Vitol released a rather sentiment-changing oil demand outlook report yesterday. I highly recommend that you read through the report.

When Vitol speaks, we listen. Vitol is the largest oil trader in the world, handling over ~7 million b/d of crude and products. Physical oil traders, along with producers like OPEC, have a better view of the demand side because they are constantly speaking to customers.

IEA, on the other hand, is just an energy agency with a political agenda, so the forecast on the demand side always errs on the side of underestimation.

But one rather mind-blowing thing is that even though Vitol is forecasting oil demand to peak later than expected and higher than expected, the forecast is still too bearish.

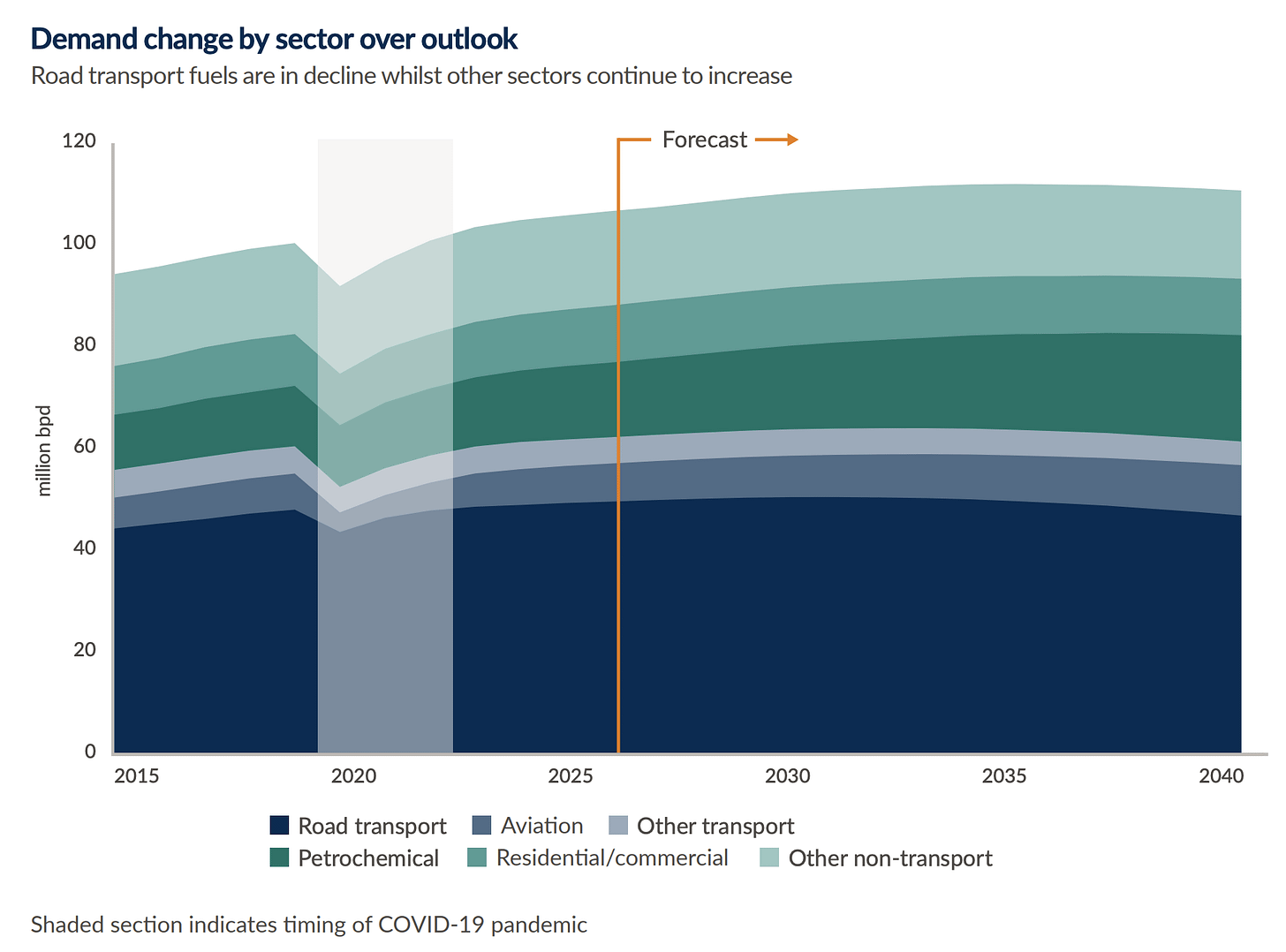

Vitol is currently projecting global oil demand to peak at ~112 million b/d, +5 million b/d from the end of 2025, by mid-2030s.

Source: Vitol

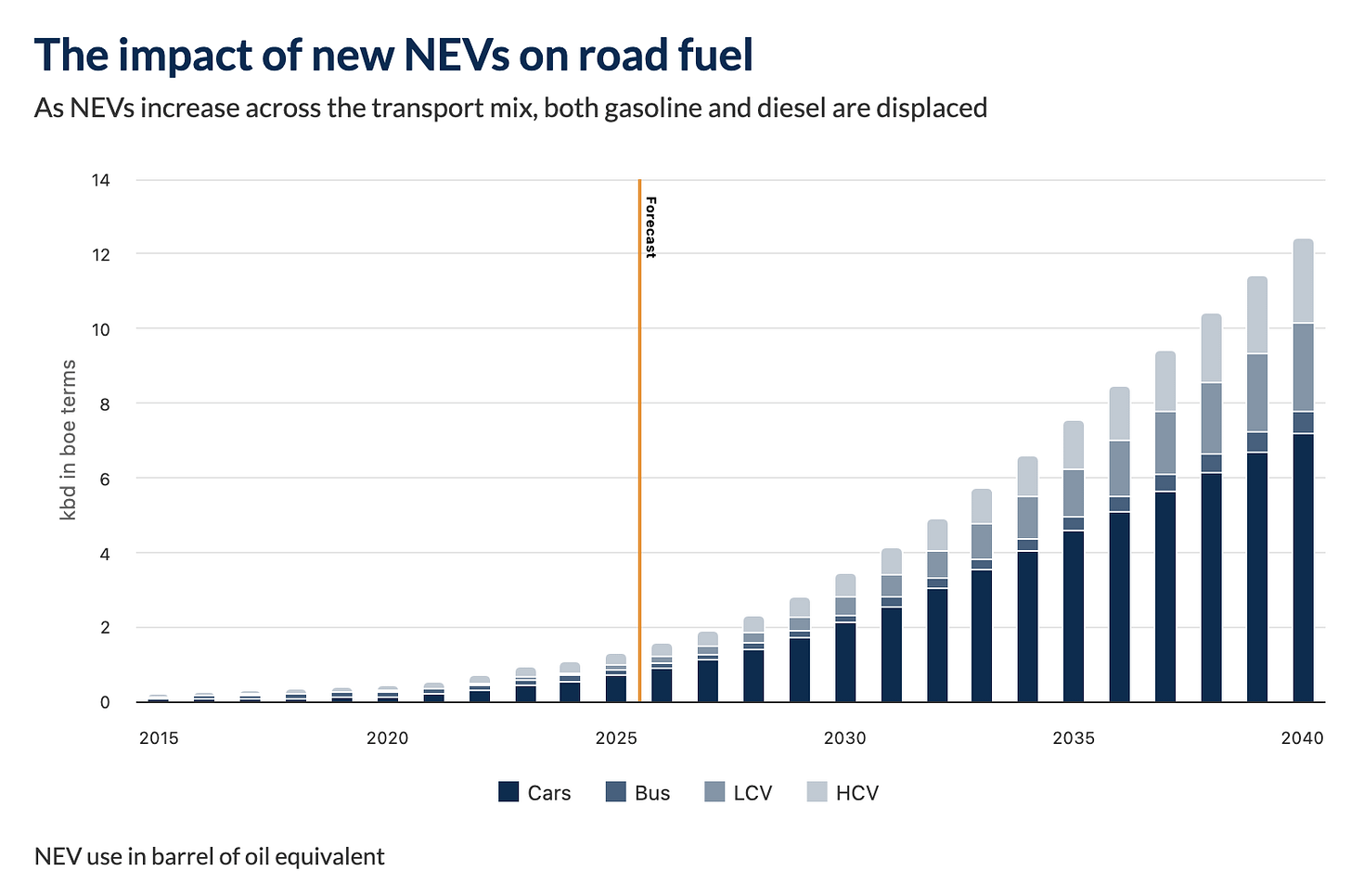

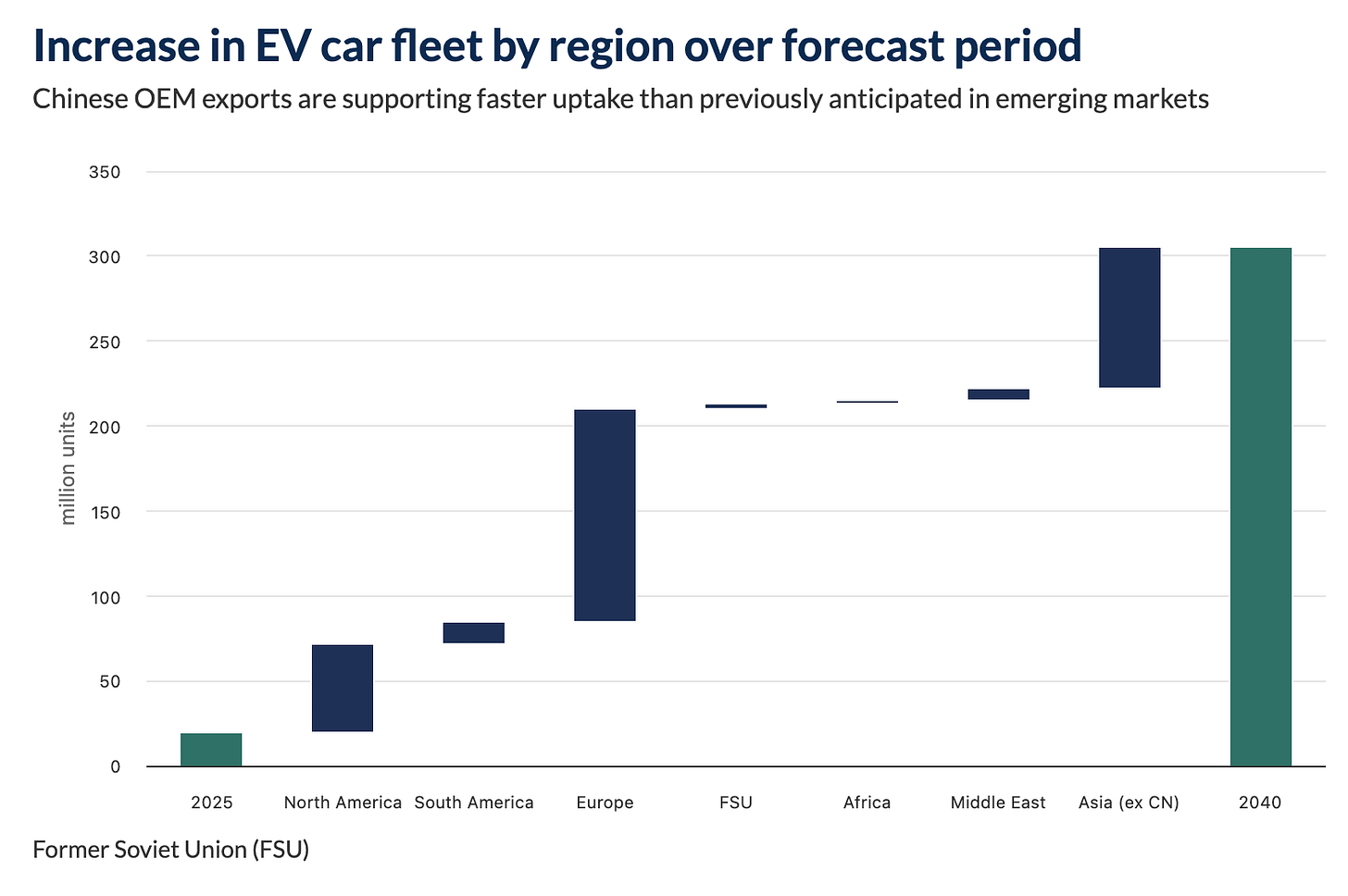

But if you read through the report, it is using the assumption that new energy vehicles (NEV) will displace ~11 million b/d of gasoline and diesel demand by 2040.

Source: Vitol

In other words, if Vitol is wrong on the assumption of NEV penetration, the global oil demand forecast is likely to be understated.

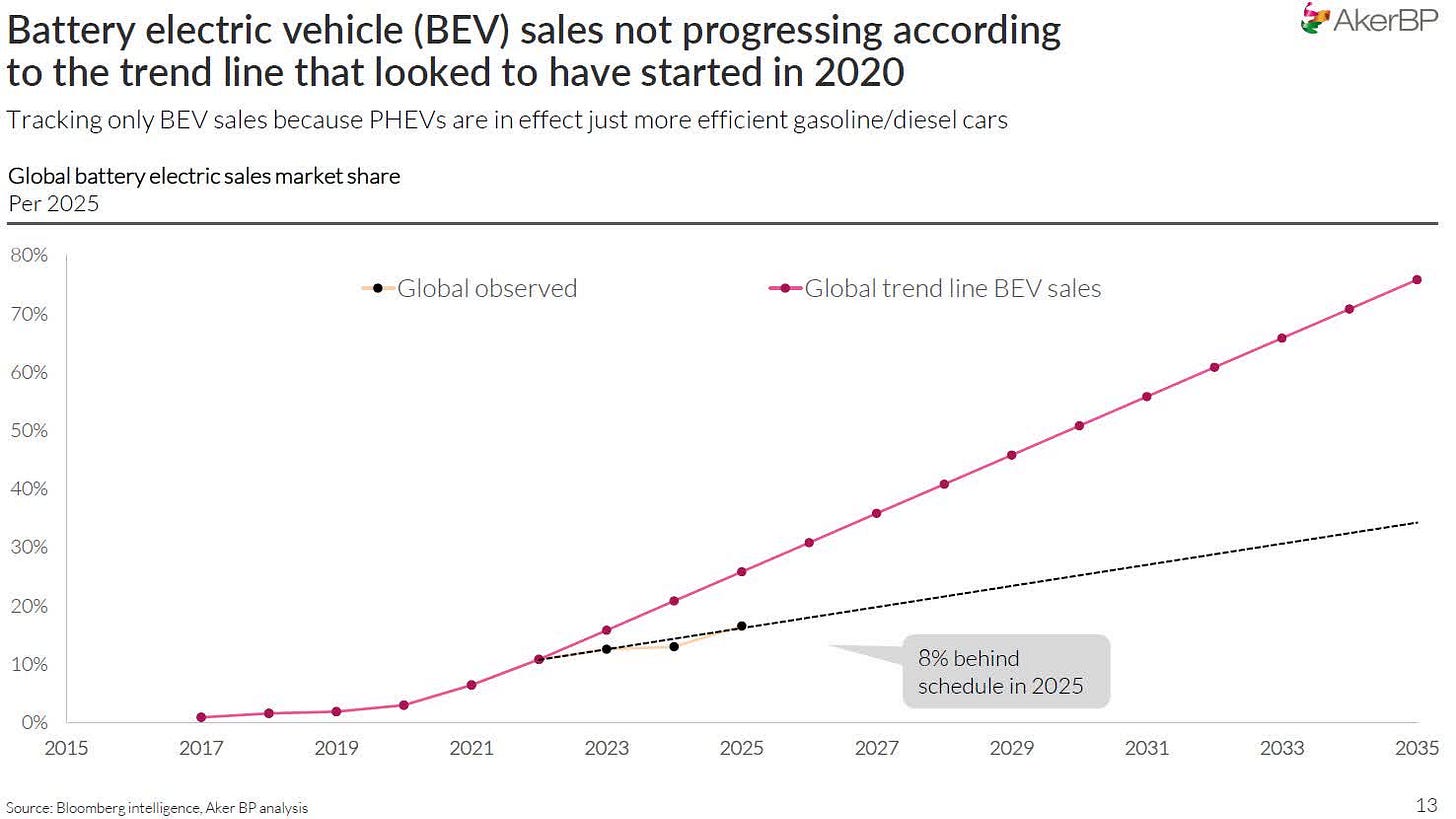

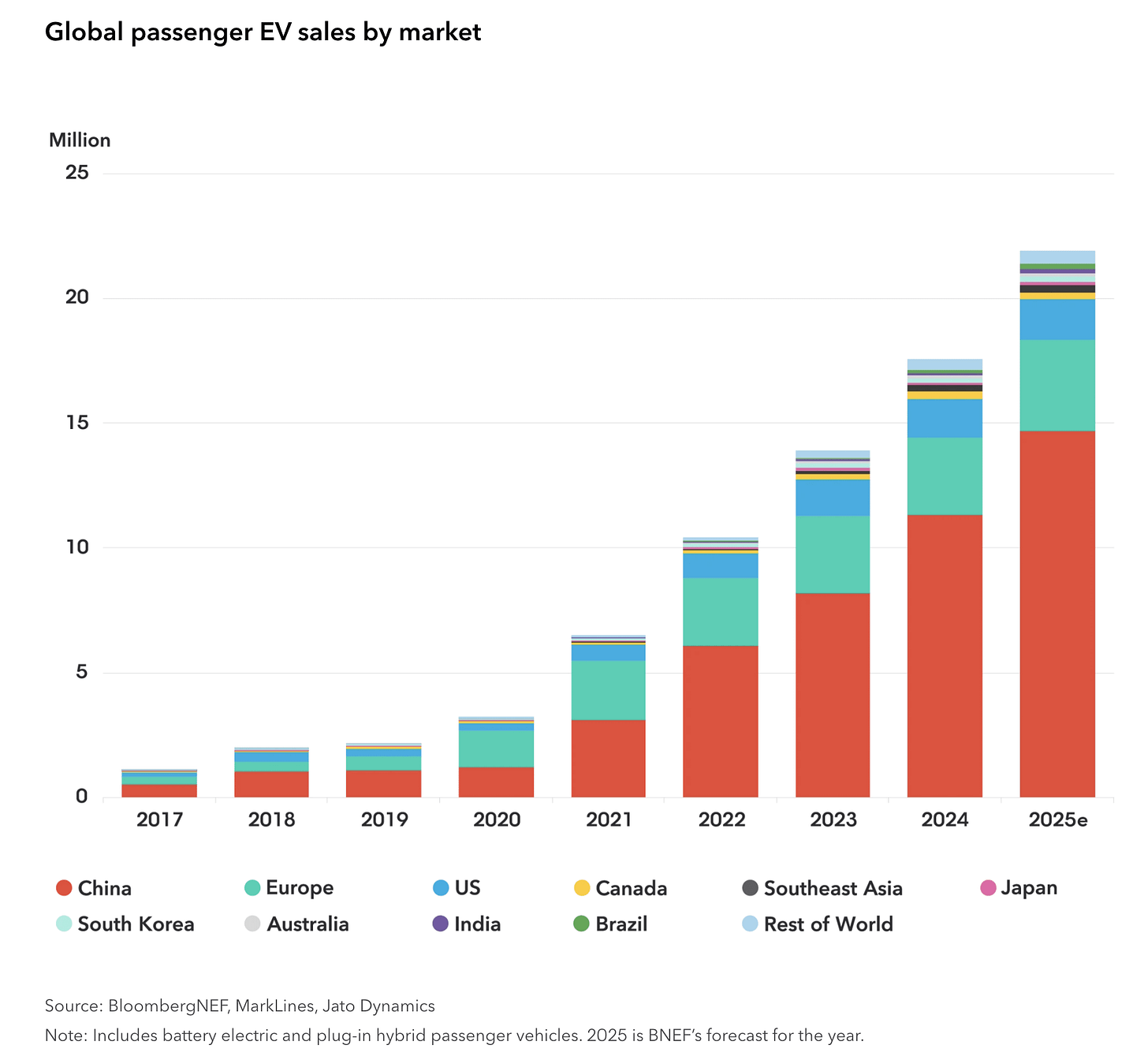

What prompted Vitol to revise its expectations of when global oil demand would peak was the disappointing EV penetration figures. Electric vehicle sales have disappointed, as widespread adoption has underwhelmed relative to previous forecasts.

Source: AkerBP

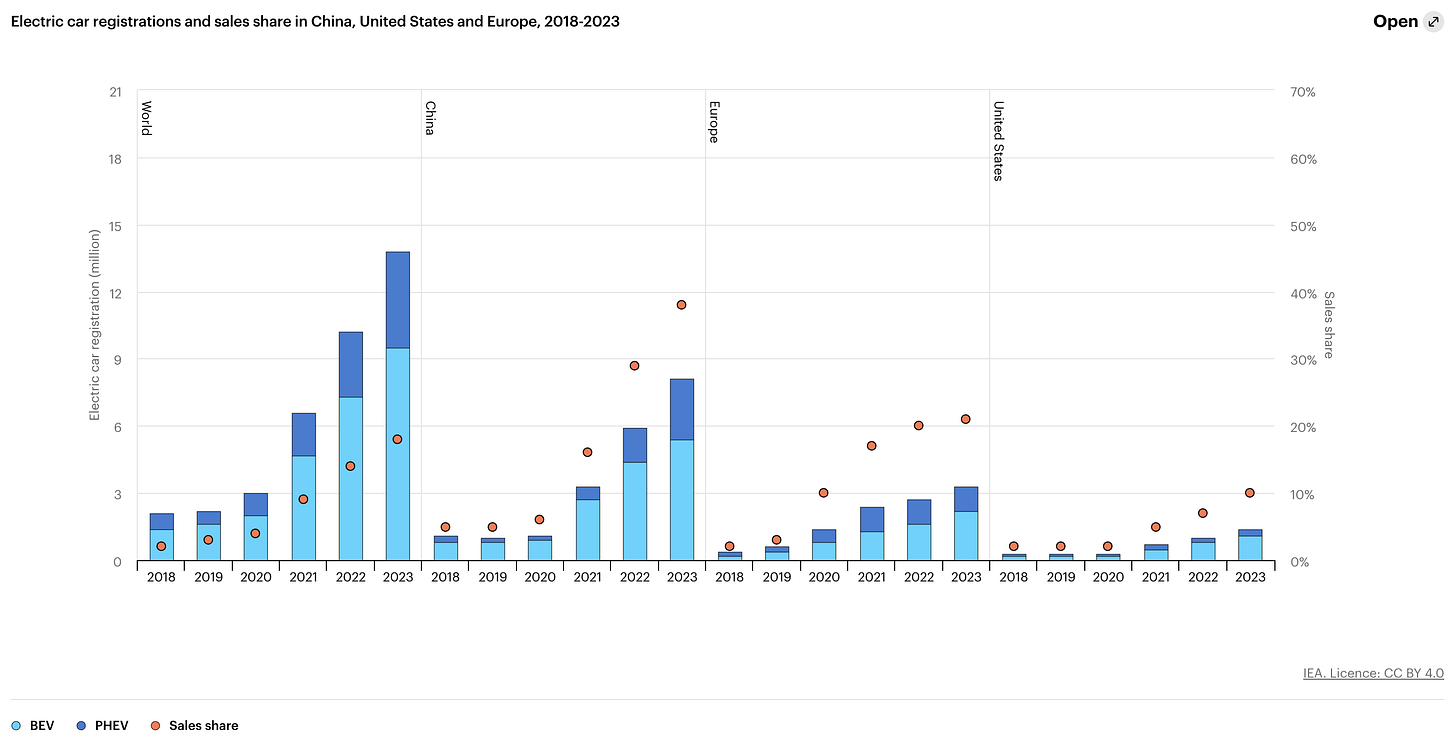

Source: IEA

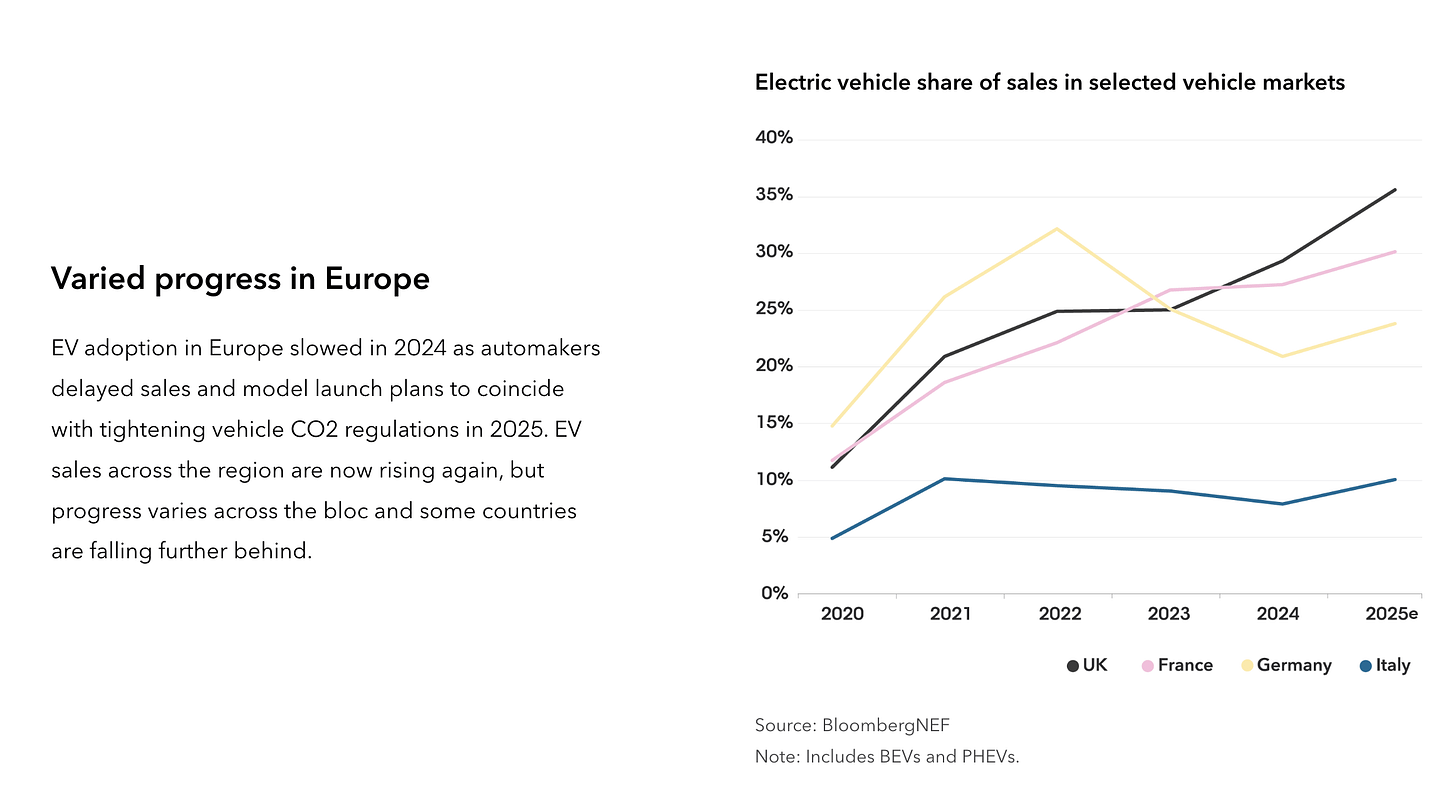

In particular, Vitol’s analysis of NEV penetration requires a large amount of demand displacement coming from Europe.

Source: Vitol

From 2025 to 2040, Vitol expects nearly ~100 million cars to be displaced in Europe by NEVs.

Source: BloombergNEF

Keep in mind that total global passenger EV sales eclipsed ~22 million in 2025. Europe was roughly ~3.5 million. To reach 100 million NEV, Europe would need to double the current sales trajectory.

Possible? Perhaps, but even BloombergNEF, which is usually extremely biased towards renewables and EVs, has expressed doubts.

Source: BloombergNEF

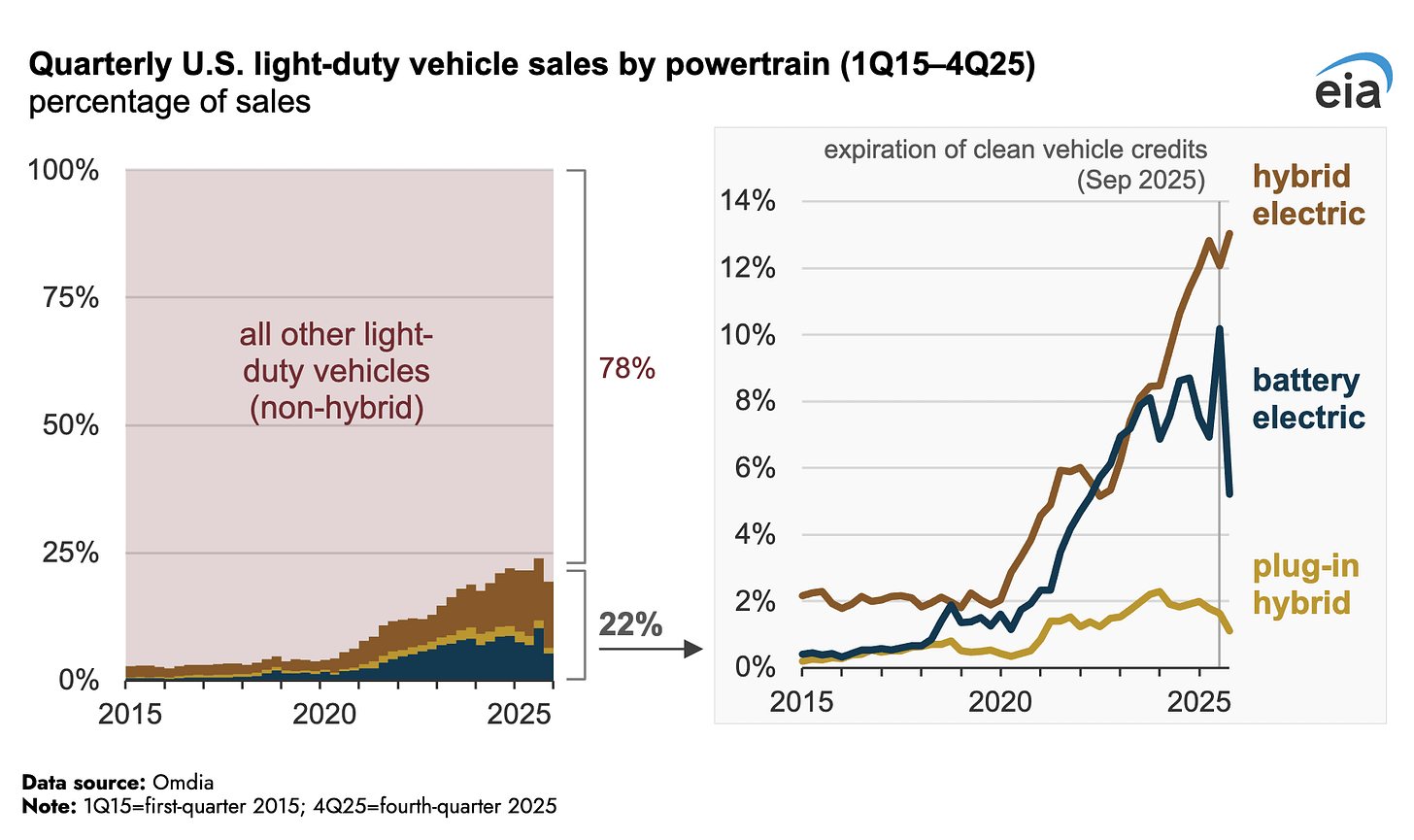

Another key assumption from Vitol is that it is assuming North America will replace ~50 million by 2040.

Source: EIA

That’s also another trend that’s coming to question. Following the collapse of the clean vehicle credits, battery-powered EV sales have fallen off a cliff. The only way for North America to show a substantial increase in NEV penetration is if:

US sales more than 3x from the current 1.28 million units sold.

Canada reinstates the law mandating ~20% of all vehicles sold to be electric. They have now scraped it.

Outside of these two material changes, the US won’t meet that requirement either.

What does that mean for demand?

To put it simply, Vitol will have to revise yet again when global oil demand will peak. The fact that NEV penetration is supposed to displace ~11 million b/d of oil demand from now to 2040 is too aggressive. My gut hunch here says that Vitol will only be right by ~25%, so global oil demand’s eventual peak will be closer to ~120 million b/d vs 112 million b/d. OPEC’s long-term outlook shows global oil demand increasing to ~123 million b/d by 2050; we think that’s closer to reality.

What about the supply side?

To answer this question using the 10,000-foot view, we would have to go to the IEA’s report published back in September 2025.

There’s one chart, in particular, that didn’t get any attention from the mainstream media, but we think it basically summarizes the entire oil thesis.