You are not alone if you are scratching your head looking at the oil market today. Not only are flat prices falling, but the timespreads are also falling in tandem.

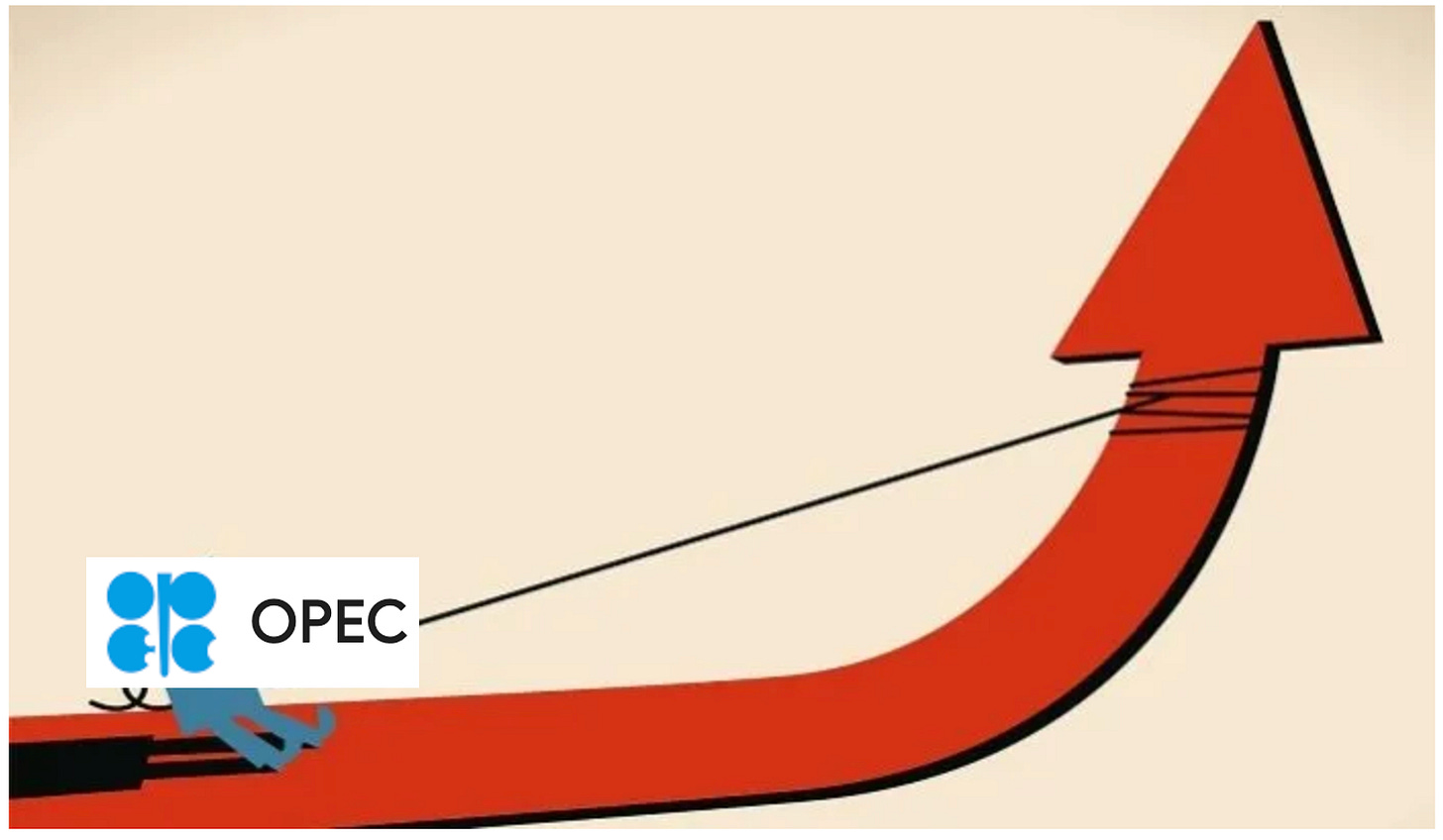

The price action tells me that the market is willing to overlook the currently depressed crude exports from OPEC+. The market appears to be using price as a mechanism to force OPEC+ to act. Judging by the consensus expectation for Q4 and Q1 2025 balances, even if inventories draw today to an absolutely low level, the builds will far exceed the current draws thus making any price improvement temporary at best.

Well, at least that's what the market believes, and because of the reflexive nature of the oil market, by being so bearish on oil market balances, OPEC+ is forced to act, and we think they will.

What's incredible about all this is that we are halfway through August now and the thesis that OPEC+ crude exports remain low is holding. We think the market, by being so bearish, is going to create more volatility later when OPEC+ decides to extend the production cut into the end of Q1 2025.