Mother Nature is delivering on her side of the bargain. Going into the end of 2025, we wrote a piece titled, “US Crude Oil Production Has Peaked And Why This Is Important For The Global Oil Market Balance.” In it, we specifically talked about the importance of weather and how it relates to oil prices:

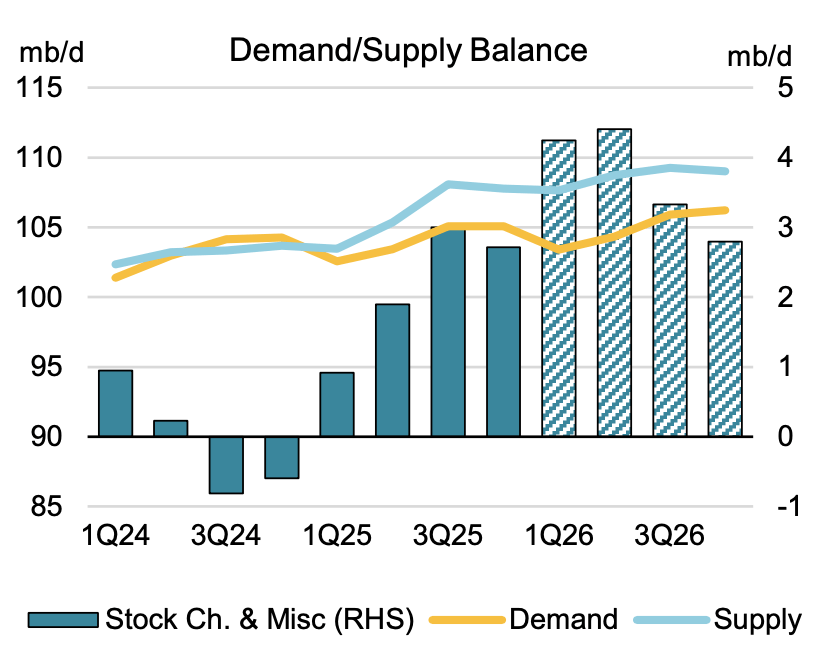

For Q1 2026, we have revised our surplus lower by ~400k b/d. Readers must keep in mind that if this winter shows normal heating demand, the +2.28 million b/d surplus will shrink to ~1.3 million b/d. In the event of a bullish winter, the surplus will shrink further to +0.6 to +0.8 million b/d.

Yes, Mother Nature will play an important role.

The outcome of this winter’s heating demand will play a pivotal role in “where” we bottom on this oil cycle. Again, if the surplus is reduced, then the bottoming cycle will happen sooner as global oil inventories won’t swell like the consensus believes.

If this winter’s heating demand disappoints, then the surplus in Q1 will materialize, and thus push WTI into the low $50s.

Here’s what the path looks like:

Normal winter = surplus of 1.3 million b/d. Bottom in WTI around $53 to $55.

Bullish winter = surplus of 0.6 to 0.8 million b/d. Bottom in WTI between $55 to $57.

Bearish winter = surplus of 2.28+ million b/d. Bottom in WTI between $48 to $50.

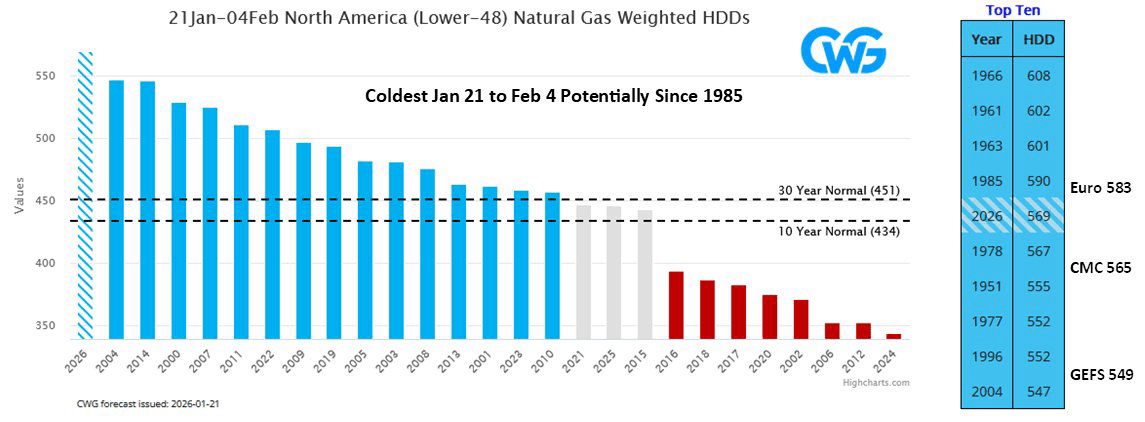

Heating demand started in 2026 with a whimper. The first two weeks of January were on pace for one of the warmest periods on record, but the sudden shift over the weekend has now pushed January heating demand to be on pace for the coldest in 41 years.

Source: Commodity Wx Group

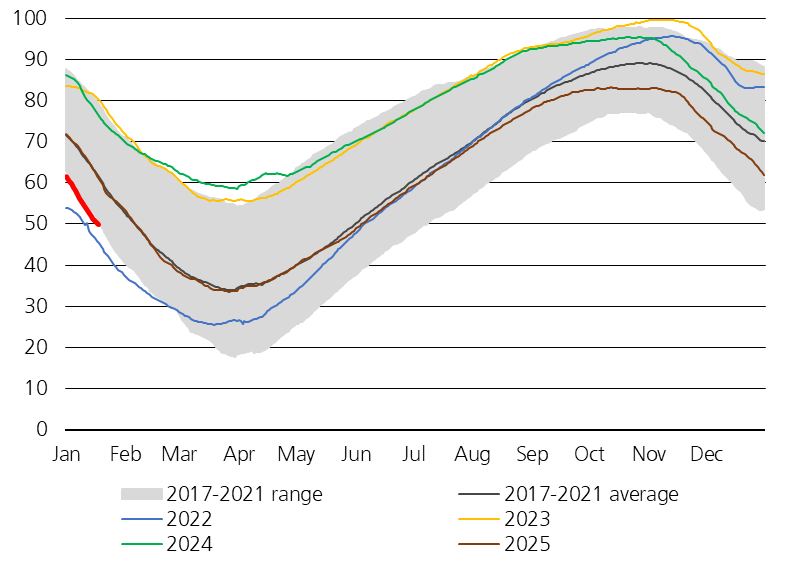

Not only is the incoming cold meaningfully impacting US heating demand, but Europe is expected to be just as bad. TTF has already responded by meaningfully gapping higher, but with overall storage levels so low, there’s a possibility of another 2022 in the making (spike in European gas prices).

Source: Giovanni Staunovo

Meanwhile, the oil market is trading as if the cold is not relevant at all. IEA just published its monthly oil market report today noting that Q1 will show a 4+ million b/d surplus. Instead of acknowledging that the possibility of this surplus is not real, it doubled down by saying:

The current global surplus has been underpinned by a robust growth in oil supply since the start of 2025, with non-OPEC+ producers accounting for close to 60% of the 3 mb/d total increase. Saudi Arabia has led the rise in OPEC+ supply following the unwinding of production cuts, while the Americas quintet of the United States, Canada, Brazil, Guyana and Argentina has dominated non-OPEC+ increases. Barring any significant sustained disruptions to output – and if OPEC+ stays the course with its current production policy and activity in the US shale patch avoids major downshifts – global oil supplies could increase by a further 2.5 mb/d in 2026.

Source: IEA

All of this to say that despite oil fundamental data (more below) completely disagreeing with IEA’s assumptions here, the massive surplus narrative lives on. At this point, not even reality itself will persuade these analysts to change their view.