What Happens To Oil Storage In The Next 2 Months Will Play A Pivotal Role For The Rest Of 2024

EIA reported a higher-than-expected crude storage build today on the back of persistently low refinery throughput. In our model, we had expected refinery throughput to have rebounded back to ~15.3 million b/d, but EIA showed 14.84 million b/d. On a y-o-y basis, US refinery throughput is now ~570k b/d lower.

Going forward, we now expect US commercial crude storage to show builds through February.

The material change in our crude storage forecast is the result of materially disappointing US refinery throughput.

Post the cold blast we saw in January, US refinery throughput has not recovered. On a utilization basis, we are at a 5-year low. Given that the US refinery maintenance season kickstarts in February, we suspect refineries opted to start maintenance earlier than normal.

Now with structurally lower refinery throughput, two important physical market signals took place:

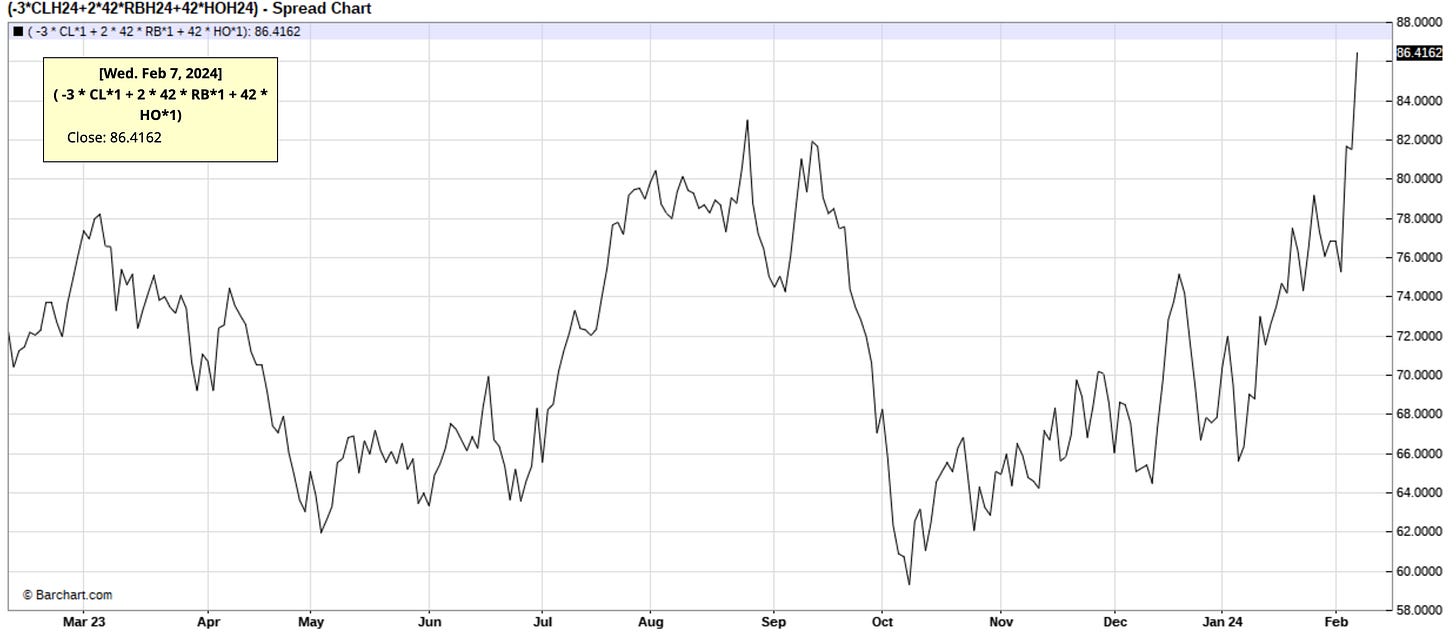

A material move higher in the traditional 3-2-1 crack spread.

WTI timespreads back to contango.

As for storage, low US refinery throughput should see the big 3 product storage drop close to 2023 levels in the next few weeks.

And looking at implied oil demand for the big 3, we should expect storage draws to outpace what we saw in 2023 (considering much lower refinery throughput).