Why Did I Buy More Energy Stocks Today?

Now more than ever, investors have to focus on the things they can control/analyze. Nothing more, nothing less.

On Jan 21, I posted an article titled, "More Noise Than Ever." In it, I wrote:

Sanctions on Iran/Russia are a distraction to oil market fundamentals.

Signals to watch for are China demand figures, US SPR buying, and actual implementation of tariffs (not the threat of tariffs).

For the oil market, US oil production will disappoint, OPEC+ will increase production later this year, and storage balances should remain supportive. Oil prices will be rangebound this year.

For the natural gas market, a structural bull market is underway once the LNG export ramp happens later this year. In the meantime, prices will be materially impacted by near-term weather model changes.

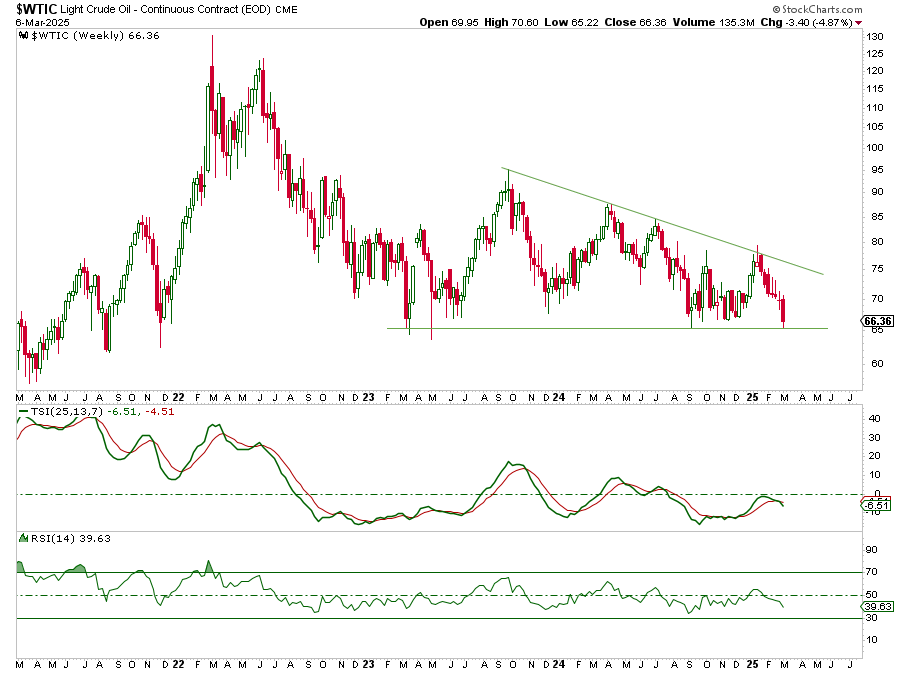

Fast forwarding to today, WTI went from $75.83 to $66.36/bbl. All the while, 1) US crude oil production is disappointing (~13.1 million b/d real-time production), 2) OPEC+ is increasing production one quarter in advance of our forecast, 3) global oil inventories are down YTD, and 4) China is finally stepping up with meaningful fiscal stimulus.

So why are oil prices down?

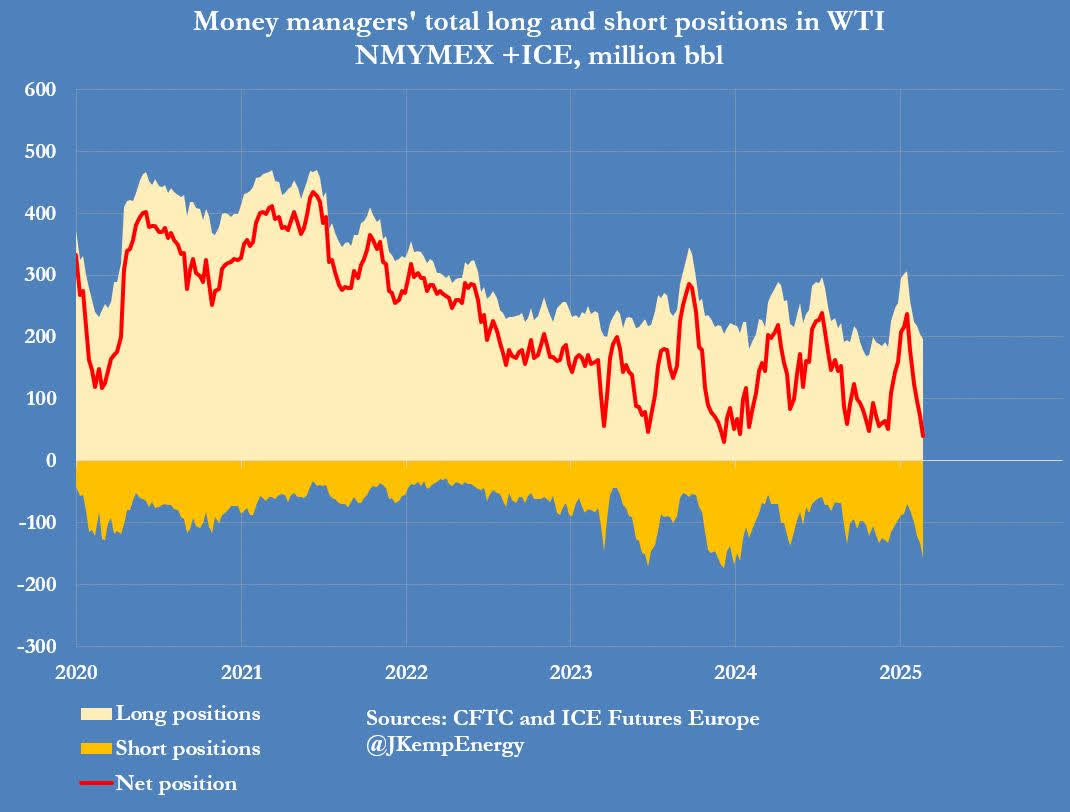

Source: John Kemp

It's largely because of the chart above. Speculators got long too early and as they dump into the market today, positioning is getting stretched once again to the downside.

This yo-yo back and forth in positioning has created some chaotic price movements as of late. Take for instance that WTI is about to close down for 8-weeks straight this week:

The last time this occurred was in 2015 (10-weeks down). Even during 2018, 2020, and 2023, WTI closed down at most 7 weeks in a row. While the magnitude was much greater in those 3 instances, it goes to show why energy investors are feeling the additional pain this week.

To make matters worse, the double whammy of tariffs + OPEC production increase came on Monday leading energy investors to sell out in unison on Tuesday. At one point, MEG Energy, one of the highest quality oilsand producers, traded below C$20 per share.

As I watched the Canadian energy sector get massacred, I knew I had to start deploying the capital I had on the sidelines (thanks to the Gear transaction).

Here's why I bought more Canadian energy stocks today.

MEG Energy

I bought a very meaningful position in MEG Energy this week. The key rationale for buying MEG.TO is very simple and I wrote a WCTW article about it back in Nov 2024.

The investment thesis in MEG is straightforward: