We have been calling for an oil price pullback since we published our WCTW on Jan 13 titled, "Oh No, Not Again." At the time, we said:

Sanctions... Yup

For the past few months, physical oil traders have been incredibly frustrated by the disconnect between fundamentals and reality. Despite global oil inventories drawing, physical timespreads moving higher, and Q1 2025 balances looking promising, oil prices failed to budge. But suddenly, as we come into 2025, things started to change.

First, we had the cold weather catalyst we've been pointing out since mid-December. This January will be the 3rd coldest January since 2000. Heating degree days are going to spike, US oil production will suffer from freeze-offs, and inventory balances should draw. Oil prices were already starting to inch higher.

Then hit the sanctions. The Biden administration is trying to blow everything up from the Ukraine/Russia conflict to sanctioning Iran and Russia crude exports just before Trump takes office. The very sanctions that could've pushed both Iranian and Russian supplies offline are finally starting to awaken the physical oil community.

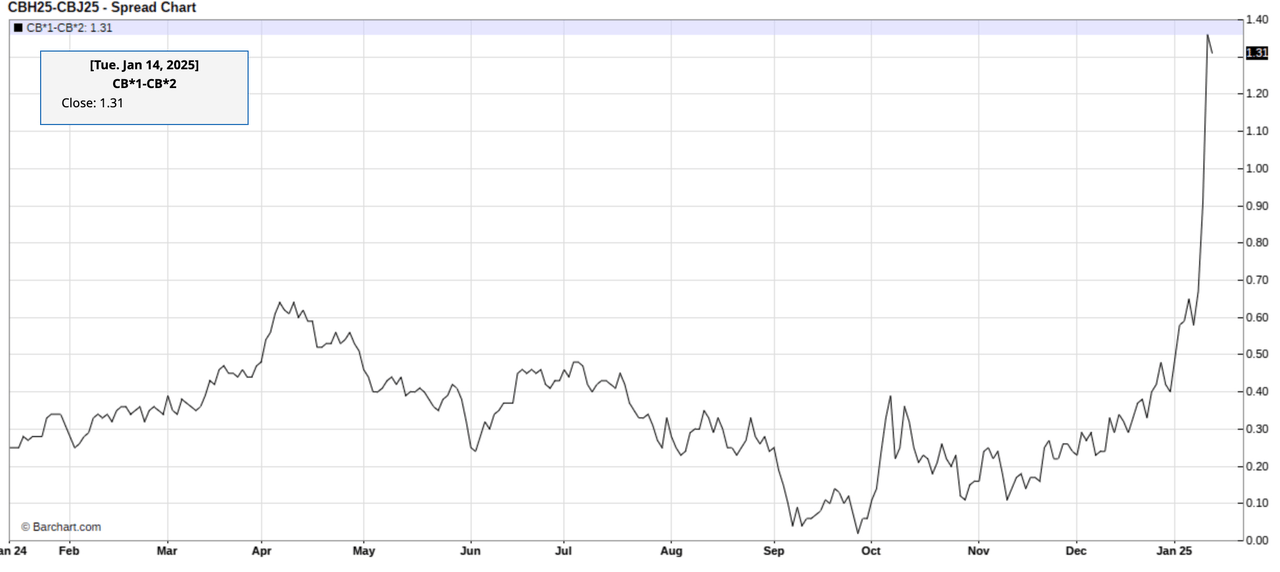

China, being one of the largest beneficiaries of sanctioned barrels, is suddenly having to source from other regions to fulfill the supply gap. This has caused the recent surge we are seeing in timespreads.

This coupled with an already low global crude storage has sent a small wake up call to the physical oil trading community and the financial flows are just following the momentum.

But it's not just the Russian/Iranian flows that are having a major impact, it's also the tariff risks on Canadian crude imports that are materially impacting global oil balances. WTI today rallied more than Brent as traders price in the possibility of lower Canadian crude imports. This would then translate to a tighter US domestic storage situation, which would translate to lower US crude exports.

I think for obvious reasons, Trump won't impose sanctions on Canadian crude imports totaling ~4.1 million b/d. Not only will this be extremely inflationary, but it will be hard for US refineries to replace the steady flow of heavy crude coming from Canada. The Trump administration must realize that US shale has much higher API crude versus the medium/heavy that the US refineries are designed to process. This crude quality mismatch is precisely why I don't think the tariffs will be imposed, and the rally in WTI vs Brent will unwind soon enough.

So in the meantime, while there are real fundamental implications arising from Chinese traders panicking about where they are going to source crude. We know from experience (September & October 2018) that such a physical driven rally is usually always unsustainable.

I think informed readers should know that this time isn't any different.

Since the publication, WTI has fallen from $77.30 back to $71.17. In our most recent oil market update titled, "Our Near-Term Oil Price Outlook." We urged readers to remain patient as we believed there was more downside with WTI possibly testing the $70/bbl low-end range.

Now with WTI near $71.17, we think there are still some short-term hurdles the market will have to contend with before we contemplate a directional long position in crude. As we will explain below, here are the signals to watch for.