In our last week’s NGF titled, “The Natural Gas Market Is Setting Up For An Extremely Interesting Winter.” We said:

With production disappointing and LNG feedgas remaining strong, the market is going to be at a sizable deficit going into the heating demand season. Even in the event of bearish heating demand, the underlying deficit can eat some of the demand weakness away.

In our base case, once the storage surplus dwindles, natural gas prices will respond asymmetrically to changes in the heating degree days. We think the market is biased to the bull side, given the deficit we explained above.

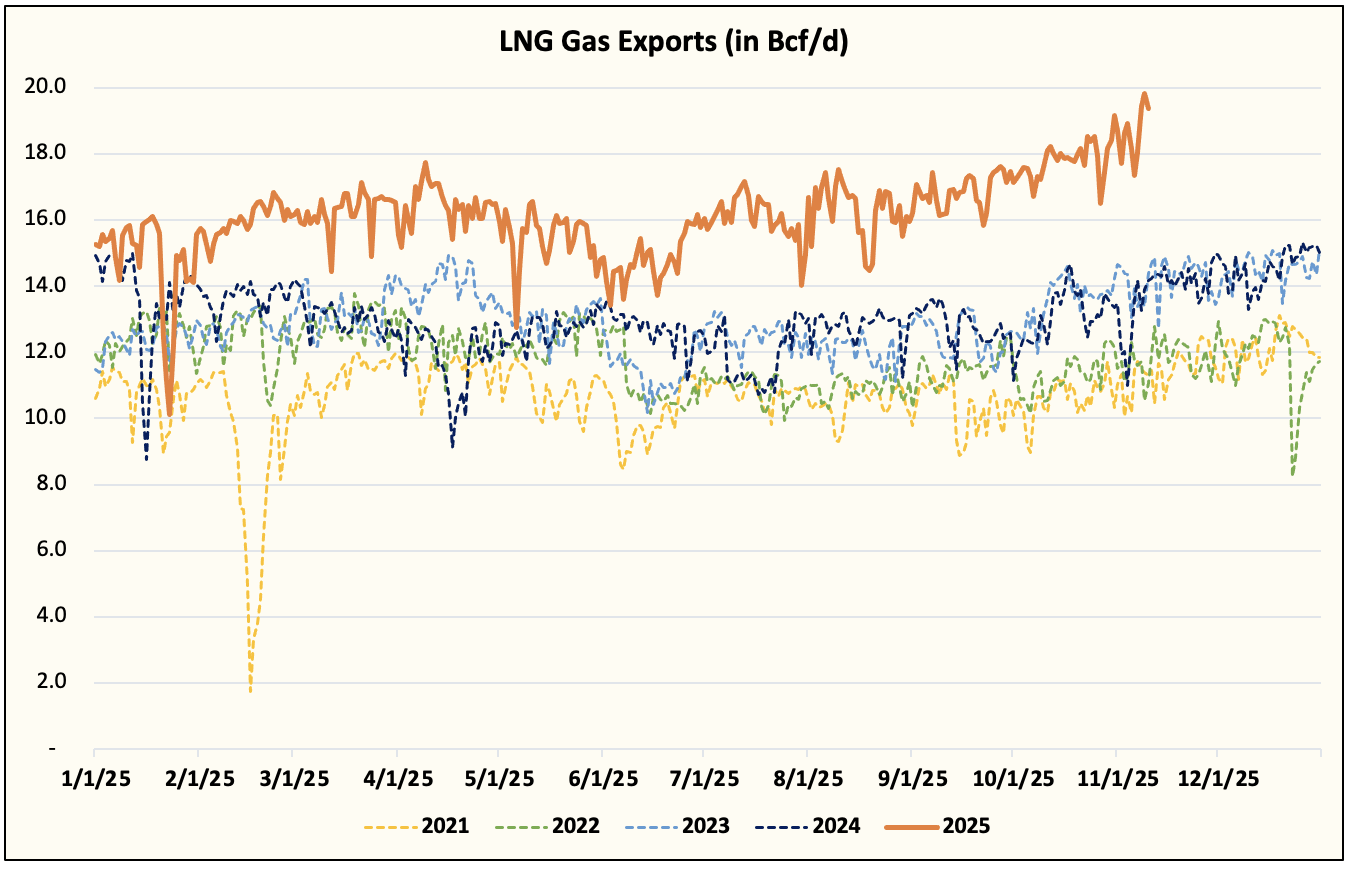

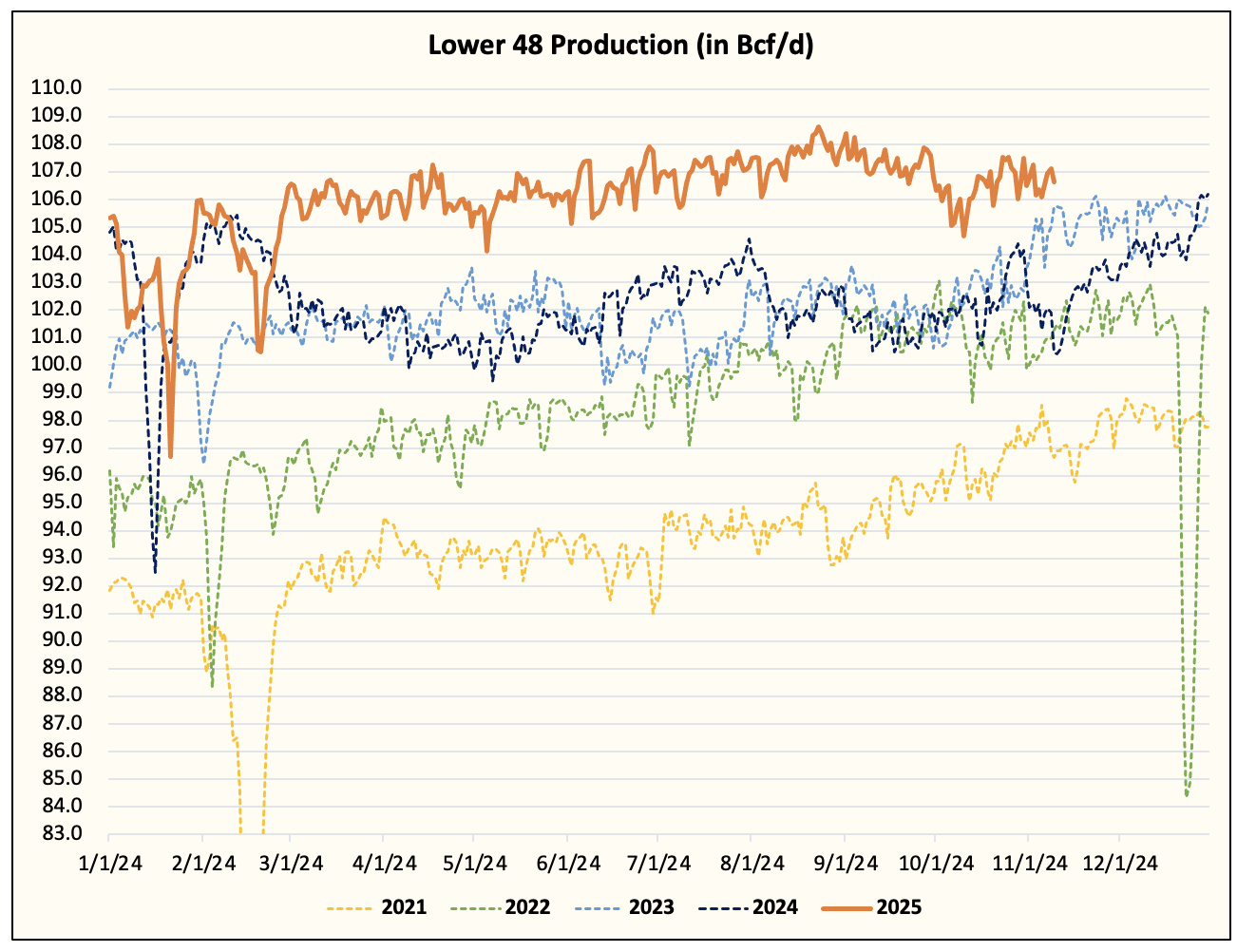

Since then, LNG feedgas surged to ~20 Bcf/d over the weekend while Lower 48 gas production averaged around ~107 Bcf/d.

LNG

Lower 48 Gas Production

As LNG feedgas remains strong throughout this winter thanks to low European natural gas storage, the US gas market will be fundamentally biased to the bull side.

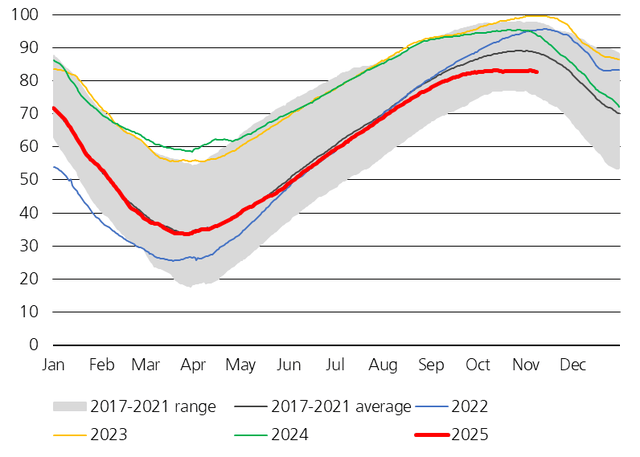

Source: Giovanni Staunovo

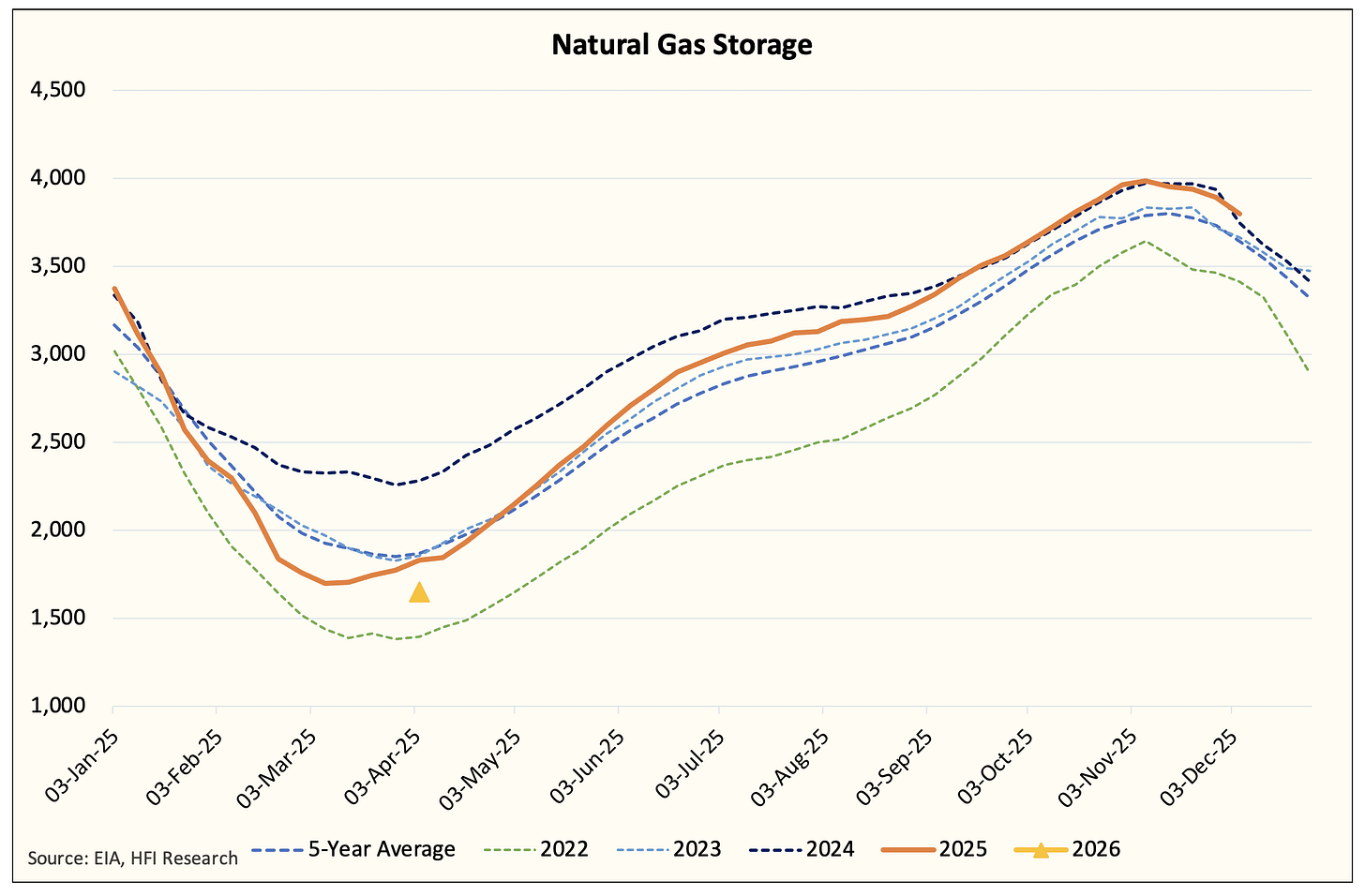

Even with the storage surplus we are seeing in the US, this surplus is going to dwindle by the end of December if the weather is just neutral.

By our estimate, the latest projection still shows April natural gas storage around ~1.65 Tcf. In a bearish heating demand scenario (2023-2024), we have natural gas storage finishing near ~1.9 Tcf.

In essence, the fundamental setup is bullish going into 2026.