Weather Remains Bearish, No Signs Of A Bottom In Natural Gas Just Yet

Higher production + bearish weather = lower prices

I hope readers have been keeping up to date with our short-term natural gas outlook articles. Following Henry Hub's December futures rallying briefly above ~$3/MMBtu last week, we published our NGF titled, "Natural Gas - A Slow Start To This Winter, The Market Is A Bit Ahead Of Itself." In it, we said:

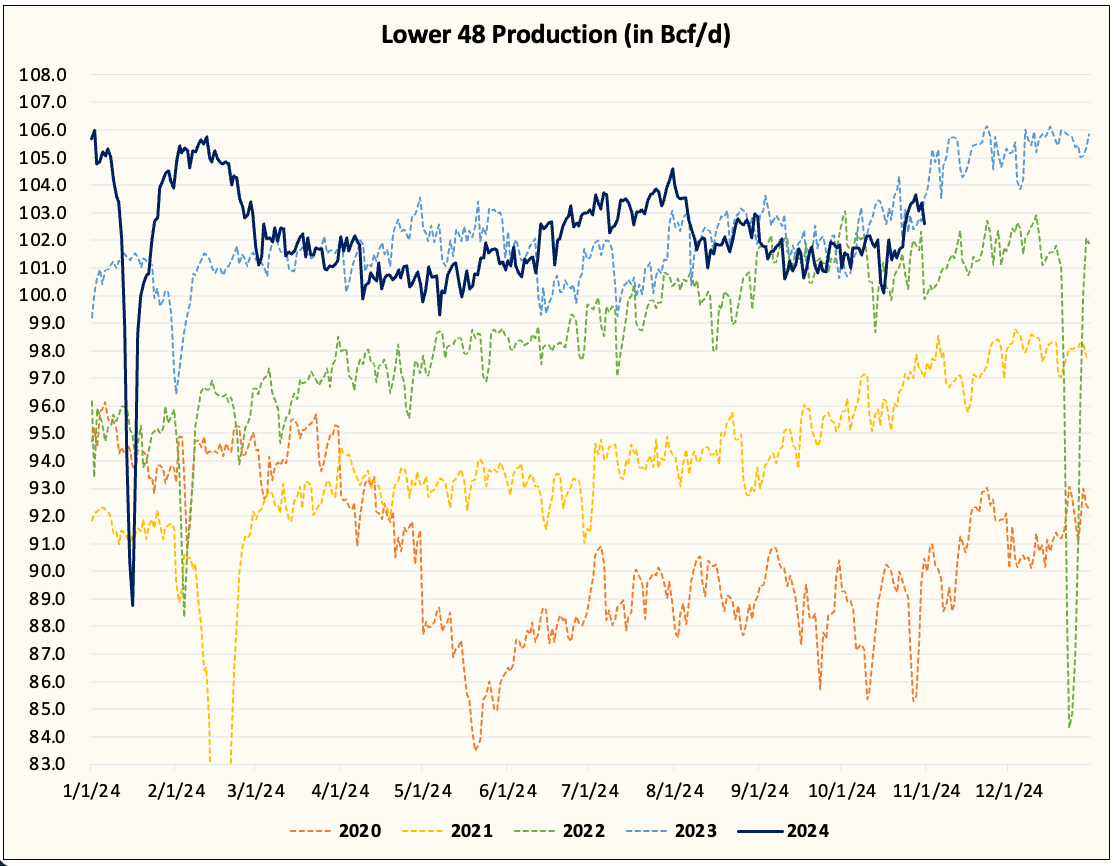

We will likely get production to average close to ~103 Bcf/d this weekend before moving even higher in November. Matterhorn is now moving ~1.4 Bcf/d, so there's another ~1.1 Bcf/d to go. The expected increase combined with the delays we saw in TILs this summer will push Lower 48 gas production back to ~106 Bcf/d.

We suspect this production increase coupled with the mildly bearish weather outlook will be terrible for natural gas.

Fast forwarding to today, December futures have fallen materially to $2.737/MMBtu, and Lower 48 gas production averaged over ~103 Bcf/d last weekend and on pace to reach ~104 Bcf/d by next week.

In my view, the bearish price action we are seeing in natural gas today is far from over. Not only is Lower 48 gas production expected to increase into year-end, but every natural gas producer that has reported so far is guiding to higher production for 2025. This wasn't unexpected as every producer that curtailed production noted that when prices rebound, they would boost production again. So with this backdrop and the weather outlook remaining bearish, who can blame traders for selling natural gas prices? This is especially the case when the futures curve was steeply in contango.

Source: CME

And speaking of the weather outlook, the incoming weather trend remains firmly bearish.