We Cannot Blame It All On Sentiment, Oil Market Fundamentals Are What They Are

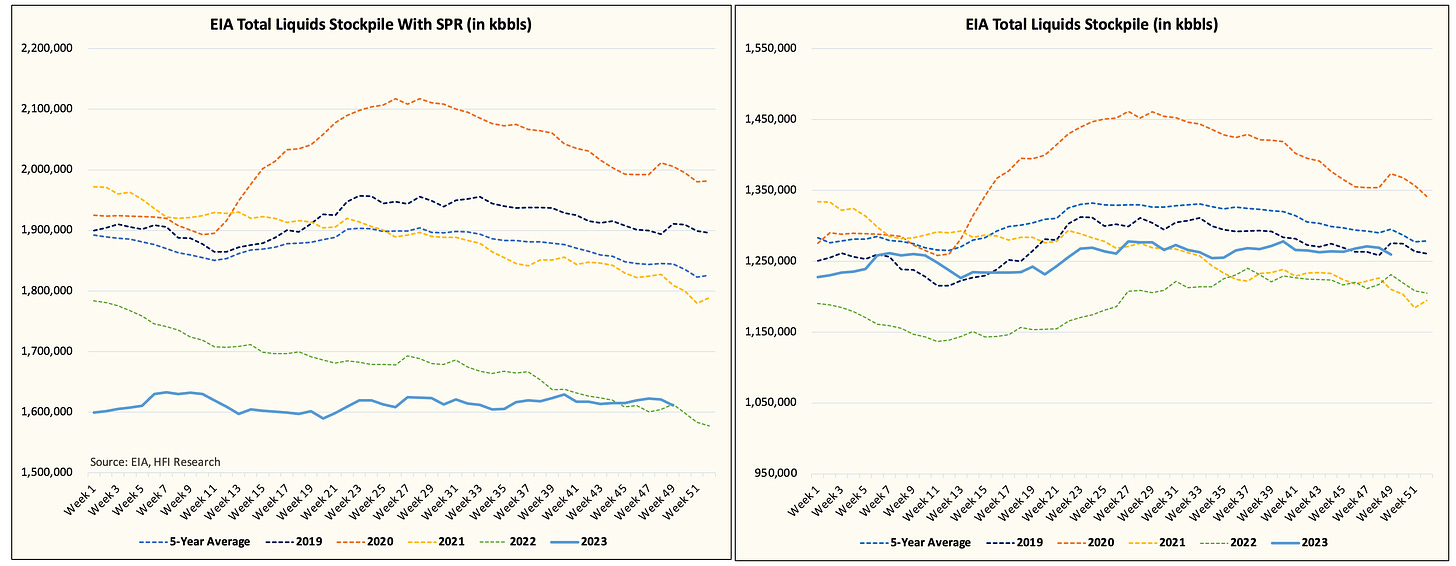

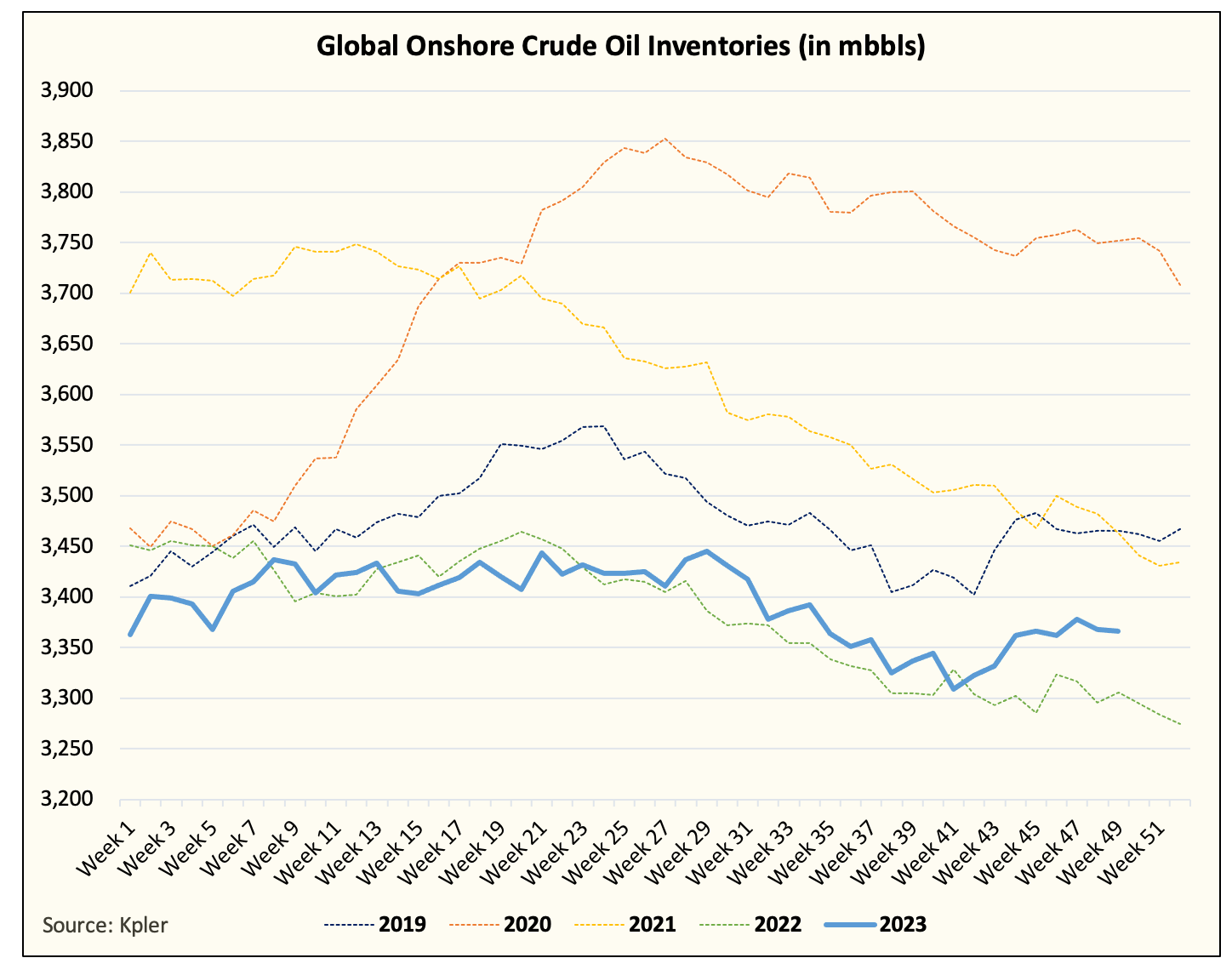

Emotions are running wild with some oil bulls questioning their sanity, and others blaming peak bearish sentiment. But the reality is that oil market fundamentals are simply not that tight. Global oil inventories have been flat since the start of the year, and what was supposed to be a very tight quarter (Q4) is turning out to be a small deficit.

US Total Liquids

Global Onshore Crude

People sometimes forget that when it comes to global oil market supply & demand, the deficit or surplus is usually just ~1%. A ~1% swing (or 1 million b/d) can meaningfully swing prices and physical inventories. And to perfectly grasp this 1% delta is a very hard thing to do.

From the market's perspective, a very simple question to ask is: if Q4 balances are coming in looser than we expected, why would Q1 2024 balances be any different?

While it is an extremely fair question, I have a perfectly valid answer for this.