(WCTW) Swing Buyer Vs Swing Producer

Coming into 2023, the big question on every oil analyst's mind was: at what oil price will China start to use its SPR?

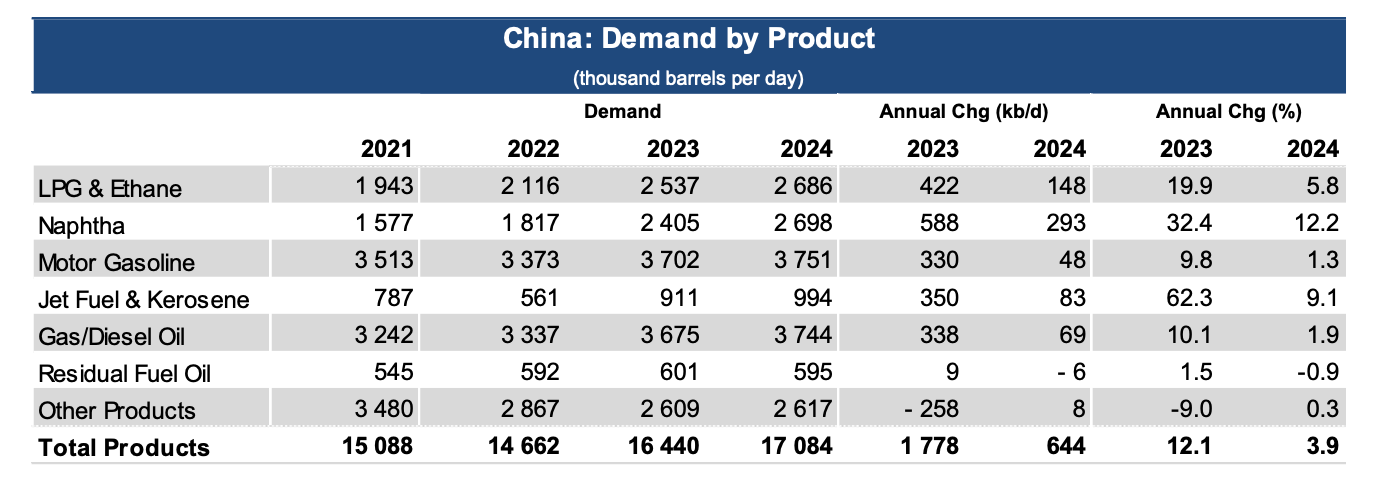

For the oil bulls, China's oil demand was set to recover materially following the lockdowns in 2022. Apparent Chinese oil demand, according to IEA, is running close to ~17 million b/d. But is China's demand really that high?

Source: IEA

Source: IEA

For us, we think the truth is somewhere in between. China's oil demand has meaningfully recovered in 2023, but the recovery is nowhere near ~17 million b/d.

Why do we say that? Because if apparent oil demand was that high, then we should 1) see much higher crude imports and 2) see much lower crude oil inventories.

Looking at Kpler's China onshore inventories, it is roughly flat from the start of the year.

And looking at China's seaborne crude imports, we are averaging 1.338 million b/d higher y-o-y (10.628 million b/d in 2023 vs 9.29 million b/d in 2022).

On the supply side, China's oil production is marginally higher at +90k b/d y-o-y.

Taking all these factors into consideration, we can assume that China's oil demand recovery is closer to ~1.4 million b/d vs the ~1.78 million b/d IEA is assuming.

While the ~380k b/d might not seem like much in the grand scheme of things, if you couple this with the increase in Iranian crude exports of ~435k b/d y-o-y, you result in a delta of ~815k b/d. This would have been the difference in the physical oil market, which could have translated to a much stronger backwardation.