Editor’s Note: EQT is a potential long holding in the HFI Portfolio. As a result, this idea write-up will be included for all HFI Research (main) subscribers. We published another piece on Transocean this week that’s only exclusive to “Ideas from HFI Research” subscribers. If you are interested, please see here.

Ideas from HFI Research cover all idea write-ups that are not in the HFI Portfolio.

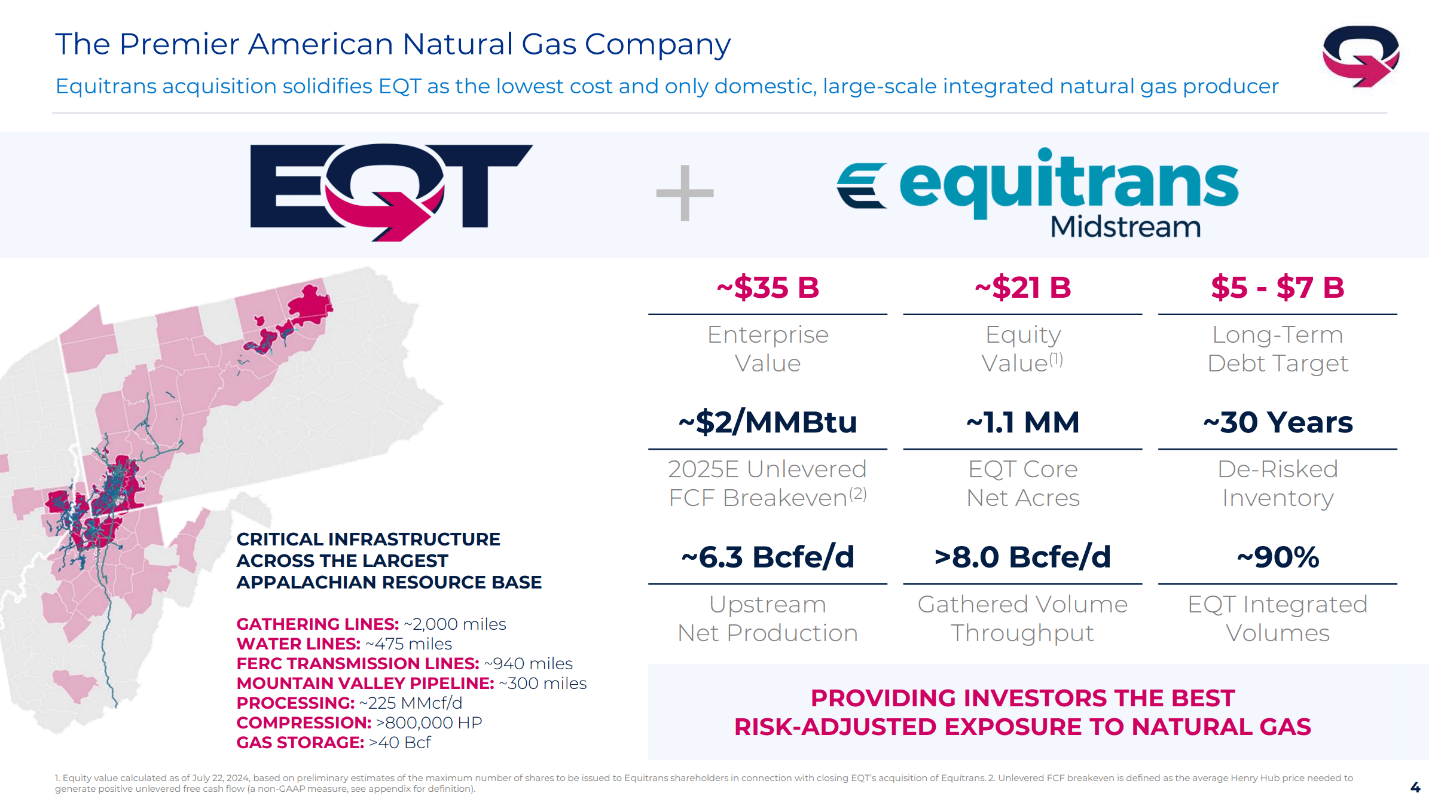

EQT (EQT) is a vertically integrated natural gas-weighted E&P operating in the Marcellus and Utica shale basins in the Northeast U.S. The company produces approximately 1 million boe/d, split between 92% natural gas and 8% liquids.

EQT intends to operate in maintenance mode over the long term, so production growth isn’t a defining feature, as it is for other gassy E&Ps. However, EQT’s production could increase marginally if it can improve egress for its production through its ownership of midstream assets from its recent Equitrans Midstream acquisition.

The following graphic provides a snapshot of the combined EQT-Equitrans entity.

Source: EQT Q2 2024 Earnings Presentation, July 23, 2024.

All EQT’s reserves lie in contiguous acreage, which facilitates optimal long-term development of its reserves. Proved reserves span approximately 12 years at the current production rate. The company’s 2023 reserve report uses an unrealistically low natural gas price of $1.70 per mcf to estimate reserve volumes, so it significantly understates reserve values based on a higher gas price. EQT’s management claims the company possesses a 30-year inventory of wells that break even below $3.50.

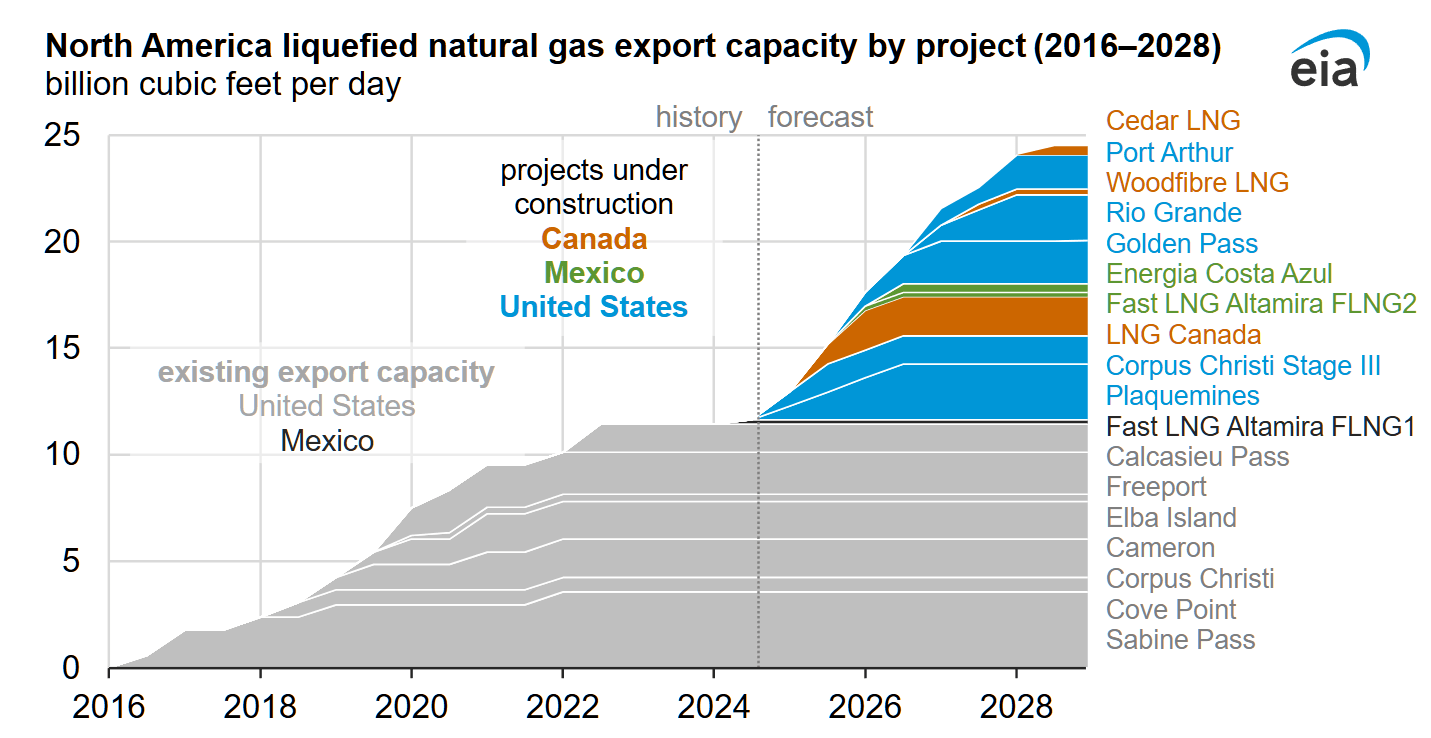

Like all natural gas E&Ps, EQT will benefit from the bullish macro natural gas backdrop set to arrive from the massive North American LNG buildout. Ten LNG export facilities are expected to enter service through 2028, as shown in the chart below.

Source: EIA, Sept. 3, 2024.

These facilities will increase North American natural gas demand by more than 10%, assuming no growth contribution from power burn. We expect the increased demand to result in higher average natural gas prices beginning in the second half of 2025.

EQT has the scale and inventory depth necessary to enter into long-term, utility-scale natural gas supply agreements with both LNG producers and electric utilities. These deals can increase long-term cash flow certainty and provide a buffer during times of persistently low prices such as today’s.

In the near term, temporary factors will depress EQT’s free cash flow. For 2024, the Equitrans acquisition will increase capex as the company works to integrate and optimize the acquired assets. In 2025 and beyond, capex will revert to pre-acquisition levels.

Also, EQT is currently curtailing production in response to low natural gas prices. The curtailments will cause the company to miss management’s initial 2024 guidance. They will also result in lower-than-expected free cash flow.

In 2025 and thereafter, EQT’s free cash flow outlook improves. Curtailments are likely to be reversed, and the integration of Equitrans assets will result in sustainably lower maintenance capex levels. Moreover, higher average natural gas demand and prices attributable to the LNG export buildout will support the company’s top line. These factors bode well for EQT’s free cash flow over the long term.