What Will It Take For Oil Prices To Breakout?

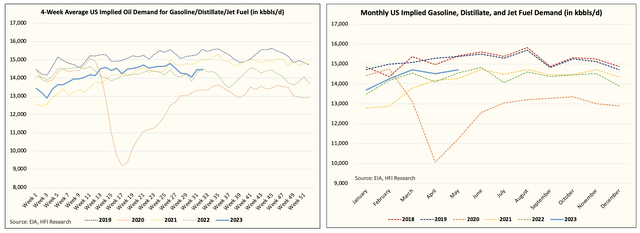

EIA's oil data today was mixed. Despite the large crude draw, implied oil demand for gasoline, distillate, and jet fuel trended lower.

While some would argue that this is not a sign of strength, we would urge readers to focus on refining margins instead. With refining margins inching higher today in spite of the crude sell-off, we think end-user demand remains fine and is not being captured in the data accurately. While EIA has had a good history of showing a directional correlation between the weekly and monthly data, the absolute figures are suspect.

In addition, we think the latest correction in oil prices is more of a technical move than something fundamental. Following the price rejection at $84.8, crude is going to retest support levels around $78 before another attempt at this crucial resistance level.

Over the coming weeks, we should continue to see US crude storage move lower, which should give a further tailwind to prices.