(WCTW) The Promised Land

Structural supply deficit is coming, but knowing how to navigate the incoming setup is just as important.

It's not every day that you see a very bullish oil & gas report from the IEA, but here it is.

The report was so shocking that I had to double-check it was from the IEA. I think you can call this sudden change in tone the Trump effect. Readers might note that earlier this year that the Trump administration threatened to pull funding for the IEA if it didn't start giving more realistic energy analysis. This looks to be one of the first few reports that's coming.

The next big shoe to drop will be a report on global oil demand. I'll be eagerly awaiting that one.

To summarize this report, here are the big points:

Observed post-peak decline (with ongoing investment): 5.6% for oil and 6.8% for natural gas (conventional fields). Big fields decline slower (2.7%), smaller fields show much higher decline (11.6%). Onshore is 4.2%, deep/ultra-deep offshore is 10.3%. Middle East is 1.8% while Europe is 9.7%.

Natural decline is 8.5% per year for oil and 9.5% per year for natural gas. This equates to ~5.5 million b/d of oil per year and ~26.14 Bcf/d of natural gas per year.

Lead times to bring on a new conventional project from license to first production now take ~20 years.

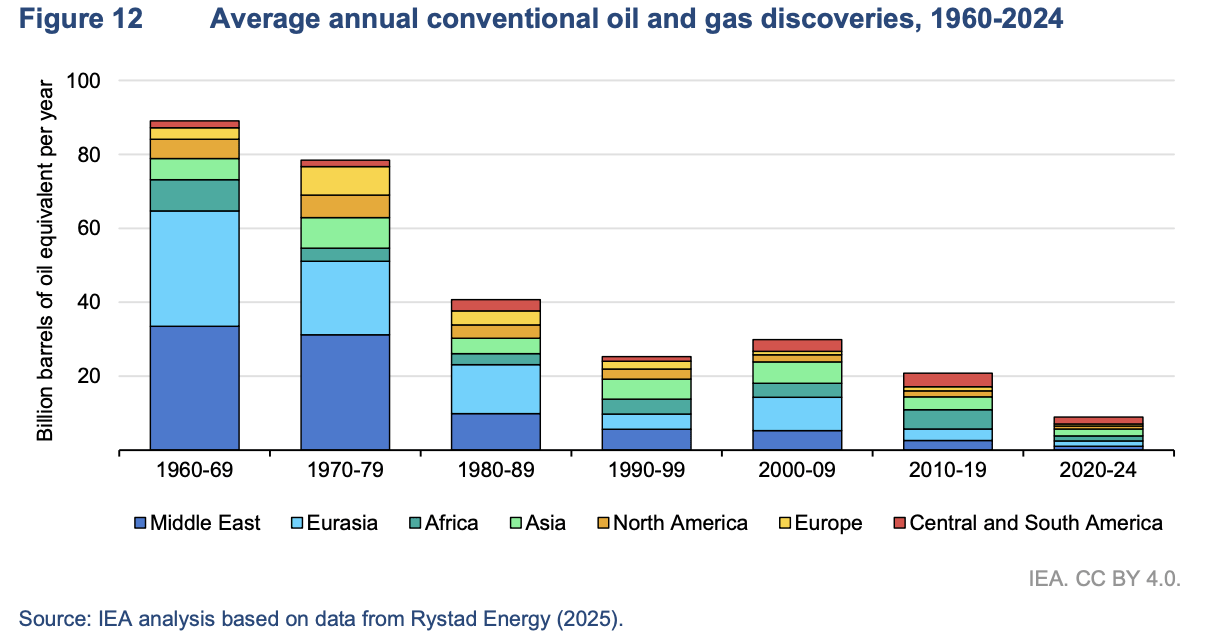

(Note: That's a wild chart.)

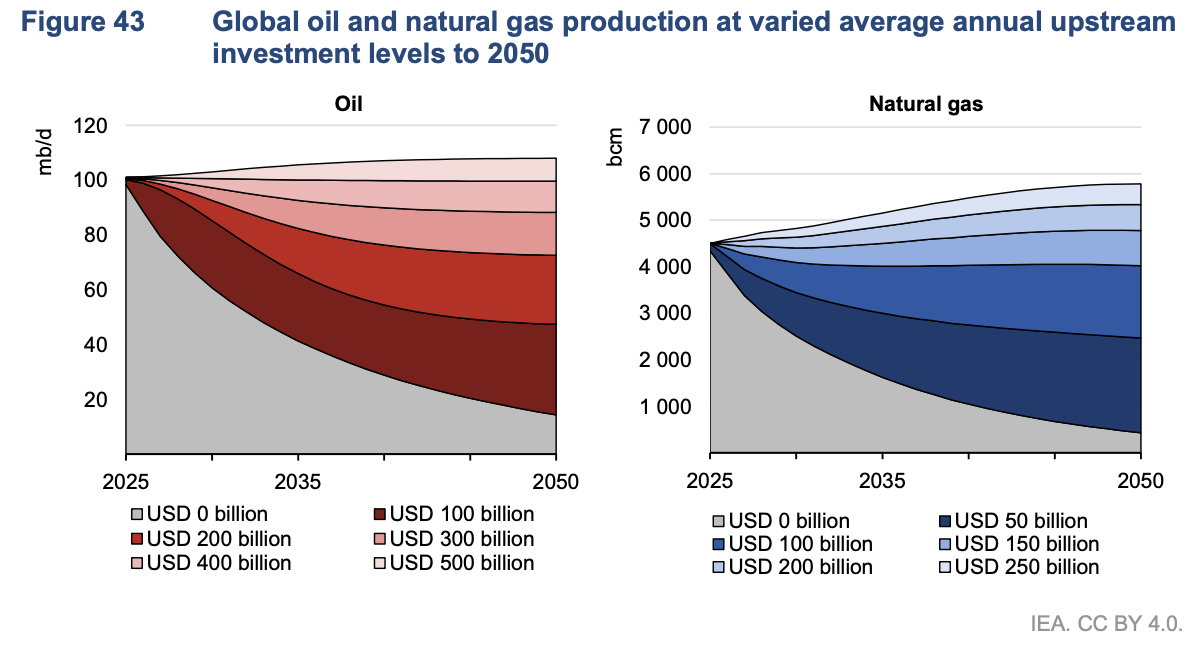

To keep today's supply flat, the world needs to spend $540 billion/year. This year (2025) is showing capex of $570 million. Since 2019, ~90% of upstream capex has gone towards offsetting existing decline rates!

In conclusion, the IEA basically admitted that the world needs to keep spending a vast amount of capex to keep production flat. Here's a chart depicting what happens if global capex dropped:

Source: IEA

It is also admitting indirectly that if the bearish global oil demand assumption it is forecasting doesn't turn out to be true, global energy security will be at serious risk if global upstream capex spend doesn't keep pace.

With that said, let's dive deeper into the timing and how we can best navigate the incoming oil market setup.