(WCTW) Waiting Will Always Be The Hardest Part

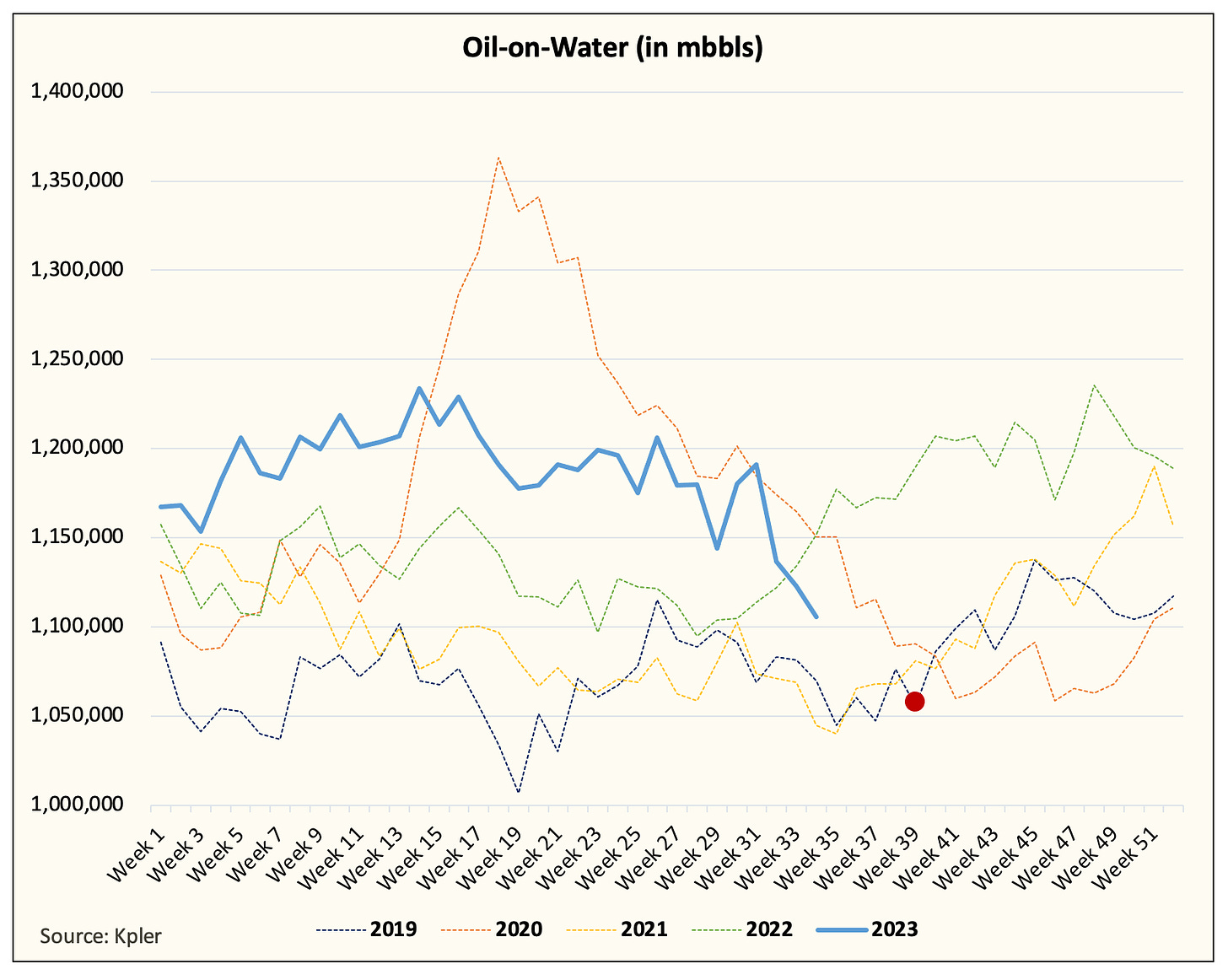

The oil market is frustratingly straightforward sometimes. With the massive reduction we are seeing from Saudi and Russia on crude exports, global oil-on-water is falling and trending towards the target we pointed out last week.

In addition, global onshore crude inventories are also starting to draw. The draw is so large that Goldman published a warning today that the figure might be erroneous.

It is waiting for further revisions in case the figures get revised higher. We understand Goldman, but there's also never been a time when Saudi and Russia cut a combined 1.5 million b/d in a short time span either. So perhaps the figures get revised higher, or perhaps it is drawing at the speed of light. We will find out soon enough.

But what is certain is this: the oil market is in a deficit because oil is a physical commodity. When you have two of the largest producers materially cut supplies to the market, the market will turn into a deficit, and inventories will draw. Now throw in the fact that US oil production has likely peaked for the year, and there are no surprises on the supply side.