It's been a while since we last updated you on the natural gas market, but not a lot (fundamentally) has changed except for the price.

As we wrote in our June 27 update, we said:

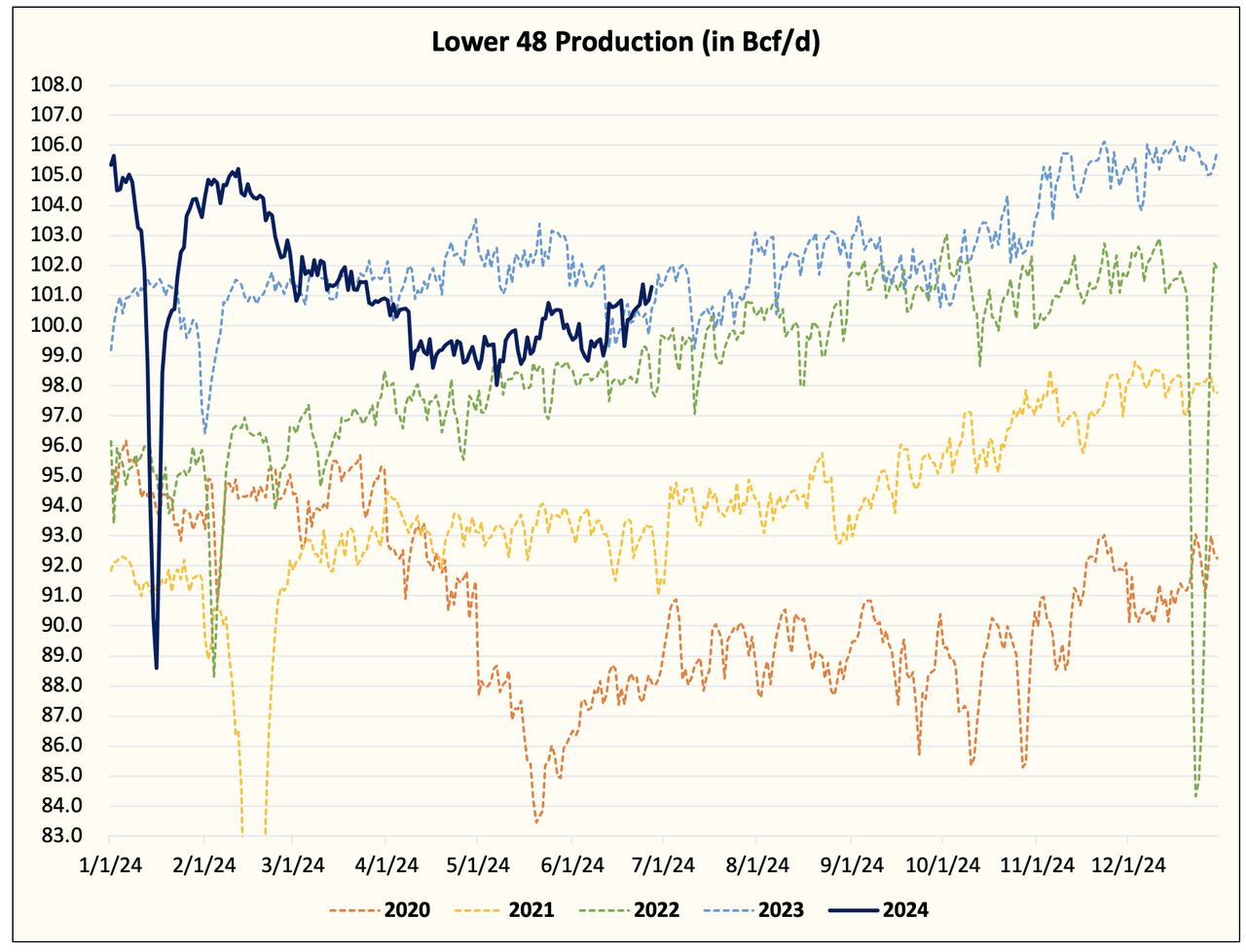

Incoming higher Lower 48 gas production to ruin the day

Since hitting sub $2/MMBtu, Lower 48 gas production has managed to recover from ~98 Bcf/d (the lows) to ~101 Bcf/d today.

While we knew all along that natural gas production would never remain around ~98 Bcf/d for long, it is remarkable that natural gas producers are already starting to pump up supplies amidst a still-tepid recovery.

We think the market is largely at fault here as traders need to consider the possibility of over-tightening the natural gas market ahead of the winter heating demand season. Understandably so, you can see the severity of the contango in the natural gas futures curve.

Source: CME

My issue with the production recovery is that in order to completely eliminate the natural gas storage surplus, production had to average below ~100 Bcf/d until mid-September. This coupled with strong power burn demand would have brought storage back to the 5-year average, but with the recovery we are seeing, this is highly unlikely.

In addition, you can see in the chart above the surplus we are seeing out of South Central. While the severity of the surplus will be nowhere near the one we saw in 2020, it will be extremely important for the weather to remain warmer than normal to avoid any concerns.

So the bloated storage situation coupled with recovering Lower 48 gas production is putting the current price recovery at risk. We think the natural gas market for the next few months will be rangebound at best with the back-end of the curve (winter months) at risk of selling off further.

Since then, you can see the severe drop in natural gas prices:

And while the front-end has taken the majority of the hit (more on this later), we think the 2024-2025 winter months have more downside ahead especially if Lower 48 gas production continues to recover.

What's going on today?

There are three variables wreaking havoc on the natural gas market today:

Lower 48 gas production continues to recover. Production has returned to ~102 Bcf/d following a brief dip last week. Our analysis indicates it is on pace to reach ~103.5 Bcf/d by mid-August and ~104 to ~105 Bcf/d by September/October.

The issue with market pricing this time around is with the severe contango we see in the market, most natural gas producers can withstand 1-2 months of low prices in order to capture the higher winter month prices. As a result, we think if production continues to recover, there's more downside to the winter months.