When the facts change, we change our minds. That’s how we look at the global oil market. You lay out the signals, watch the signals, and if it pivots, you pivot.

This week’s EIA data was quite an interesting turn of events.

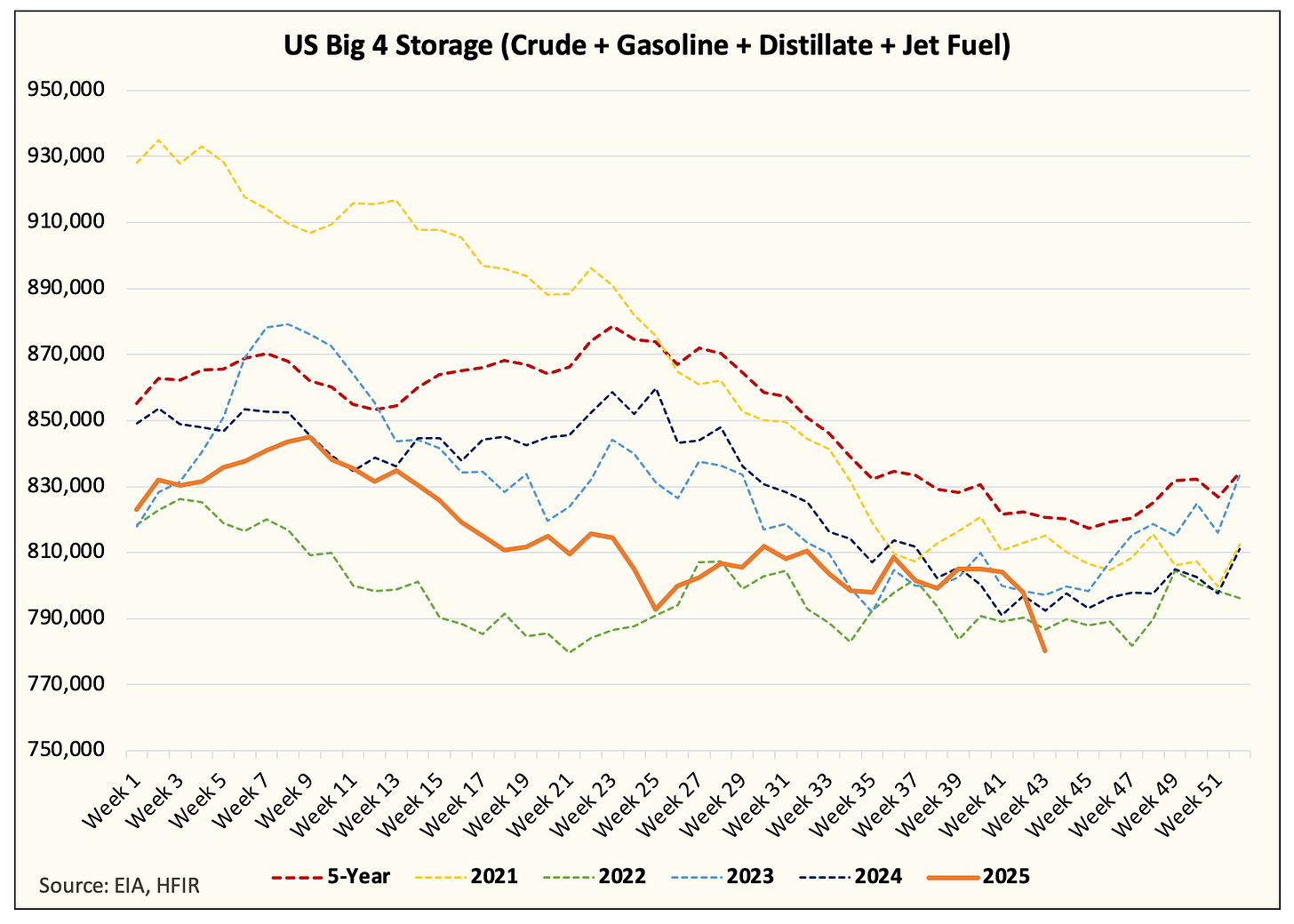

Not only did we not have the monstrous builds the IEA and the rest of the world (including us) expected, but EIA reported a total oil inventory draw of 15.4 million bbls.

For us, what changed this week (WCTW) is the following:

Global oil market balances are not on pace to hit +4 million b/d. I’m fairly certain everyone is aware of this by now. The implied surplus in the oil market Q4 to date is +0.3 to +0.5 million b/d. Now, if you take into account oil-on-water, which is subject to massive change, then the surplus gets closer to +1.6 million b/d. But we will need to see that oil hit onshore first before coming to a conclusion.

US crude oil production did not keep pace with the record rise we saw in August and September. Real-time data shows a meaningful correction, so there’s some half-truth in the data (more on this later).

Global oil demand is holding up much better than we think (likely close to ~107 million b/d). This is good news as this improves the 2026 oil market balances.

On a global oil supply & demand basis, we will need to revise a few important assumptions going forward if the positive data from EIA continues. In this article, I will walk you through everything from timing to how we are thinking about the bottom of the cycle.