(WCTW) This Is It

Over the weekend, I published a piece titled, "Wow, That's All I Can Say." The gist of the article is that people may be underestimating just how little global oil supplies will grow in the future. Namely, the key catalyst for our analysis is the dramatic slowdown we are seeing in US shale oil production.

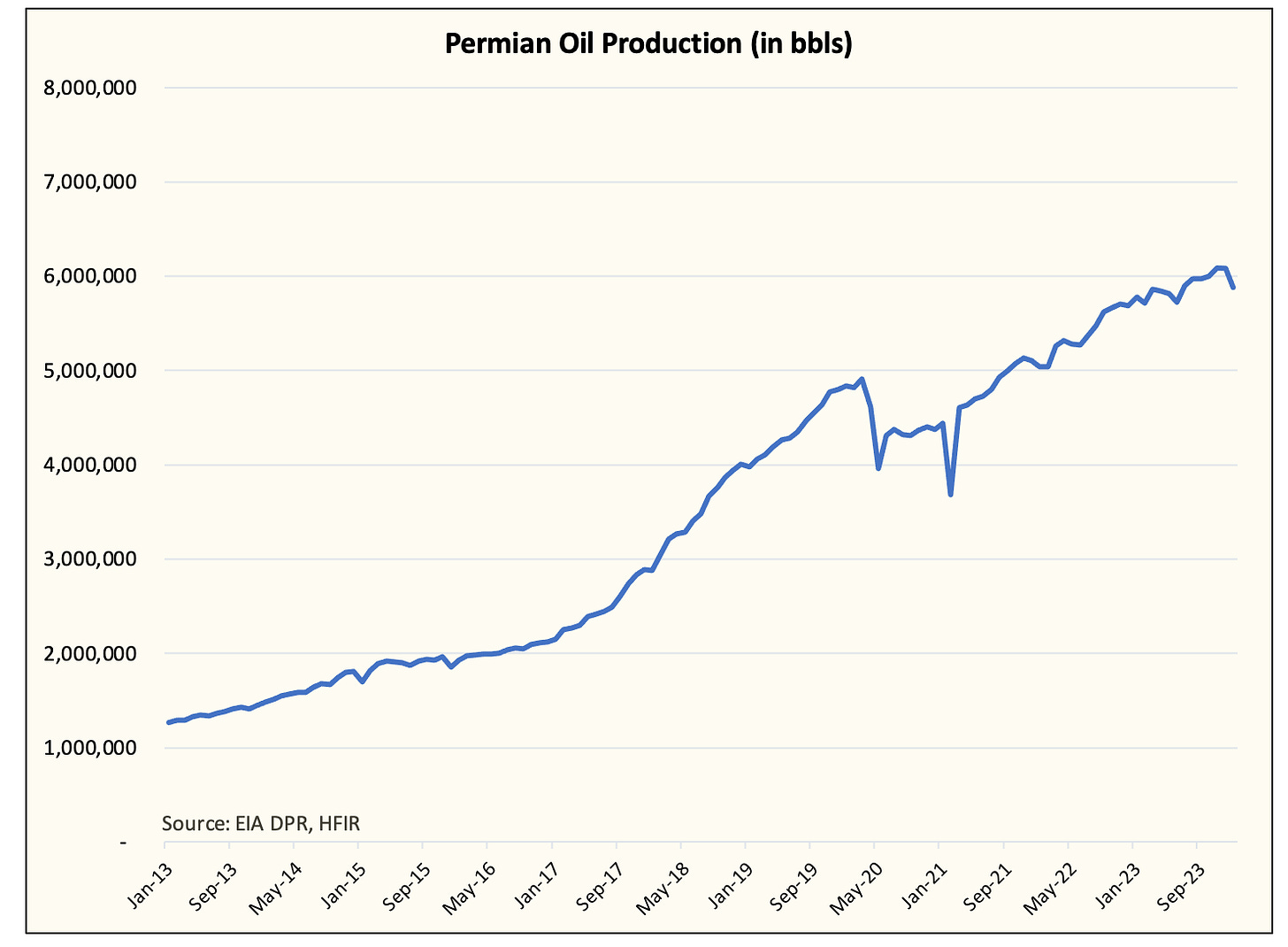

But before we kickstart this piece, readers need to understand what has happened since 2017. If oil bulls could point fingers at just one variable that stalled the "oil bull market", it's this chart right here.

Since January 2017, Permian oil production has grown from 2.149 million b/d to 6.085 million b/d. That's a growth of 3.936 million b/d. For the Bakken and Eagle Ford, oil production growth has not recovered back to their previous peaks.

Bakken - growth of 301k b/d since Jan 2017

Eagle Ford - decline of ~36k b/d

In essence, if it wasn't for Permian, the global oil market would have not only exhausted all of OPEC+ spare capacity already, but oil prices would be significantly higher than today.

Putting what I'm saying in another way, if the Permian stops growing, non-OPEC production would meaningfully stall as well.