Oil prices have gone nowhere these past few months. The lack of “volatility” is giving some energy investors a false sense of comfort that the market won’t push oil stocks lower.

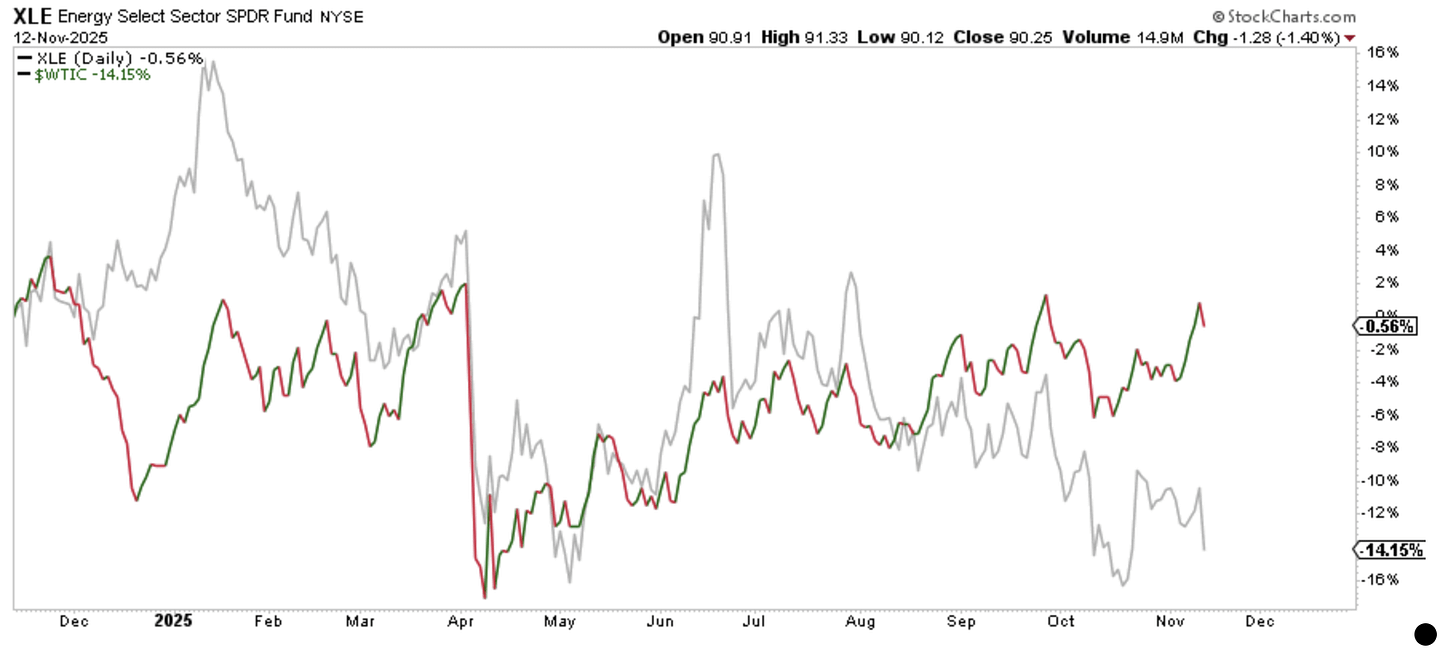

Relatively speaking, XLE has managed to stay flat over the past year while WTI is down 14.15%. The relative strength, as some investors have pointed out, must imply that investors are overlooking the incoming glut, right?

Yes and no.

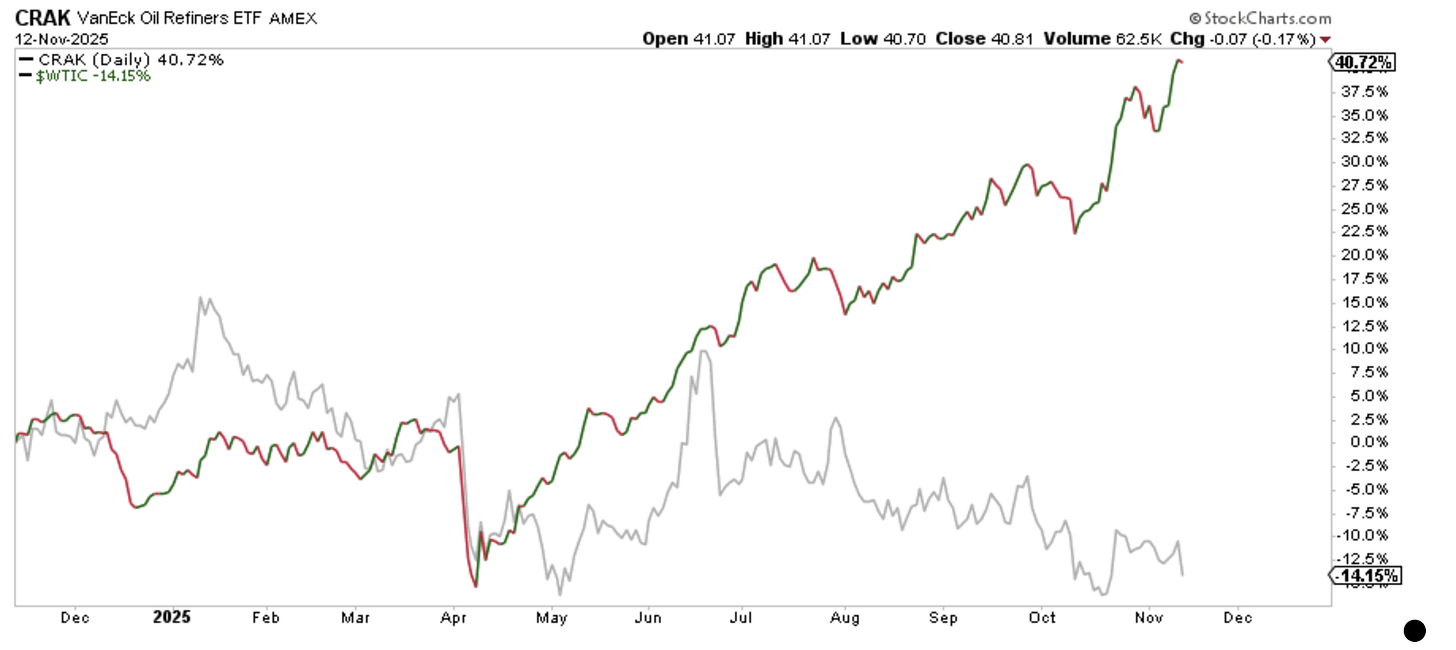

XLE encompasses oil majors and refineries. The oversupply we are seeing today is in crude, while refining margins are elevated thanks to Ukraine’s attacks on Russia’s refineries.

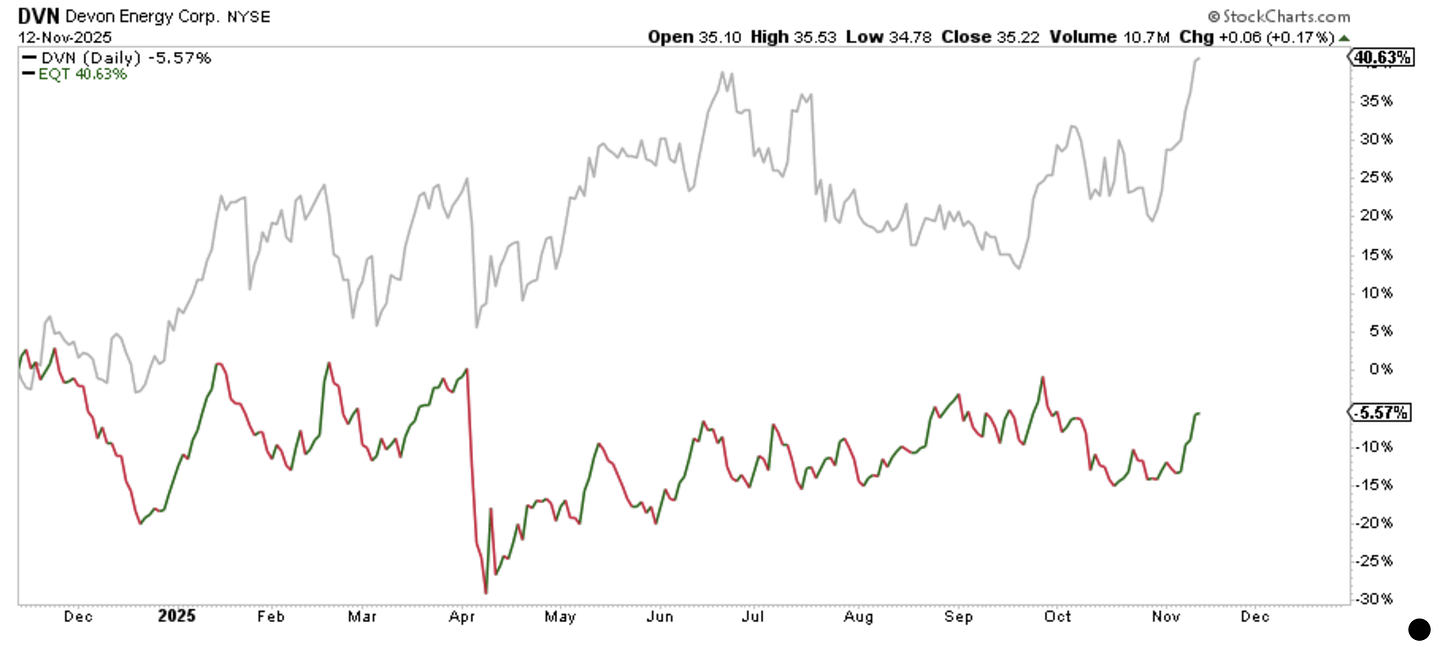

This is why, on a relative basis, you are seeing refinery stocks absolutely destroy WTI. And this is another reason why oil producer stocks have materially underperformed their natural gas counterparts.

Devon vs EQT

And here’s the bad news, oil producer equities will underperform further in the coming 6-9 months as the inevitable discharge from global oil-on-water makes it onshore. Investors right now are ignoring this datapoint and attributing it to noise, but the reality is a lot worse than you think.

In this article, I’m going to explain to you the following:

How does it end up in onshore storage?

Implications on energy investing (which subsector to invest in).

The Oversupply

Global onshore crude inventories + oil-on-water are skyrocketing. This is not a datapoint we all want to take lightly. According to a physical oil trader we speak to frequently, he has informed us of the following datapoints:

Global liquids: +1.6 million b/d

China crude storage: +0.1 million b/d

Oil-in-transit (crude + product): +1.2 million b/d

Global observable liquids (EIA data, etc): +0.4 million b/d