand outperforms, we see room for the voluntary cuts to unwind into year-end.

Global inventories have trended in the right direction so far this year, so implied balances are tighter than expected, however, more is needed.

On the bear side, we have these negative variables:

2024 is an election year, which means if oil prices get elevated, then the US will release SPR again.

China has ample crude storage, so if prices get high, China can release SPR as well.

Global oil demand remains on shaky grounds. Global sentiment on oil demand growth remains weak, which means the physical oil market will have to take charge.

On one end, we have decelerating non-OPEC supply growth, but on the other, demand growth has not been stellar. With 2024 being an election year, the US will use SPR if needed, so we do see a ceiling for prices.

As much as we are bullish on oil, we don't see signs that demand growth will vastly outperform to the extent that oil prices spike. It's contradictory as higher-than-expected oil demand growth will have to come from, in part, lower oil prices and a better overall economy. As a result, if we reach over $90/bbl WTI, the US and China alike will use SPR to dampen the price rise.

Rangebound so invest accordingly...

At HFI Research, we are using $82.50 for the average price of WTI in 2024. We have built a very comprehensive E&P valuation Google sheet for all (paying) subscribers to use. See the link below: