What's Going On With The Oil Market?

With WTI trading back below $70/bbl, the question needs to be asked. What's going on with the oil market?

I think an even fairer question to ask at this time is, when do the oil bulls admit they are wrong? Quite frankly, the market price action is saying loud and clear that demand is likely going to disappoint to the downside, and in turn, oil market balances won't be nearly as tight as one would hope for.

When I look at this question, the answer is very black and white. There are two key variables the oil bulls have to watch for, and if those two variables do not materialize, then they are wrong. If they materialize, then one can say that the latest sell-off is financially driven and related to emotions over fundamentals.

OPEC+ production cut.

Oil demand.

The first variable, the OPEC+ production cut, will be a key driver for oil market balances in H2 2023. In early April, the surprise announcement of a cut sent prices higher, but only for prices to now be lower than before as markets remain skeptical on both the compliance and meaning. If demand was healthy, why would OPEC+ need to cut? And these are very fair questions to ask.

So for us, the first important signal to watch out for will be this weekend's Aramco official selling price or OSP announcement. Market participants are expecting a cut of $0.35 to $1/bbl to Asia. If Aramco announces no reduction in OSP, then it sends a clear message to the market that it is serious about reducing supplies. If Aramco meets the market expectation with a cut in between that price range, then it implies that oil demand is really soft, and it does not want to lose market share. The latter will be very bearish for oil, so readers have to watch this announcement closely.

Our view is that Aramco will announce no change to the OSP. Historically speaking, Saudi's compliance has been very high when it announces voluntary cuts. There is also a rumor now that when OPEC+ meets in June, these voluntary cuts will be solidified into mandatory production cuts. Either way, we think given the credibility issue here, Saudis will follow through, and the Aramco OSP announcement will reflect as such.

On a side note, for those of you that remember the debacle of March 2020, the OPEC+ meeting ended in catastrophe with no agreement to cut production amidst the COVID pandemic. Immediately following the meeting, Aramco announced drastic OSP cuts to the market with the most discounts offered to Europe. At the time, we wrote numerous articles noting that the Aramco OSP cuts were designed to target Russia and to shut in barrels. A month later, Russia caved, and OPEC+ reached an agreement to cut production by ~10 million b/d.

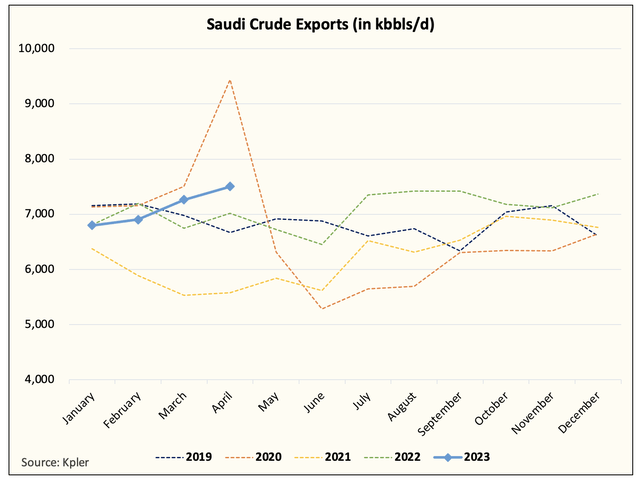

Similarly, if Aramco follows through on no OSP cuts this time, we will see Saudi crude exports drop.

We should see May figures drop back below ~7 million b/d, at least.

So for oil bulls, compliance from OPEC+ with the exception of Russia, will be key to understanding how the oil market balances fair in H2 2023. If the voluntary production cuts from Saudi, UAE, Kuwait, and Iraq follow through, we think a deficit will reveal itself, and by mid-May, oil market balances should reflect that.

Second variable - demand...

If the first variable, OPEC+, follows through, then for oil watchers, oil demand is the only remaining variable that could meaningfully sway balances. The question going forward is what will demand look like?

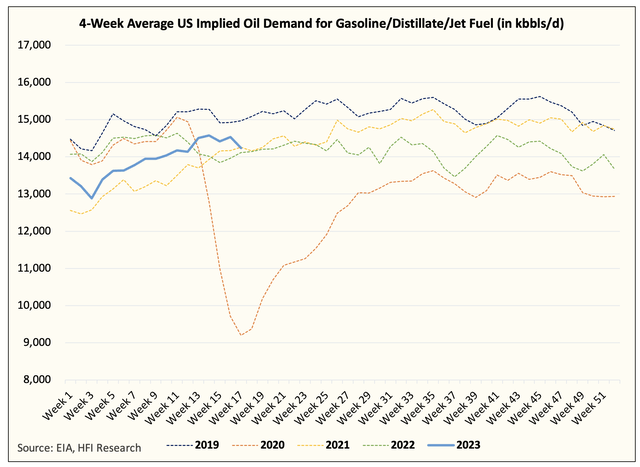

Looking at the latest US implied oil demand charts, demand isn't bad, but it isn't good either.

And to me, that's the big unknown in the market. Our base case view is that US oil demand will perform better than expected, but with more regional bank failures under way, consumers reducing spending, and credit conditions tightening much faster than previously expected, you have to wonder how that will impact demand going forward.

Are we going to match 2022's downward trending trajectory, or do we muddle somewhere between 2021 and 2019?

From the market's perspective, it is basically saying that we will not only match the 2022 trajectory, but we are likely going to trend below it. Just for your information, we have OECD oil demand of -0.29 million b/d y-o-y, and despite this assumption, the oil market balance still shows a draw over ~1 million b/d in H2 2023 (assuming OPEC+ follows through).

This leaves us with quite a comfortable margin on the downside, but like all things markets, you don't know what you don't know.

So for oil watchers, how can we validate the view that demand is not all that bad? Well, we have to keep watching these weekly demand charts. The weekly data has been a bit volatile as of late, but the general trend is much better than what we saw in 2022. If, however, the trend starts to turn and trend downward, then you will know we are wrong about our demand assumptions. If the inverse occurs and demand trends higher going into summer, then you will know that the market is being far too bearish on demand, and oil market balances will likely surprise to the upside.

Conclusion

The way I see it, OPEC+ and demand are the most important variables. For OPEC+, this weekend will tell you everything you need to know about Saudi's intentions. You can then extrapolate the price signal to what will likely happen in reality. This is then followed up by close monitoring of the weekly demand signals, and if demand continues to improve, then we are on the right trajectory. If it doesn't, then we need to reevaluate.