This meme best describes the global oil market today.

Don't laugh, I'm being dead serious.

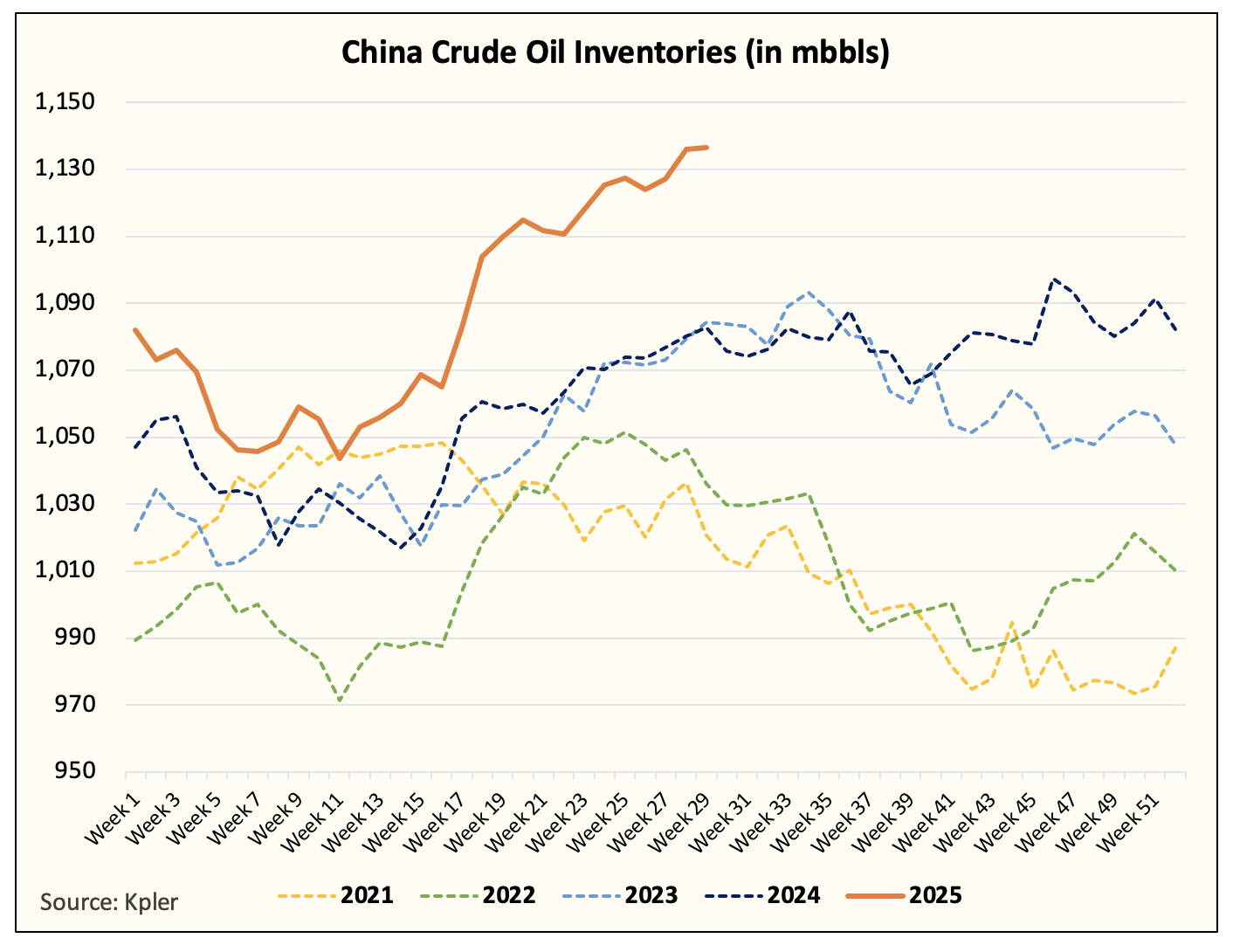

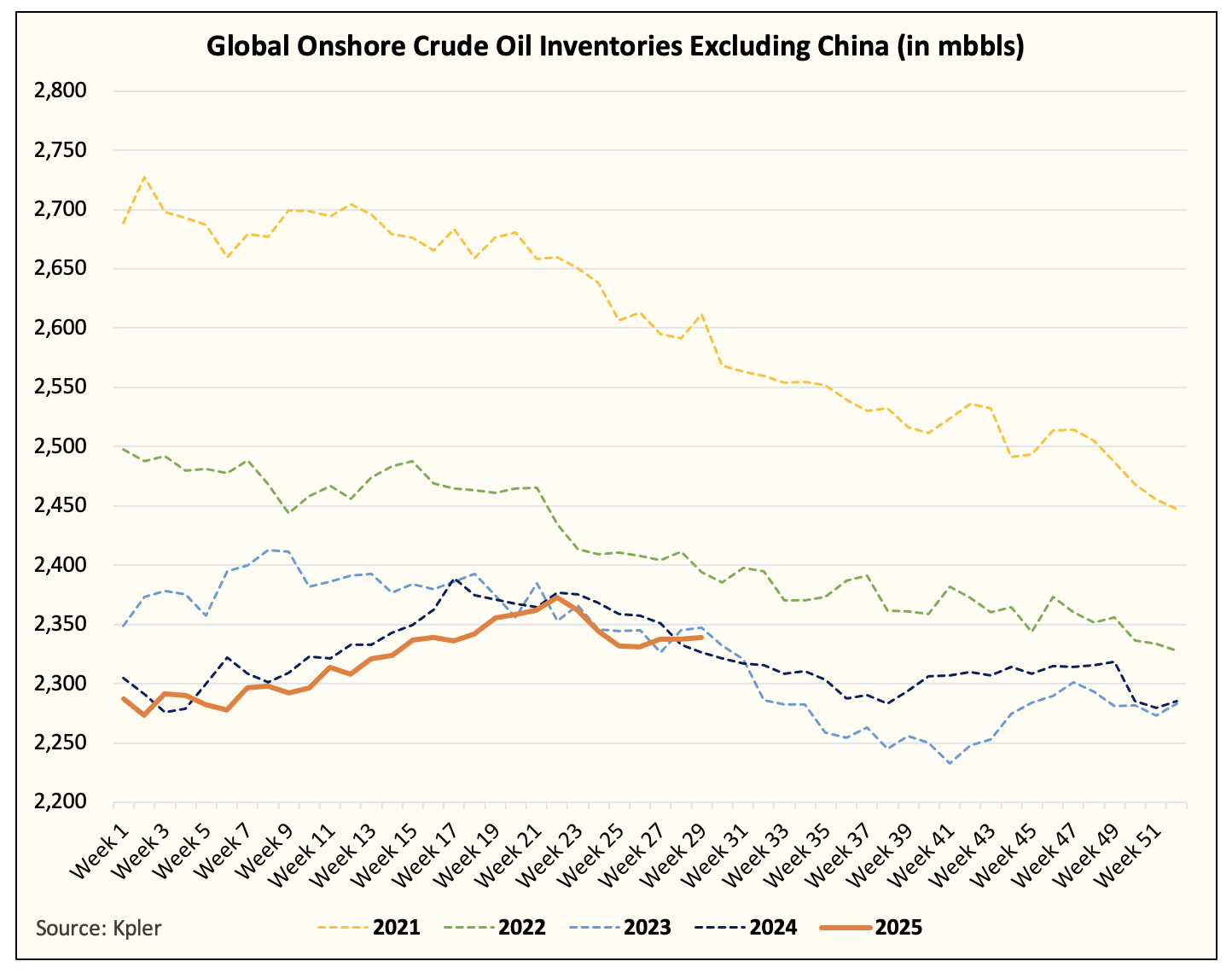

Here's a chart of China's onshore crude oil inventories. China's crude buying has been so strong that crude inventories everywhere else are tight.

But how much longer can China keep up its pace of relentless crude buying? Or perhaps, a better question to ask is, will China's crude buying ever end if Brent remains in the mid-$60s?

Well, China is reported to have a total capacity of 1.8 billion bbls. But the most important metric here is the onshore storage capacity, which is observable by satellite. In this case, it's only 1.23 billion, so we are ~90 million bbls away from China hitting its max.

At the current pace of onshore storage builds, China will hit its peak in ~15 weeks. By the end of the year, China's crude stockpiling will end, and the tight crude environment the world is currently seeing will come to an end.

That's a yellow light flashing, and it's flashing bright now.