(WCTW) Simply Too Bearish

As we wrote last week Thursday, the oil market is simply too bearish. From CTA positioning, global inventory changes YTD, OPEC+ exports, and the physical oil market, the market is too bearish on oil.

To make matters worse, IEA published its latest oil market report last week Thursday pointing to surpluses for the rest of the year:

Source: IEA

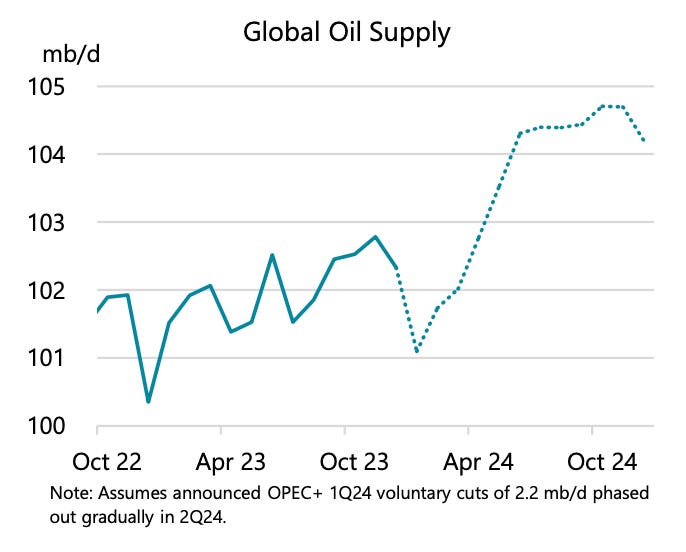

The caveat to this forecast is that 1) it assumes OPEC+ starts to unwind production cuts from Q2 2024 and onward, and 2) assumes anemic demand growth in OECD.

Global Oil Supply

Source: IEA

Global Oil Demand

Source: IEA

OECD

Source: IEA

Non-OECD

Source: IEA

Even if we assume IEA is correct for a moment here, the assumption that OPEC+ will unwind the production cuts by Q2 appears to be premature. If, in theory, IEA is correct that the surplus shoots up to ~1 million b/d by Q2, OPEC+ will likely prolong their cuts, thus balancing the market.

But taking this point aside, we think IEA is far too bearish on OECD oil demand. In IEA's latest forecast, it has OECD oil demand falling 0.1 million b/d versus 2023. This is following a zero growth year in 2023 vs 2022. We believe this assumption assumes that Europe will remain in recession, despite the steep fall in natural gas prices, and the US economy further worsens. In addition, this does not assume what will happen to the US economy if 1) inflation starts to normalize and 2) the Fed starts to cut.

It's safe to assume that IEA's demand assumption for OECD is about as bearish as it gets. We are of the view that OECD demand will increase by ~500k b/d this year, which would jolt balances to the deficit.

The other big caveat we see with IEA's balance appears to be in the non-OPEC supply growth category.