This is an update on the WCTW article titled, “Complete Reversal.”

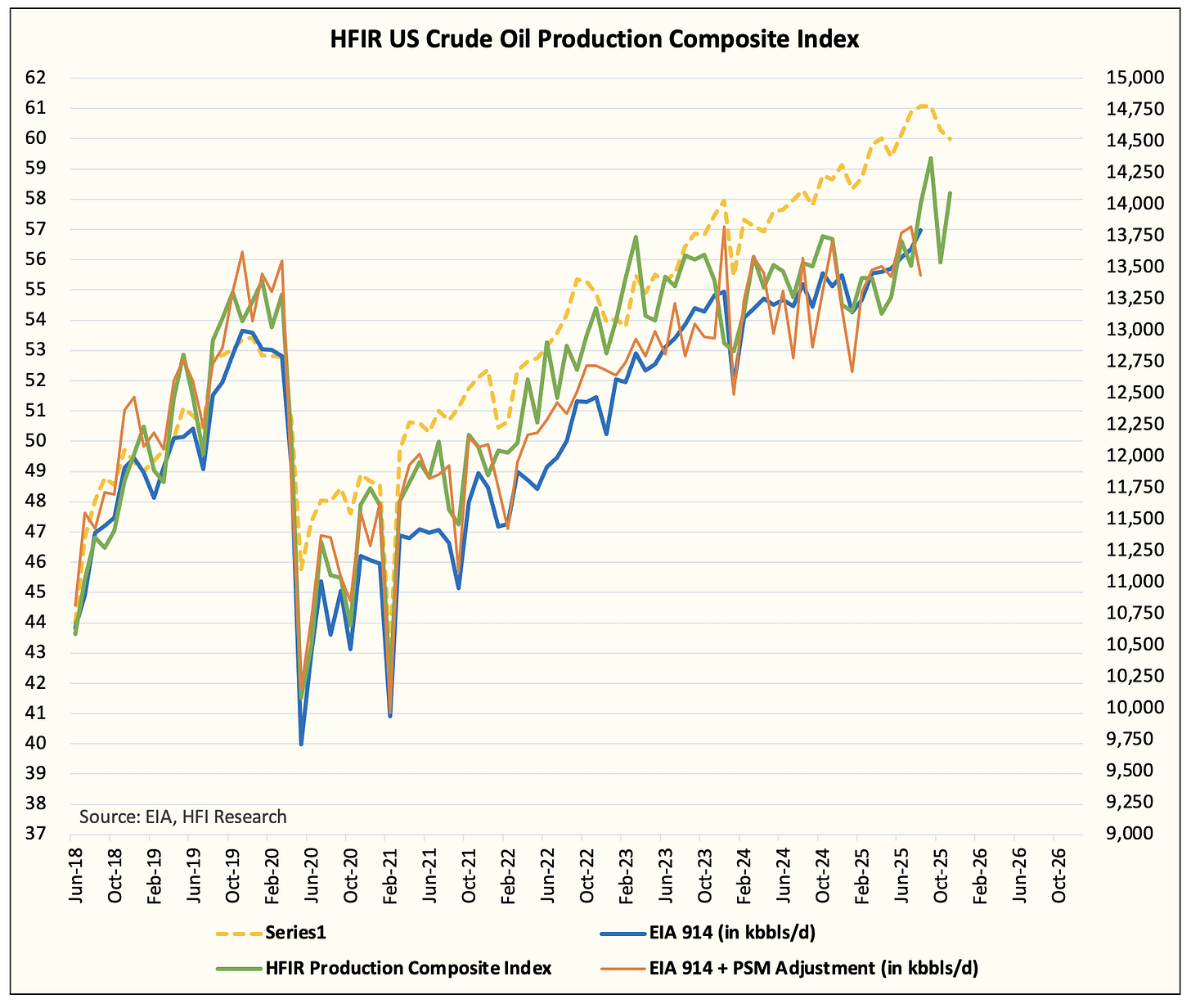

US crude oil production surprised to the upside in Q3 2025. This prompted OPEC to upgrade its non-OPEC supply growth forecast in its latest oil market report.

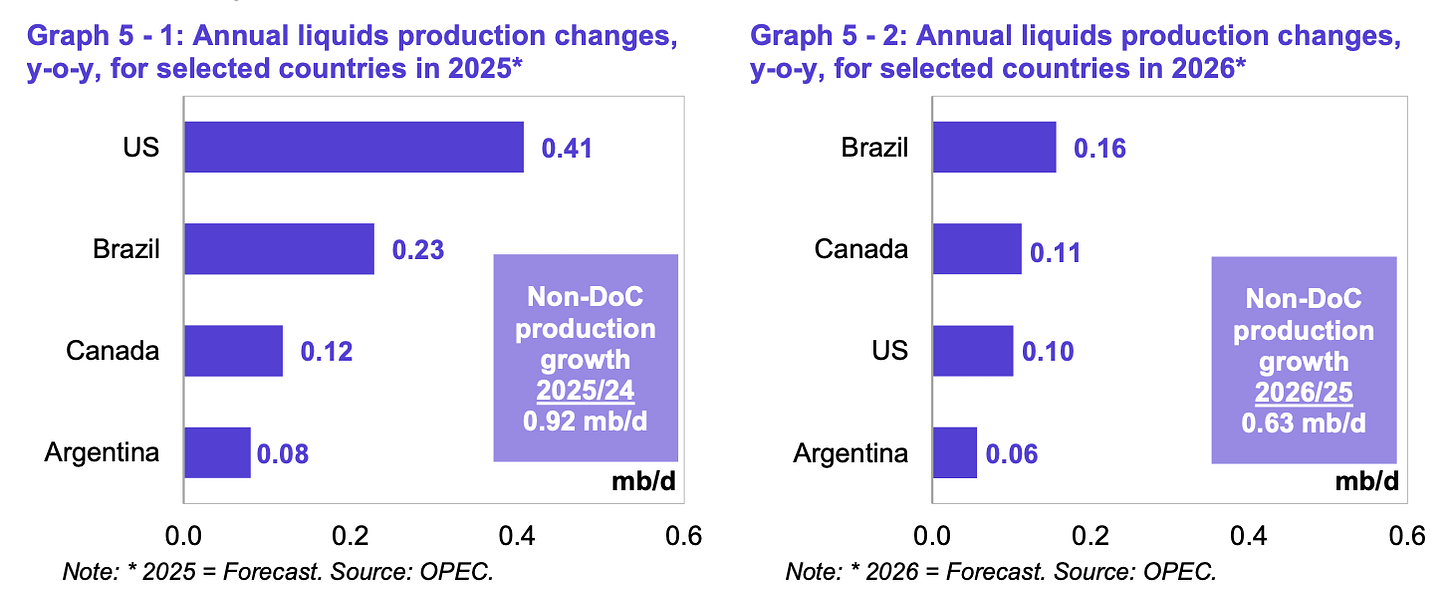

November OMR

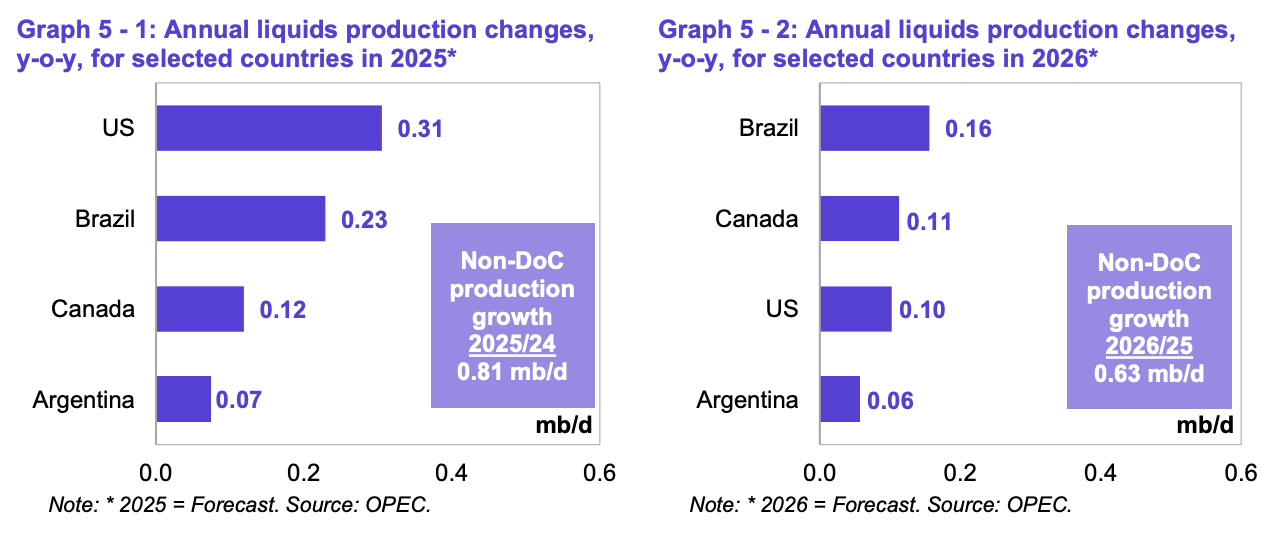

October OMR

OPEC kept its 2026 forecast the same while it upgraded US liquids production growth by ~100k b/d. This is a negligible amount, but it is worth noting that the higher revision is due to the trends we pointed out in August and September.

Fortunately, US crude oil production has reversed since then, and we can see several other key indicators saying the same thing (associated gas production).

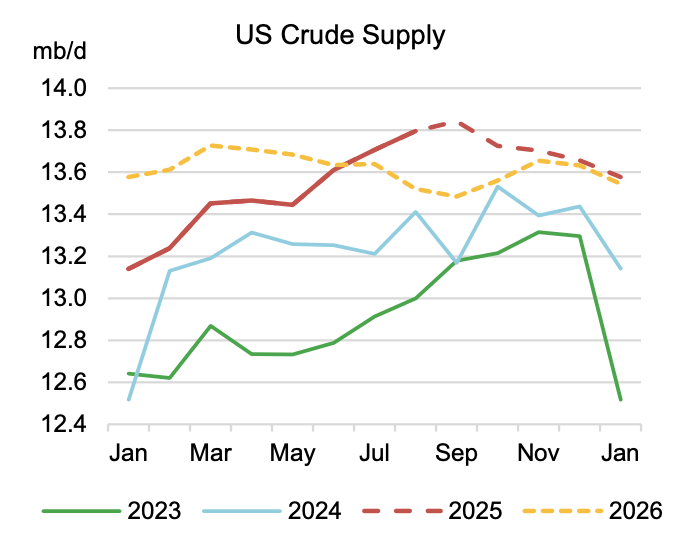

The good news here is that the September US crude oil production is going to be the peak for this year. The bad news is that overall production remains elevated near ~13.7 million b/d (using our latest real-time data).

Now, what’s interesting about the latest oil market analysis is that the IEA is assuming the same production uptick for September before revising US crude oil production lower.

Note: IEA, are you reading our reports? haha

Source: IEA

You can see a similar projection in IEA’s latest oil market report. From September onward, US crude oil production is expected to fall to ~13.58 million b/d by year-end with the bottom coinciding with September next year.

Our analysis shows a higher decline projection if WTI remains at or below $60/bbl. While the delta, in the grand scheme of things, will be small, it’s good to see IEA adopt a more realistic US crude oil production forecast.

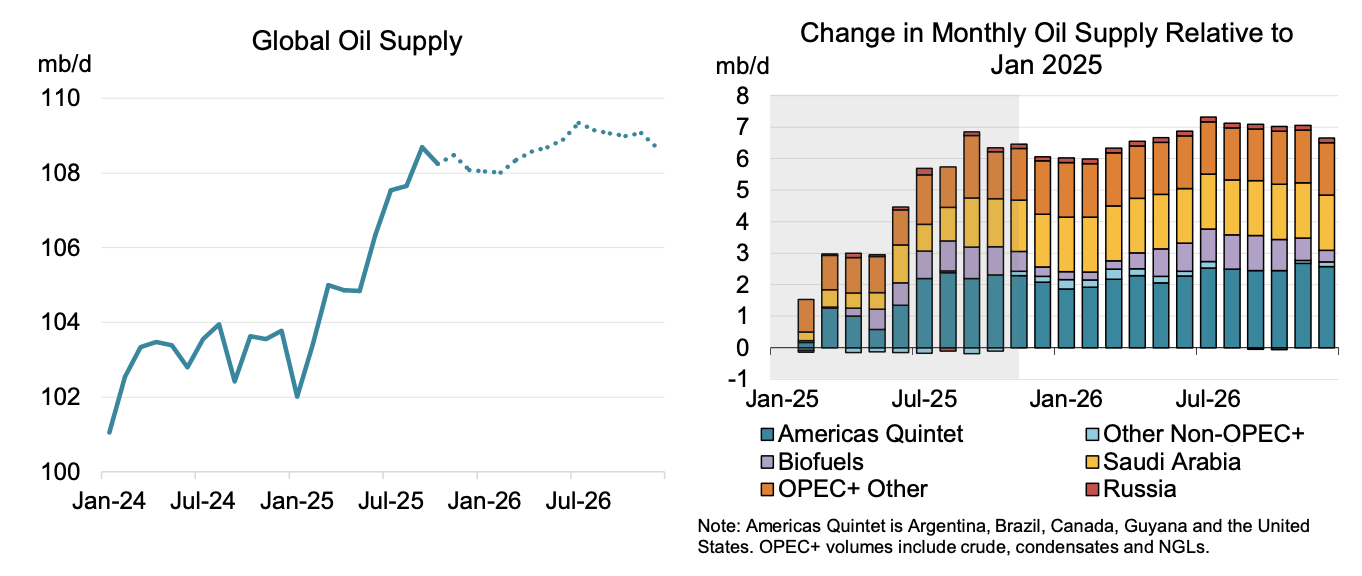

The drop in US crude oil production by this time next year is what sets up the inevitable peak in global oil supply.

While the IEA continues to message that the global oil market is headed for a historic “glut”, the interesting thing about the analysis is that if you look at the global oil supply chart, it has the end of 2026 global oil supply equating to the levels we are seeing today.

In other words, every barrel of demand increase from this point forward will chip away at the oil surplus forecast.

This is a point you have to understand if you want to truly understand where the oil market is headed.