What's Going On In The Oil Market Today?

Bear with me, there are a few topics we need to cover today.

OPEC+ mid-month crude export update.

Iranian sanctions could be lifted soon, so what does that mean?

The physical oil market is weakening, but refining margins are picking up.

OPEC+ Mid-Month Update

Last month following the Biden/Saudi visit, I wrote a piece talking about the possibility that the Saudis will spike production to ~11 million b/d faster than expected. The timing was precarious because Saudi crude exports were spiking just as the meeting took place. So while I had my theories, the data needed to further validate that there was some kind of hidden agreement that took place.

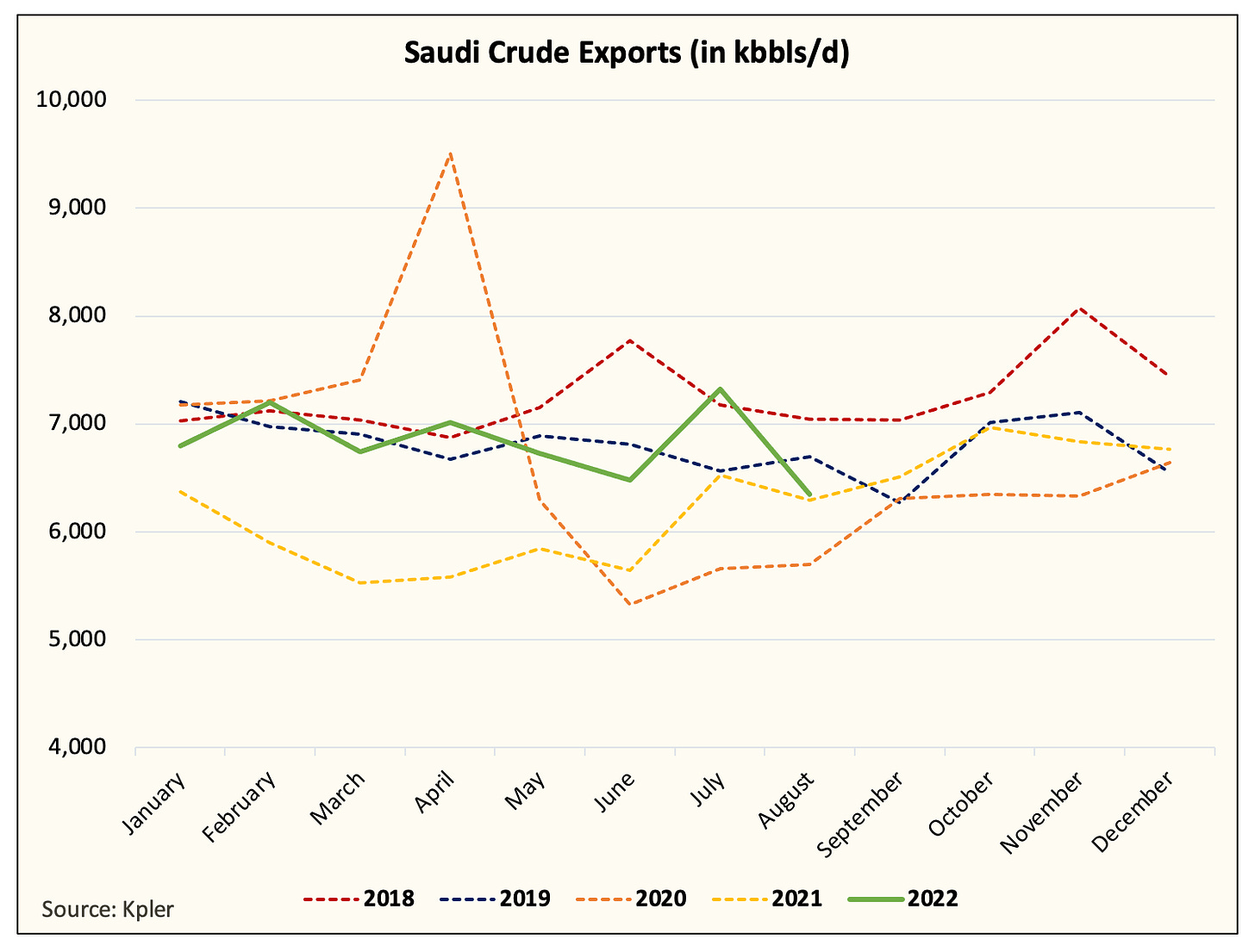

Fast forwarding to today, there were several signals that illustrated to me that my initial assumption was flawed. First, Saudi increased the official selling price to the US. In 2018, it decreased OSP to the US. So when the exact opposite happened, it implies to me that the Saudis did not make a deal. Then, there's the mid-month crude export update, and this is what it looks like:

July looks like a one-off and if this is further validated by the month-end data, then we may need to change our assumption altogether. So far, our initial theory looks very off, and there was no agreement between the Saudis and the US.