(WCTW) Speculators Gone Wild

If you aren't living under a rock, you must know by now that oil-managed long positioning is at a record low. There are several ways to look at it:

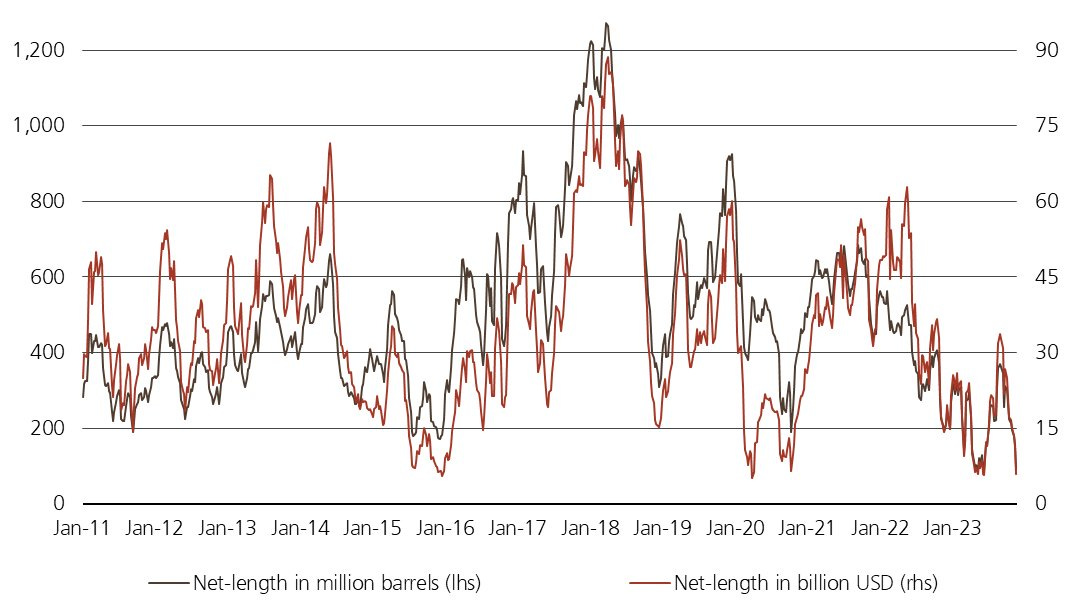

Net length in barrels and dollars:

Source: Giovanni Staunovo, CFTC

Positioning:

Source: Giovanni Staunovo, CFTC

Short positioning as a percentage:

Source: Warren Pies, 3Fourteen Research

No matter how you slice and dice these charts, one conclusion is straightforward: speculators have gone wild.

Now for those of you looking at this chart, it could still be concluded that speculators are still "net long" oil. That is correct, but net-long exposure has never been this low. So whether speculators have gone wild or the narrative has gone wild, the fact is that market exposure to oil has never been this low in history.

In our last week's WCTW titled, "Speculators Vs OPEC+, We Know How The Story Ends." We said:

Speculators have so far been winning the sentiment battle this year. Supply-side surprises from Iran and the US have led to persistent weakness in the physical balance. Without the large inventory draws, the tailwind is absent to sway sentiment meaningfully in one direction. But with speculators positioning back to the lows, you don't need a lot to go right before prices meaningfully jump higher.

We believe tighter compliance from OPEC+ will easily swing balances in Q1 and as a result, the market will be surprised to see the lack of builds. While the physical market remains weak for now, crude tightness will return, and inventories will draw. This should once again help the bulls.

We all know how the story ends. Speculators are winning for now, but oil is a physical commodity. At the end of the day, balances will win, and speculators will reverse their peak bearish positioning. We believe oil has found its bottom here.

And following this CFTC update, our view on a bottom in oil has strengthened. In our latest oil market signal update, it is clear to us that the signals are almost all bullish.