This feels like the opposite of 2022.

What do I mean by that?

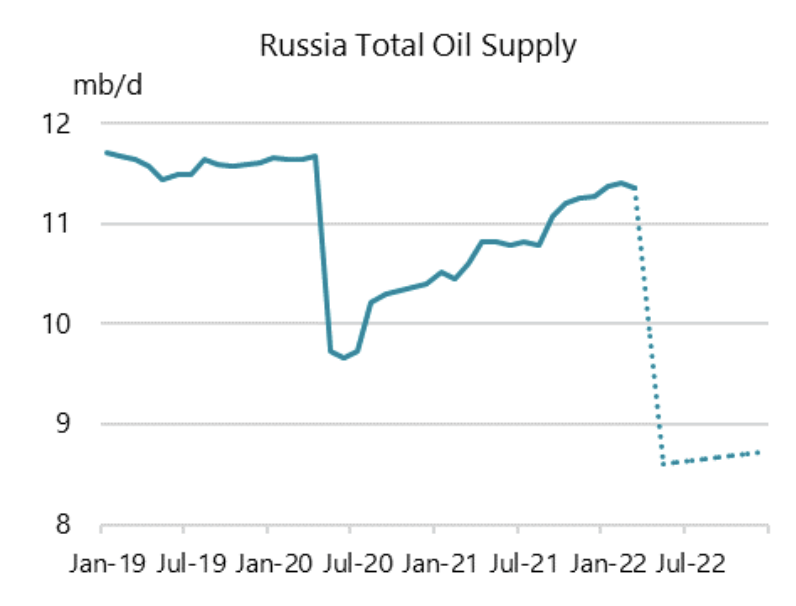

For those of you who may not recall, during the heart of the Russia invasion of Ukraine, IEA published an oil market report predicting that Russia’s crude oil production would drop over ~2 million b/d.

Source: IEA

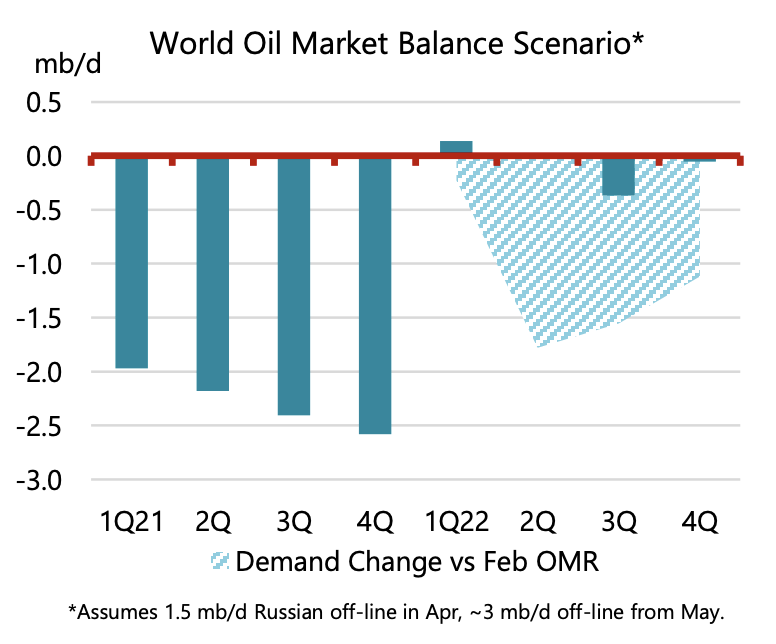

In particular, it noted that if Russian oil production declines, global oil inventory balances would be steeply in deficit.

Source: IEA

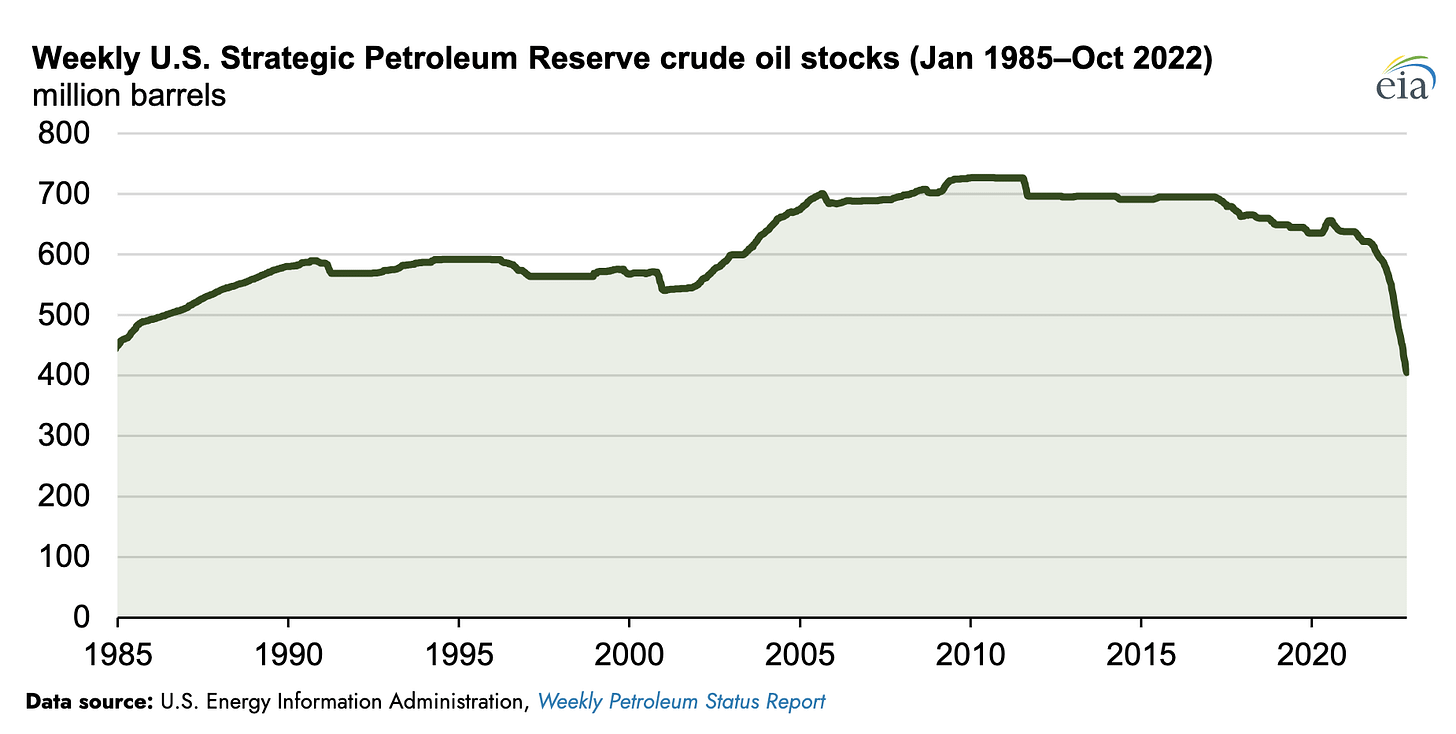

The subsequent analysis prompted IEA to coordinate a global SPR release of 250+ million bbls. US crude storage in the SPR subsequently dropped to multi-decade lows to compensate for the IEA’s deficit analysis.

But what really happened?

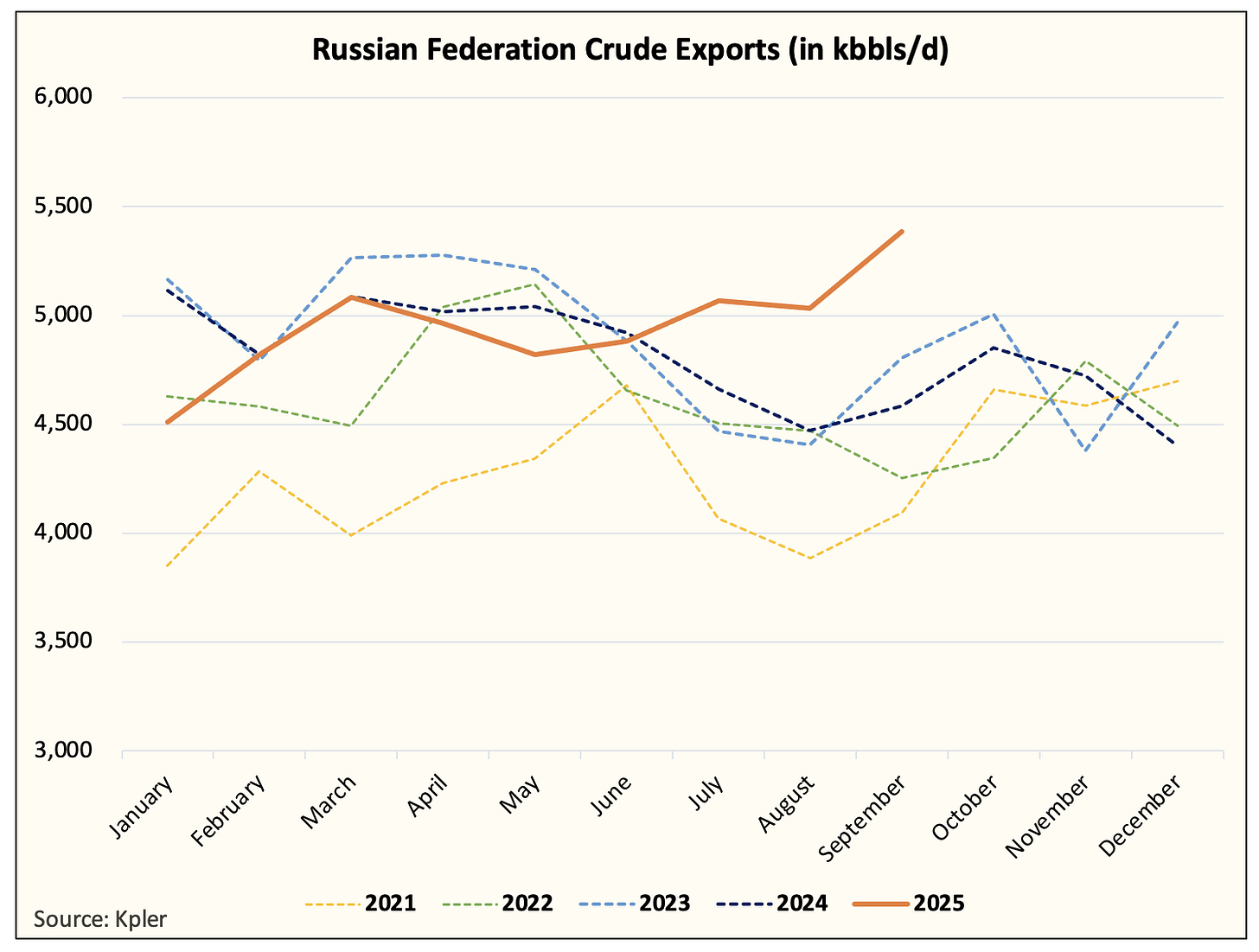

Russia never lost any production.

In fact, the opposite happened. Russian crude exports started to surge!

Couple this with backroom dealings between the Biden administration and Iran, and instead of an oil market headed for “the largest deficit on record”, we ended up with total oil supplies way above estimates.

Relevance?

The reason why I’m bringing up the parallels of 2022 is that the IEA is performing the opposite act today. Instead of calling for record deficits on the horizon, the IEA is calling for a record surplus.

How much of a surplus?

Source: IEA

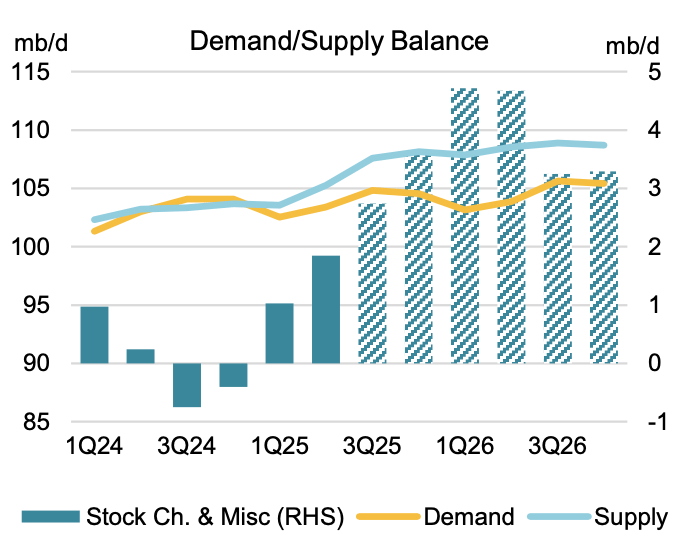

According to IEA’s latest supply & demand model, it estimates that 2026 oil market balances will show a surplus of ~4 million b/d.

In total, global oil inventories will show a build over ~1.4 billion bbls.

Yes, 1.4+ billion bbls.

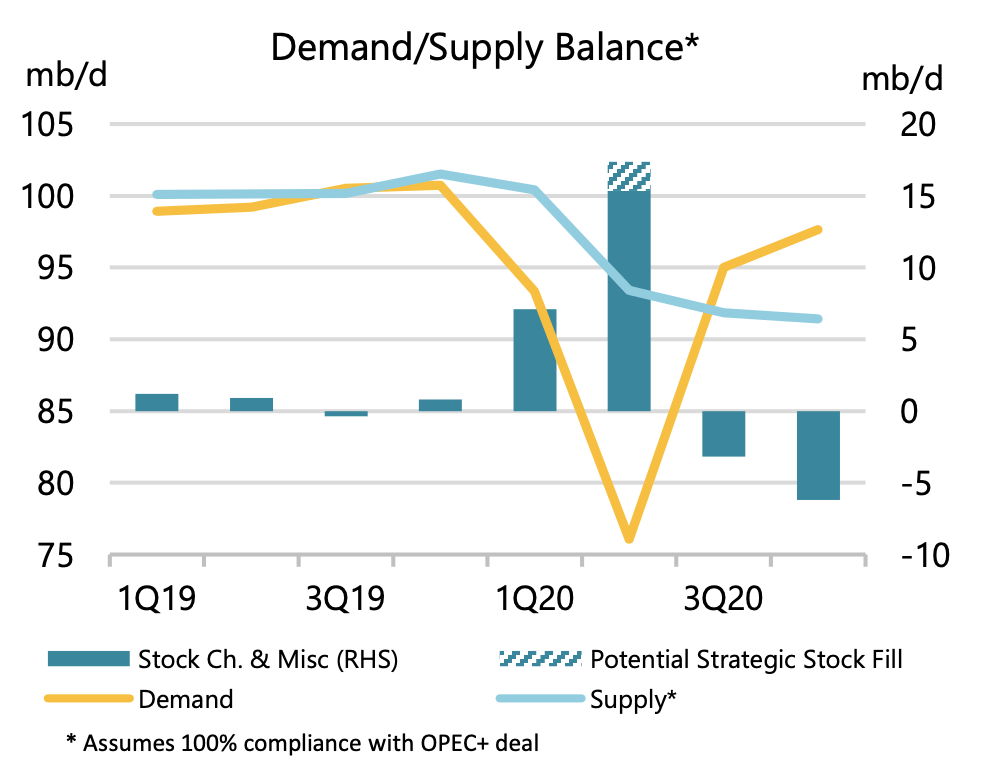

To put this asinine figure into context, this will be larger than the builds we saw in the middle of COVID.

Source: IEA, 2020 oil market balance

If global oil inventories were truly going to build by ~1.4 billion bbls, oil prices should be so far in the negative that only God could lift them out of the ground.

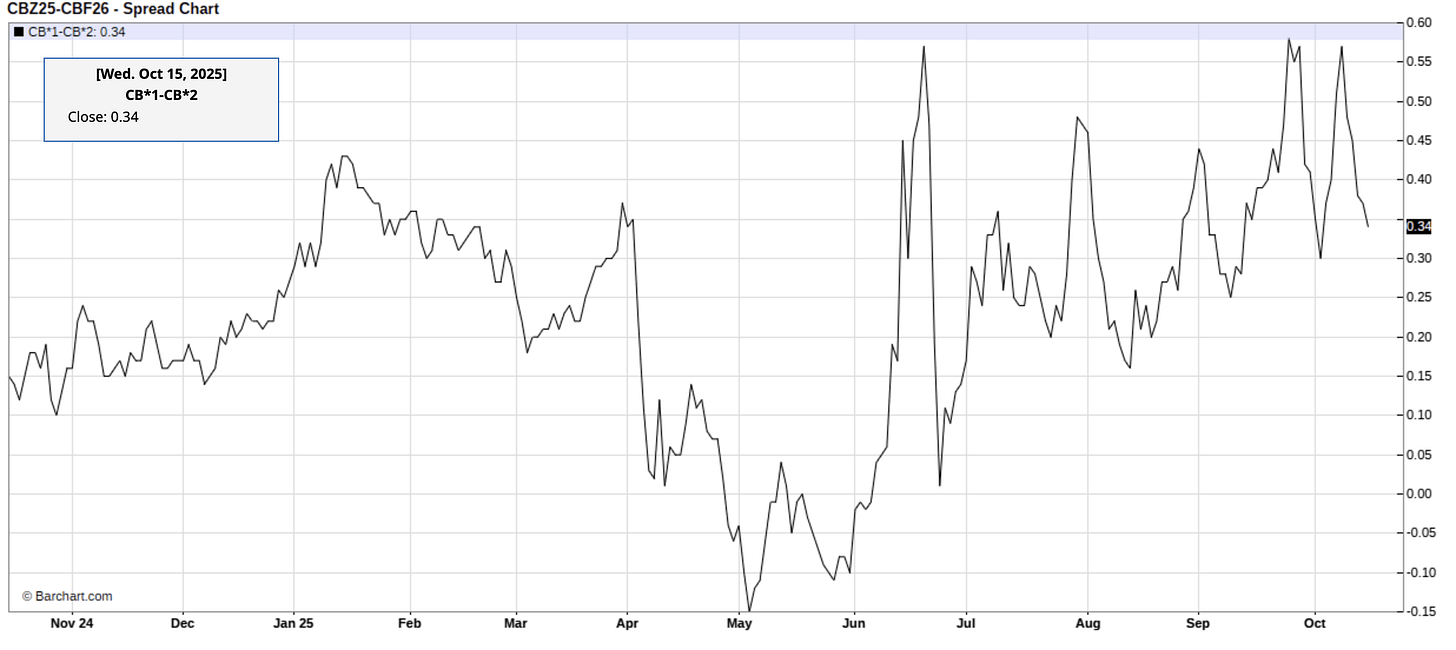

But the market is clearly telling you that this analysis is bogus. And it’s akin to the market’s reaction we saw in 2022 when physical crude timespreads started to collapse in backwardation. It was the market telling you that it’s not going to be a record draw, and similarly, the market dynamics we are seeing today is saying it won’t be a record build.

Source: Barchart.com

With that said, are we saying to ignore the IEA’s analysis here?

No. I think the IEA is more of a measurement of sentiment rather than fundamentals. It’s clear to even the casual observer that IEA’s analysis is not useful, but the unfortunate or fortunate thing is that energy companies look at this surplus forecast and plan their capex accordingly.

For long-term oil bulls, this should be music to your ears. IEA was created with the mission of ensuring energy security, but this analysis almost guarantees the opposite outcome.